Ultimate Price Action Suite

- Indicatori

- Quang Trung Luu

- Versione: 1.35

- Attivazioni: 5

### Introducing the Price Action Ultimate Suite – The Ultimate Trading Tool for Professional Traders!

Are you searching for a powerful tool to elevate your Price Action trading strategy? Look no further than the **Price Action Ultimate Suite** – a comprehensive and intelligent indicator for MetaTrader 5 (MT5) – designed to be your trusted partner in conquering the financial markets! Packed with advanced features and user-friendly functionality, this indicator helps you identify key price patterns, optimize your trading decisions, and significantly boost your profits.

#### **Key Features of Ultimate Price Action Suite **

1. **Precise Pin Bar Detection**

- Automatically identifies Bullish Pin Bars and Bearish Pin Bars with high accuracy, based on customizable parameters such as the wick-to-range ratio (`MinWickToRangeRatio`), opposite wick ratio (`MaxOppositeWickToRangeRatio`), and minimum wick size (`MinWickSizePoints`).

- Signals are marked with arrows directly on the chart, with adjustable spacing for better visibility (`ArrowOffsetPoints`).

2. **Top-Tier Engulfing Pattern Detection**

- Detects Bullish Engulfing and Bearish Engulfing patterns – powerful reversal signals – with a minimum body-to-range ratio condition (`MinBodyToRangeRatio`).

- Signals are clearly marked with upward (lime) and downward (red) arrows, making it easy to spot trading opportunities.

3. **Inside Bar and Outside Bar Detection**

- Automatically identifies Inside Bars (consolidation patterns) and Outside Bars (breakout patterns) – critical price formations that signal accumulation or breakouts.

- Draws price zones on the chart with distinct colors (green for Inside Bars, red for Outside Bars), helping you pinpoint potential breakout zones.

- Customizable lookback candle count (`InsideOutsideCandleCount`) to suit your trading strategy.

4. **Automated Support and Resistance Zones**

- Uses an intelligent algorithm to detect Support and Resistance zones based on swing highs and lows.

- Adjust sensitivity (`Sensitivity`), price tolerance (`PriceTolerance`), and minimum touch count (`MinTouches`) to filter for more accurate signals.

- Displays zones on the chart with clear colors (green for Support, blue for Resistance), helping you identify key price levels.

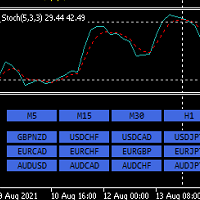

5. **Integrated EMA25 for Price and Volume**

- Includes an Exponential Moving Average (EMA25) for price (blue line) to identify short-term trends.

- An EMA25 for volume (purple line) helps you analyze the strength of trading volume and detect momentum shifts in the market.

- Provides a comprehensive view of both price and volume, empowering you to make smarter trading decisions.

6. **Candle Close Countdown Timer**

- Displays a countdown timer for candle closure directly on the chart (bottom-right corner), helping you manage your trading timing effectively.

- Clear time format (hours, minutes, seconds) with customizable colors, perfect for any trading style.

7. **Customizable Alerts**

- Supports alerts for detected Pin Bars, Engulfing patterns, Inside Bars, and Outside Bars.

- Sends notifications via email so you never miss a trading opportunity, even when you’re away from the chart.

- Option to enable/disable alerts (`EnableAlerts`) for flexible use.

8. **Highly Customizable**

- Comes with easy-to-adjust input parameters, from arrow spacing and pattern detection sensitivity to the number of lookback candles.

- Suitable for all trading styles: scalping, day trading, swing trading, or long-term investing.

#### **Why Choose Ultimate Price Action Suite ?**

- **High Accuracy**: Built with advanced algorithms to deliver reliable trading signals.

- **User-Friendly**: Intuitive interface, perfect for both novice and experienced traders. Install and start using it right away!

- **Time-Saving**: Automates price pattern detection, allowing you to focus on making trading decisions instead of manual analysis.

- **Versatile**: Works seamlessly across all timeframes (M1, M5, H1, D1, etc.) and all instruments (Forex, Gold, Stocks, etc.).

- **Developed by Experts**: Created by a team of trading professionals with over 10 years of experience, committed to delivering real value to you.

#### HOW TO USE:

---

### ** Ultimate Price Action Suite – Input Settings Explained**

Welcome to the ultimate trading tool designed to help you spot high-probability setups with ease! Our indicator, the "Pin Bar & Engulfing Detector with EMA25," combines powerful pattern detection (Pin Bars, Engulfing Patterns, Inside Bars, and Outside Bars) with the trend-following power of the EMA25. Whether you're a beginner or a seasoned trader, these customizable settings allow you to fine-tune the indicator to match your strategy. Let’s dive into each input setting and see how they can work for you!

