Rejoignez notre page de fans

- Vues:

- 7738

- Note:

- Publié:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

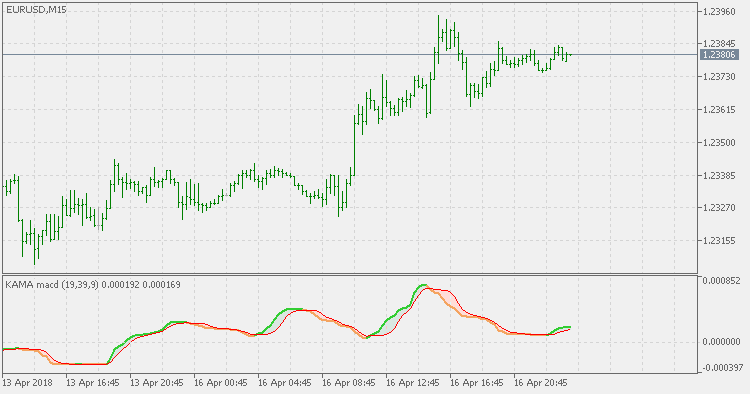

Adaptive Moving Average (AMA) technical indicator is used for constructing a Moving Average with low sensitivity to price series' noises and is characterized by the minimal lag for trend detection. This indicator was developed and described by Perry Kaufman in his book "Smarter Trading".

Maybe what is strange when Kaufman AMA is concerned, is that it is rarely used in indicators based on averages (like MACD).

This indicator partially fills that gap: this is the MACD built exclusively using Kaufman AMA (even signal line is using that). That way this is a completely adaptive MACD (bearing in mind that Kaufman AMA is adaptive Moving Average).

Price Channel Stop

Price Channel Stop

The Price Channel Stop indicator shows the current estimated trend based on channel period and desired risk. It also shows two levels of values that can be used as a stop loss for orders opened based on this indicator (using the trend color change can be used as a signal for a new order opening as well as closing already opened orders).

Smoother Momentum Stops

Smoother Momentum Stops

In the Smoother Momentum Stops indicator the stops are calculated using the smoother momentum and the direction of the stops is determined based on the smoother momentum.

Bulls and Bears

Bulls and Bears

This indicator shows Bulls and Bears power in the same indicator subwindow.

Kaufman AMA with filter

Kaufman AMA with filter

In addition to the usual parameters that are controlling the way Kaufman AMA is calculated, this version has adjustable smoothing and filter that can eliminate insignificant AMA changes.