Allan Graham Pike / Perfil

- Información

|

no

experiencia

|

16

productos

|

13

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Esa convicción da forma a todo lo que construyo. Mis EAs se prueban tanto en mercados alcistas como bajistas, diseñados para resistir cuando el mercado se vuelve salvaje. No están hechos para lucir bien solo en un backtest, sino para durar en el trading real.

Si compartes la idea de que el trading debe ser consistente, basado en reglas y enfocado en BTC, estás en el lugar correcto. Y en el camino, simplemente creamos grandes EAs.

I’ve just pushed an upgrade to AP VWAP Bands (MT4) based on a user request from Jose Angel Hernandez.

The indicator now creates live chart objects for the current VWAP levels:

VWAP 0

VWAP +1 / -1

VWAP +2 / -2

These objects move with price and can be read directly by EAs, making it easier to build VWAP-based automation or rule sets without rewriting the maths yourself.

If you already use the indicator, simply download the new version from your MQL5 profile and drop it on the chart as usual – the objects will appear automatically in the MT4 “Objects List” and update in real time.

Thanks again to Jose for the suggestion.

If you have other ideas or workflow requests for VWAP tools, feel free to message me – I’m happy to evolve these tools around real trader use.

AP Retroceso de Fibonacci PRO (MT5) Visión general AP Fibonacci Retracement PRO es un EA de retroceso de continuación de tendencia. Espera un swing confirmado, calcula la zona de retroceso de Fibonacci y busca entradas en la dirección del movimiento original. Sin rejilla, sin martingala. Lógica de la estrategia Detecta la última oscilación válida alta/baja usando Fractales en el marco temporal de la señal seleccionada. Calcula la zona de retroceso entre el 38,2% y el 61,8% (configurable). En

Most “AI trading” products on the market promise the same thing:

The robot thinks for you

The robot learns from every mistake

The equity curve goes up in a straight line

In practice, that usually means a black-box system, heavy optimisation, and very little transparency about how risk is actually handled.

AP AlphaLog AI is built on the opposite idea:

Let the EA record your trading with full transparency, and let AI help you analyse and improve it – not place trades for you.

I’m preparing AP AlphaLog AI for release on MQL5, but before it goes live there I’m running it with a smaller group of traders directly. Below is a quick overview of how it works.

1. AP AlphaLog AI – MT5 Trade Journal Engine (EA)

This is a non-trading EA for MT5. It does not open or manage orders.

What it does:

Attaches to any MT5 chart (works on gold, FX majors, crypto, indices etc.)

Automatically records every closed trade into a compact .alog file

Captures:

Symbol, direction, lot size

Entry/exit time and session tag (London/NY/Asia, etc.)

Initial risk in points

R-multiple for each trade (profit or loss measured vs initial SL)

Basic tags needed for performance analysis

Key points:

No auto-trading, no hidden grids or martingale

Safe to run on live or demo accounts

You keep a structured, machine-readable history of what you actually did, not just what you remember

The .alog files are designed specifically for the second part of the workflow: the web analyser.

2. AP AlphaLog AI – Web Analyser + AI Report

Once you have some trading history, you upload your .alog file to a dedicated analysis page (outside MQL5).

The analyser runs locally in the browser and server-side, and produces:

Statistical breakdown

Total trades, winrate, net result

R-multiple stats (average R, best/worst R, distribution)

Performance by symbol

Performance by session (London / New York / Asia, etc.)

Performance by day of week

Equity curve based on your actual trade outcomes

AI-generated review

On top of the raw stats, an AI model is used as a performance coach, not a signal generator. It receives:

A numeric summary of your trading

The per-symbol / per-session breakdowns

R-multiple information and consistency

It then returns a structured text report, typically including:

2–3 strengths in your current trading

3–5 key issues (risk, discipline, symbol selection, session behaviour, etc.)

A concrete action plan for the next 10–20 trades (checklists, risk rules, focus points)

No trade entries are suggested. The AI is used only to interpret your data and present it in clear language.

Why I think this is a better use of AI

Instead of:

“Trust this opaque bot and hope it keeps working.”

You get:

Full visibility over your own behaviour

Data-driven feedback on where your edge is actually coming from (or leaking away)

A repeatable process: trade → log → analyse → adjust plan

It is a tool for serious testers and discretionary/systematic traders who want to see their trading like a developer or quant would.