---

#### **1. MinWickToRangeRatio (Default: 0.6)**

- **What it does**: This setting controls the minimum ratio of the wick (shadow) to the total range (high to low) of a candle for it to qualify as a Pin Bar.

- **Why it matters**: A Pin Bar is a strong reversal signal, but we want to ensure the wick is significant enough to indicate rejection. A higher value (e.g., 0.7) makes the indicator stricter, only detecting Pin Bars with very prominent wicks. A lower value (e.g., 0.5) will catch more Pin Bars but might include weaker signals.

- **How to use it**: If you trade in volatile markets like forex (e.g., XAUUSD), the default 0.6 is a great balance. For less volatile markets, you might lower it to 0.5 to catch more setups.

---

#### **2. MaxOppositeWickToRangeRatio (Default: 0.2)**

- **What it does**: This sets the maximum allowed ratio of the opposite wick to the total range for a Pin Bar.

- **Why it matters**: A true Pin Bar should have a small opposite wick to show strong rejection in one direction. For example, a Bullish Pin Bar should have a long lower wick and a very small upper wick. A higher value (e.g., 0.3) allows more flexibility, while a lower value (e.g., 0.1) ensures stricter Pin Bar criteria.

- **How to use it**: The default 0.2 works well for most markets. If you’re seeing too many false Pin Bars, lower this to 0.15 for cleaner signals.

---

#### **3. MinWickSizePoints (Default: 20)**

- **What it does**: This defines the minimum size of the wick (in points) for a candle to be considered a Pin Bar.

- **Why it matters**: We don’t want tiny Pin Bars that might just be noise. This setting ensures the wick is significant enough to matter. For example, on XAUUSD, 20 points means the wick must be at least 0.20 USD in length.

- **How to use it**: Adjust this based on your market. For high-volatility pairs like XAUUSD, 20 points is fine. For lower-volatility pairs like EURUSD, you might reduce it to 10 points to catch smaller but still meaningful Pin Bars.

---

#### **4. MinBodyToRangeRatio (Default: 0.6)**

- **What it does**: This sets the minimum ratio of the candle’s body (open to close) to its total range for it to qualify as an Engulfing Pattern.

- **Why it matters**: Engulfing Patterns are powerful reversal signals, but we want the engulfing candle to have a strong body to confirm momentum. A higher value (e.g., 0.7) ensures only strong Engulfing Patterns are detected, while a lower value (e.g., 0.5) allows for weaker patterns.

- **How to use it**: The default 0.6 is a great starting point. If you’re trading on higher timeframes (e.g., H4 or D1) where Engulfing Patterns are rarer, you might lower this to 0.5 to catch more opportunities.

---

#### **5. EnableAlerts (Default: true)**

- **What it does**: This toggles whether the indicator sends alerts for detected patterns (Pin Bars, Engulfing Patterns, Inside Bar Breakouts/Breakdowns, etc.).

- **Why it matters**: Alerts keep you informed in real-time, so you never miss a trading opportunity, even if you’re not watching the chart. It also sends email notifications if you have email alerts set up in your MetaTrader platform.

- **How to use it**: Keep this as `true` if you want to be notified of every signal. Set it to `false` if you prefer to manually review the chart without interruptions.

---

#### **6. Sensitivity (Default: 5)**

- **What it does**: This controls how sensitive the indicator is when detecting Support and Resistance levels.

- **Why it matters**: Support and Resistance levels are drawn based on swing highs and lows. A higher sensitivity (e.g., 7) requires more candles on either side of a swing point to confirm it as a level, making the levels rarer but more significant. A lower sensitivity (e.g., 3) detects more levels but might include less reliable ones.

- **How to use it**: The default 5 is a good balance for most timeframes. On lower timeframes (e.g., M5), you might increase it to 7 to filter out noise. On higher timeframes (e.g., D1), you can lower it to 3 to catch more levels.

---

#### **7. PriceTolerance (Default: 0.5)**

- **What it does**: This sets the percentage tolerance for price to consider a level as "touched" when detecting Support and Resistance.

- **Why it matters**: Prices rarely touch Support/Resistance levels exactly. This setting allows some flexibility. For example, a 0.5% tolerance means a price can be within 0.5% of the level to count as a touch.

- **How to use it**: The default 0.5% works well for most markets. For very volatile instruments like cryptocurrencies, you might increase it to 1.0% to account for larger price swings. For stable pairs like EURUSD, you can lower it to 0.3% for precision.