Early phase: free AI reports for 60 days

Before AP AlphaLog AI goes live on the MQL5 Market, I’m running an early access phase:

The MT5 journalling EA is provided directly (compiled, unrestricted, no lot or symbol limits).

The web analyser + full AI report is free for 60 days for early users.

After that, AI reporting will move to a paid model, but testers keep the EA.

If you are:

Trading on MT5 (gold / FX majors / BTC welcome)

Comfortable running Strategy Tester and collecting some basic stats

Interested in a transparent, data-driven way to use AI after the trade, not instead of you

you’re the type of trader I built this for.

How to get involved

For now, AP AlphaLog AI is not yet published on MQL5.

If you’d like early access:

Send me a message here on MQL5.

I’ll reply with:

The AP AlphaLog AI MT5 EA (journal engine)

The analyser link and short “how to use” guide

Details on the 60-day free AI reporting window

This is my view of how AI should be used in trading:

Not as a black box that replaces your decisions, but as a clear, brutally honest mirror of what you are really doing in the market.

You’ve probably seen the ads:

• “Quantum AI trading engine”

• “Neural network EA that learns from every mistake”

• “GPT-powered robot with no losing trades in backtests”

On the surface, it sounds amazing: install an EA, turn it on, let “AI” do the thinking, and watch the equity curve go up in a straight line.

There are several reasons I don’t build, sell or rely on that kind of black-box “AI robot”, and why my own tools and teaching take a very different approach.

I want to walk you through those reasons clearly, so you know exactly where I stand.

________________________________________

1. What I mean by “black-box AI robots”

When I say black-box AI robots, I mean EAs that:

• Hide their real logic behind buzzwords: quantum, neuro-fractal, deep AI, GPT control, big data, no losses, etc.

• Provide no clear explanation of:

o What the underlying trading logic actually is.

o How risk is controlled.

o How the model was tested out of sample.

• Often show perfect or near-perfect backtests, sometimes with:

o No visible losses.

o Extremely smooth equity curves.

o Tiny drawdowns that look “too good to be true”.

The key problem is not that they use some machine-learning technique; it’s that you, the trader, cannot see or understand what’s actually happening.

You’re being asked to trust the marketing and hand over your account to a black box.

________________________________________

2. The core technical problems with these systems

a) Overfitting: it’s easy to make a pretty backtest

With enough parameters, any algorithm (AI or not) can be tuned to fit the past:

• You can perfectly “explain” yesterday’s price action.

• But that does not mean you can survive tomorrow’s.

When you combine complex neural networks with a lot of optimisation and then test on the same data you trained on, you get:

• Stunning historical performance.

• Very little robustness out of sample.

If an EA claims that it “learns from every past mistake” and presents you with a backtest where those mistakes simply no longer exist, you are often just looking at the final, heavily optimised version that has been tailored to that exact history.

That’s not learning; it’s curve-fitting.

b) Non-stationary markets: what worked then may not work now

Markets change. Volatility regimes shift. Liquidity and behaviour of participants evolve.

Any learning model is a product of the data it saw:

• If a model was trained mostly on one kind of environment, its decisions may be wrong in a different environment.

• A black-box ML system with no transparent logic can fail abruptly when the regime shifts.

A rule-based EA with clear logic can also suffer in new regimes, of course — but at least you can see where and why, and decide whether to adjust or pause it.

c) “No losses in backtests” is a red flag, not a feature

If a robot can lose in live trading, then in an honest simulation it should also be able to lose.

Claims like:

• “The system corrects its mistakes so they disappear in the backtest”

• “The EA prevents losing patterns from ever repeating”

are incompatible with how random, noisy markets actually behave.

Losses are not bugs to be coded away; they’re part of the distribution of outcomes. A system can aim to manage losses, not magically eliminate them.

When you see “no losses” or “almost no drawdown” in a retail backtest, it usually tells you more about the testing process than about the true robustness of the system.

________________________________________

3. Practical problems for you as a trader

Even if we ignore the technical discussion, black-box AI robots cause very practical issues:

a) You can’t see the risk engine

If you don’t know:

• How lot size is chosen,

• How many positions can be open,

• Whether there is hidden grid, martingale, or “recovery” logic,

you cannot meaningfully control risk.

You only find out what the EA can do after you’ve placed real money behind it — and sometimes after a catastrophic move.

b) You can’t meaningfully debug or improve it

When all you have is:

• Marketing text about “quantum AI” and

• A DLL or compiled EA that hides all logic,

you cannot:

• Understand why a bad trade happened.