---

#### **8. MinTouches (Default: 2)**

- **What it does**: This defines the minimum number of times a price must touch a Support or Resistance level for it to be drawn on the chart.

- **Why it matters**: A level that’s been tested multiple times is more significant. A higher value (e.g., 3) ensures only well-tested levels are shown, while a lower value (e.g., 1) shows more levels but they might be less reliable.

- **How to use it**: The default 2 touches is a good starting point. If you want stronger levels, increase it to 3. If you’re on a lower timeframe and want to see more levels, you can set it to 1.

---

#### **9. InsideOutsideCandleCount (Default: 10)**

- **What it does**: This sets the maximum number of candles the indicator will look back to detect Inside Bars and Outside Bars.

- **Why it matters**: Inside Bars (a series of candles contained within the range of a "mother" candle) and Outside Bars (a series of candles engulfed by a larger "mother" candle) are key consolidation and breakout patterns. This setting controls how many candles the indicator considers for these patterns. A higher value (e.g., 15) allows for longer consolidation patterns, while a lower value (e.g., 5) focuses on shorter patterns.

- **How to use it**: The default 10 is ideal for most timeframes. On lower timeframes (e.g., M5), you might reduce it to 5 to focus on shorter consolidations. On higher timeframes (e.g., H4), you can increase it to 15 to catch longer patterns.

---

### **Why These Settings Make This Indicator a Game-Changer**

- **Precision and Flexibility**: With settings like `MinWickToRangeRatio` and `MinBodyToRangeRatio`, you can fine-tune the indicator to catch only the strongest Pin Bars and Engulfing Patterns, or loosen the criteria to spot more opportunities.

- **Real-Time Alerts**: The `EnableAlerts` feature ensures you never miss a trade, even if you’re away from your screen.

- **Context with EMA25**: The indicator uses the EMA25 to filter signals, ensuring Pin Bars, Engulfing Patterns, and Inside Bar Breakouts/Breakdowns align with the trend for higher-probability trades.

- **Support/Resistance Detection**: With `Sensitivity`, `PriceTolerance`, and `MinTouches`, you get reliable Support and Resistance levels to complement your pattern-based trading.

- **Breakout Opportunities**: The `InsideOutsideCandleCount` setting lets you spot consolidation patterns (Inside Bars and Outside Bars) and their breakouts, giving you an edge in trending markets.

---

### **How to Get Started**

1. **Load the Indicator**: Add the "Ultimate Price Action" to your chart (e.g., XAUUSD on M5).

2. **Adjust the Settings**: Start with the default values—they’re optimized for most markets. Then tweak them based on your trading style:

- Want stricter Pin Bars? Increase `MinWickToRangeRatio` to 0.7.

- Trading on a higher timeframe? Lower `Sensitivity` to 3 for more Support/Resistance levels.

- Need more Inside Bar breakouts? Reduce `InsideOutsideCandleCount` to 5.

3. **Watch the Magic Happen**: Look for Pin Bars, Engulfing Patterns, and Inside Bar Breakouts/Breakdowns, all marked with arrows on your chart. Alerts will notify you of new signals in real-time.

4. **Combine with Your Strategy**: Use the Support/Resistance levels and EMA25 to confirm your trades, ensuring you’re trading with the trend and at key levels.

---

### **Ready to Take Your Trading to the Next Level?**

The " Ultimate Price Action" is your all-in-one tool for spotting high-probability setups with confidence. With its customizable settings, you can tailor it to any market, timeframe, or trading style. Try it out today, and let it help you find those winning trades!

If you have any questions or need help optimizing the settings for your specific needs, feel free to reach out—I’m here to help you succeed!

---

How does that sound? Let me know if you'd like me to adjust the tone or add more details!

#### **Special Offer – Buy Now!**

🎉 **Only $59.9**, and you’ll own the **Price Action Ultimate Suite** – a tool designed to maximize your profits and minimize risks!

💎 **Limited-Time Deal**: Purchase today and receive a **detailed user guide** and an **exclusive Price Action trading strategy** for free!

📈 **30-Day Money-Back Guarantee**: Not satisfied? We’ll refund 100% – no questions asked!

#### **Don’t Miss This Opportunity!**

Thousands of traders worldwide have trusted the **Price Action Ultimate Suite** and achieved results beyond their expectations. Join the community of successful traders today!

**Price Action Ultimate Suite – Your Partner on the Path to Trading Success!** 🚀

L'utente non ha lasciato alcun commento sulla valutazione.