• Adjust rules in a targeted way.

• Build your own edge on top of the system.

You are locked into trusting that the black box knows better than you, and that is not how I believe trading should be approached.

c) It encourages the wrong mindset

Black-box AI marketing is often designed to sell a dream:

• No effort.

• No understanding needed.

• Just install, press start, and “the AI will handle it”.

This pushes traders towards gambling behaviour:

• No risk plan.

• No respect for drawdown.

• No understanding of when to pause, adjust, or stop.

The more you give away your decision-making to something you don’t understand, the more likely you are to panic or interfere at exactly the wrong time.

________________________________________

4. What I do instead

I’m not against automation or algorithms. I write and use EAs myself.

The difference is in how they’re designed and how transparent they are.

Here’s the approach I take with my own tools and course:

a) Strategy first, automation second

• I start from a clear, human-understandable strategy:

o Example: London breakout box, defined session window, fixed rules for entry, SL, TP.

• The EA is there to execute that plan consistently:

o Placing the correct pending orders.

o Managing stops and targets.

o Following your risk rules.

You should be able to explain the strategy in simple language, without any AI buzzwords.

b) Simple, testable logic

• Every key rule can be described in plain English.

• You can test it on demo.

• You can see:

o When the EA will trade.

o When it will stand aside.

o What each setting does.

There is no hidden martingale mode, no secret grid, no “magic” behaviour that only shows up under stress.

c) Risk first, not curve aesthetics

I care more about:

• Controlled position sizing.

• Known maximum exposure.

• Honest drawdown expectations.

than about producing a perfectly smooth equity curve in a marketing screenshot.

You will still see losing trades, losing weeks, and drawdowns — because that’s real trading. The point is to survive them and understand what’s happening, not pretend they don’t exist.

d) Education alongside the tool

I don’t want you to be dependent on me or any single EA. That’s why the course and tools are designed to:

• Teach you what the strategy is actually doing.

• Teach you basic risk management.

• Show you how to test and evaluate performance.

If you decide to stop using any EA, you still keep the understanding and can apply it elsewhere.

________________________________________

5. If you still want to experiment with “AI” robots

If you are curious and want to test AI-branded EAs anyway, I’d strongly recommend:

• Demo first, always.

• Use the smallest possible real exposure if you ever go live.

• Avoid any system that:

Hides risk controls.

Requires you to enable DLLs without careful explanation.

Shows “no losses” or truly unrealistic backtests.

• Look for:

Honest description of logic.

Clear risk management.

Real forward-test history, not just a perfect backtest image.

Treat them as experiments, not as the core of your trading plan.

________________________________________

6. Summary

I don’t use or promote black-box AI robots because:

• They often rely on heavy overfitting and marketing rather than robust design.

• They hide crucial details about risk and logic.

• They encourage a “turn it on and pray” mindset that is dangerous for traders.

• They make it impossible for you to learn, understand, and ultimately take responsibility for your own trading.

Instead, I focus on:

• Clear, rule-based strategies that you can understand.

• Transparent EAs that automate those rules without hidden tricks.

• Risk management and education as the foundation.

Automation is a powerful tool — but it should work for you, not replace your understanding.

AP Session Boxes - Superposición de rangos de Asia / Londres / NY (Indicador MT5) Cuadros de sesión limpios en su gráfico. Este ligero indicador dibuja las ventanas horarias de Asia , Londres y Nueva York directamente en el gráfico, incluyendo los máximos y mínimos de cada cuadro como líneas discontinuas. Es perfecto para un contexto rápido, planificación de rupturas y capturas de pantalla limpias. Estructura instantánea: vea dónde osciló el mercado durante las sesiones clave. Preparación de

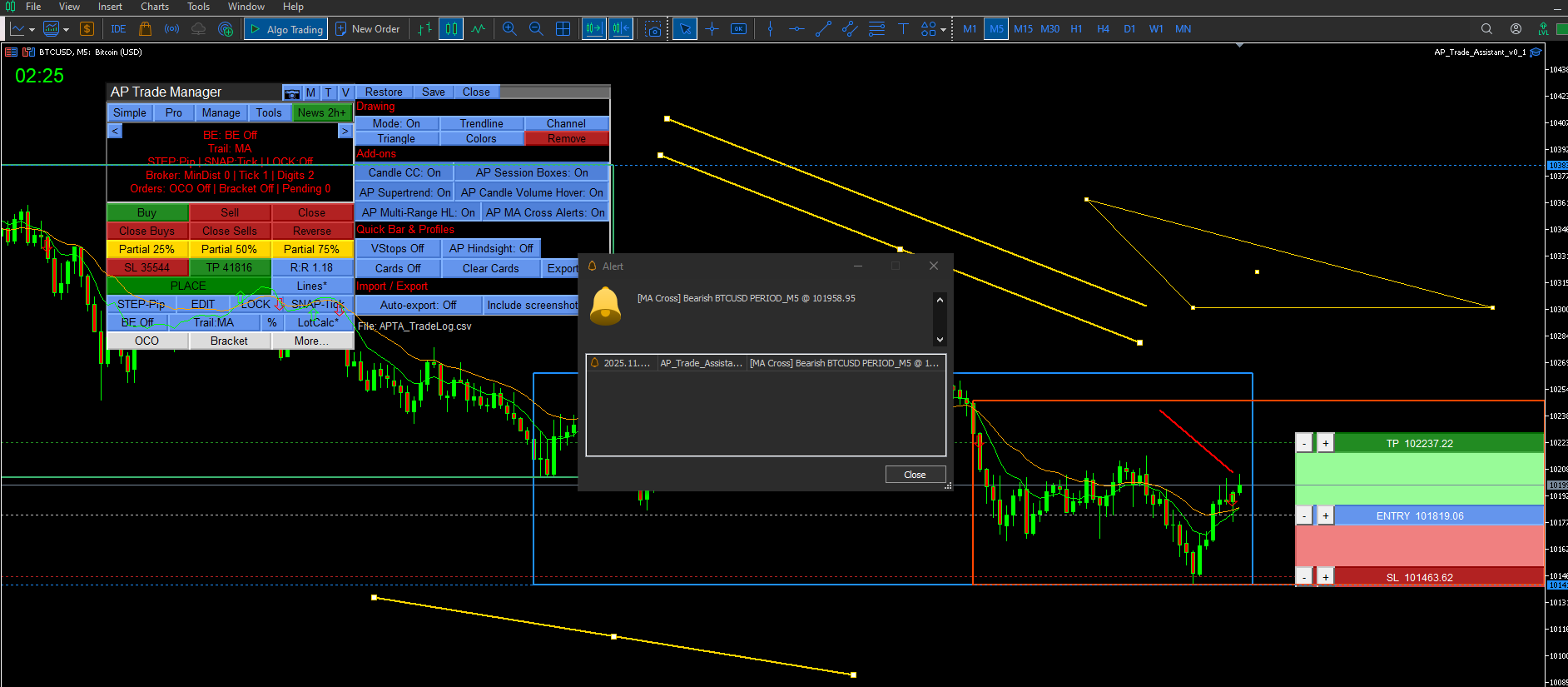

AP Trade Manager - Descripción del producto AP Trade Manager es una utilidad compacta y segura para MT5 que convierte su gráfico en una estación de trabajo rápida y disciplinada. Maneja entradas, salidas, parciales, breakeven+, lógica OCO/Bracket, trailing stops y acciones programadas desde un panel limpio que puede acoplar en cualquier lugar. Es puro MQL5 (sin DLL, sin WebRequest), y diseñado para gráficos en vivo. Lo que hace Ejecución con un solo toque. Mercado de compra/venta y los cuatro

Motor intradía para XAUUSD (Oro). Construye una "caja" de ventana temporal, espera a que se produzca un movimiento decisivo más allá de ella y, a continuación, coloca una orden pendiente para participar en el retroceso. Controles de riesgo estrictos, sin rejilla ni martingala. Cómo funciona Usted define una o varias ventanas horarias (por ejemplo, Londres, Nueva York u horas personalizadas). Tras el cierre de una ventana, el EA comprueba si se ha producido un movimiento limpio más allá de la

AP Día-Semana-Mes Máximo-Mínimo MT4 Superposición ligera que dibuja los máximos/mínimos del Día, Semana y Mes anteriores en cualquier gráfico. Ideal para planificar sesiones, confluencias y alertas cuando el precio vuelve a niveles de oscilación importantes. Qué hace Traza 6 líneas: Máximo/Mínimo del día, Máximo/Mínimo de la semana, Máximo/Mínimo del mes (de las sesiones anteriores completadas). Alerta cuando el precio alcanza una línea seleccionada (con una tolerancia fijada por el usuario)

AP VWAP Bandas Pro (MT4) Precio medio ponderado por volumen con bandas ±σ para un sesgo intradía claro, zonas de reversión media y soporte/resistencia dinámicos. Funciona con criptomonedas (incluido BTC), divisas, índices y metales. Utiliza tick-volumen cuando el volumen real no está disponible. Lo que muestra Línea VWAP (precio medio ponderado por volumen). Dos envolventes alrededor del VWAP (por defecto ±1σ y ±2σ) para resaltar el equilibrio frente a la extensión. Modos de reajuste: Día

AP VWAP Bandas Pro (MT5) Precio medio ponderado por volumen con bandas ±σ para un sesgo intradía claro, zonas de reversión media y soporte/resistencia dinámicos. Funciona con criptomonedas (incluido BTC) , divisas , índices y metales . Utiliza tick-volumen cuando el volumen real no está disponible. Lo que muestra Línea VWAP (precio medio ponderado por volumen). Dos envolventes alrededor del VWAP (por defecto ±1σ y ±2σ) para resaltar el equilibrio frente a la extensión. Modos de reajuste : Día

AP Día-Semana-Mes Máximo-Mínimo superposición que dibuja los máximos y mínimos del día, semana y mes anteriores en cualquier gráfico. Ideal para planificar sesiones, confluencias y alertas cuando el precio vuelve a niveles de oscilación importantes. Qué hace Traza 6 líneas: Máximo/Bajo del día , Máximo/Bajo de la semana , Máximo/Bajo del mes (de las sesiones anteriores completadas). Alertas de toque/cerca cuando el precio alcanza una línea seleccionada (con una tolerancia fijada por el usuario)

AP Oil Navigator PRO (MT4) Qué es AP Oil Navigator PRO es un Asesor Experto basado en reglas diseñado específicamente para símbolos energéticos como XTIUSD (WTI) y UKOIL (Brent). El EA busca un sesgo direccional utilizando un filtro de tendencia de marco de tiempo superior, y luego sincroniza las entradas en el marco de tiempo de trabajo utilizando una puerta de volatilidad y una ruptura de estructura. Las órdenes se colocan con comprobaciones seguras para el corredor y riesgo fijo. Sin

AP London Breakout MT4 negocia el primer impulso cuando Europa da el relevo y llega la liquidez de Londres. Construye un rango pre-Londres (servidor 02:00-07:00), comprueba la altura de la caja y el diferencial, y luego publica una ruptura limpia con riesgo fijo. Sin martingala, sin rejilla, sin persecución; una vez llenado, cancela el otro lado y se detiene para el día. Diseñado para las principales divisas y el oro en M5-M15, con una colocación segura para el broker (Stops/Freeze aware)

AP DayTrader Impulse Box MT4 Qué hace Motor intradía que combina un rango de "caja" de sesión ( M5) con un filtro de impulso ( EMA/RSI en M15). Cuando el precio escapa de la caja con confirmación de impulso, el EA coloca una única orden de mercado en esa dirección. Una posición por símbolo. Lógica simple, pocos mandos Caja + confirmación de impulso Sin martingala, sin rejilla, sin promediado Funciona en cuentas de compensación Cómo se deciden las entradas Construya una "caja" de ventana temporal

AP DayTrader Impulse Box (MT5) Para qué sirve Motor intradía que combina un rango de "caja" de sesión (M5) con un filtro de impulso (EMA/RSI en M15). Cuando el precio escapa de la caja con confirmación de impulso, el EA coloca una única orden de mercado en esa dirección. Lógica simple, pocos mandos Caja + confirmación de impulso Sin martingala, sin rejilla, sin promediado Funciona en cuentas de compensación Cómo se deciden las entradas Construya una "caja" de ventana temporal a partir de las

AP BTC Retest alcista (MT5) EA de largo plazo para BTC. Espera un cierre decisivo por encima de la resistencia , confirma la calidad de la tendencia/volumen, luego coloca un LÍMITE DE COMPRA en el retroceso al nivel roto. Una configuración a la vez. Sin rejilla, sin martingala. Sin DLL/WebRequest. Qué es Un motor de breakout-and-retest para BTC. Construye manijas de resistencia significativas (clusters de cuerpo alto) en un TF más alto, requiere un cierre limpio a través de esa manija, luego