Allan Graham Pike / Profilo

- Informazioni

|

no

esperienza

|

16

prodotti

|

13

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Questa convinzione plasma tutto ciò che costruisco. I miei EA sono testati sia nei mercati rialzisti che ribassisti, progettati per resistere quando il mercato diventa instabile. Non sono fatti per sembrare belli solo nei backtest — sono costruiti per durare nel trading reale.

Se condividi l’idea che il trading debba essere coerente, basato su regole e focalizzato su BTC, allora sei nel posto giusto. E lungo la strada, finiamo per creare ottimi EA.

I’ve just pushed an upgrade to AP VWAP Bands (MT4) based on a user request from Jose Angel Hernandez.

The indicator now creates live chart objects for the current VWAP levels:

VWAP 0

VWAP +1 / -1

VWAP +2 / -2

These objects move with price and can be read directly by EAs, making it easier to build VWAP-based automation or rule sets without rewriting the maths yourself.

If you already use the indicator, simply download the new version from your MQL5 profile and drop it on the chart as usual – the objects will appear automatically in the MT4 “Objects List” and update in real time.

Thanks again to Jose for the suggestion.

If you have other ideas or workflow requests for VWAP tools, feel free to message me – I’m happy to evolve these tools around real trader use.

AP Fibonacci Retracement PRO (MT5) Overview AP Fibonacci Retracement PRO is a trend-continuation pullback EA. It waits for a confirmed swing, calculates the Fibonacci retracement zone, and looks for entries in the direction of the original move. No grid, no martingale. Strategy logic Detects the last valid swing high/low using Fractals on the selected signal timeframe. Calculates the retracement zone between 38.2% and 61.8% (configurable). On a closed bar, if price is inside the zone (with

Most “AI trading” products on the market promise the same thing:

The robot thinks for you

The robot learns from every mistake

The equity curve goes up in a straight line

In practice, that usually means a black-box system, heavy optimisation, and very little transparency about how risk is actually handled.

AP AlphaLog AI is built on the opposite idea:

Let the EA record your trading with full transparency, and let AI help you analyse and improve it – not place trades for you.

I’m preparing AP AlphaLog AI for release on MQL5, but before it goes live there I’m running it with a smaller group of traders directly. Below is a quick overview of how it works.

1. AP AlphaLog AI – MT5 Trade Journal Engine (EA)

This is a non-trading EA for MT5. It does not open or manage orders.

What it does:

Attaches to any MT5 chart (works on gold, FX majors, crypto, indices etc.)

Automatically records every closed trade into a compact .alog file

Captures:

Symbol, direction, lot size

Entry/exit time and session tag (London/NY/Asia, etc.)

Initial risk in points

R-multiple for each trade (profit or loss measured vs initial SL)

Basic tags needed for performance analysis

Key points:

No auto-trading, no hidden grids or martingale

Safe to run on live or demo accounts

You keep a structured, machine-readable history of what you actually did, not just what you remember

The .alog files are designed specifically for the second part of the workflow: the web analyser.

2. AP AlphaLog AI – Web Analyser + AI Report

Once you have some trading history, you upload your .alog file to a dedicated analysis page (outside MQL5).

The analyser runs locally in the browser and server-side, and produces:

Statistical breakdown

Total trades, winrate, net result

R-multiple stats (average R, best/worst R, distribution)

Performance by symbol

Performance by session (London / New York / Asia, etc.)

Performance by day of week

Equity curve based on your actual trade outcomes

AI-generated review

On top of the raw stats, an AI model is used as a performance coach, not a signal generator. It receives:

A numeric summary of your trading

The per-symbol / per-session breakdowns

R-multiple information and consistency

It then returns a structured text report, typically including:

2–3 strengths in your current trading

3–5 key issues (risk, discipline, symbol selection, session behaviour, etc.)

A concrete action plan for the next 10–20 trades (checklists, risk rules, focus points)

No trade entries are suggested. The AI is used only to interpret your data and present it in clear language.

Why I think this is a better use of AI

Instead of:

“Trust this opaque bot and hope it keeps working.”

You get:

Full visibility over your own behaviour

Data-driven feedback on where your edge is actually coming from (or leaking away)

A repeatable process: trade → log → analyse → adjust plan

It is a tool for serious testers and discretionary/systematic traders who want to see their trading like a developer or quant would.

Early phase: free AI reports for 60 days

Before AP AlphaLog AI goes live on the MQL5 Market, I’m running an early access phase:

The MT5 journalling EA is provided directly (compiled, unrestricted, no lot or symbol limits).

The web analyser + full AI report is free for 60 days for early users.

After that, AI reporting will move to a paid model, but testers keep the EA.

If you are:

Trading on MT5 (gold / FX majors / BTC welcome)

Comfortable running Strategy Tester and collecting some basic stats

Interested in a transparent, data-driven way to use AI after the trade, not instead of you

you’re the type of trader I built this for.

How to get involved

For now, AP AlphaLog AI is not yet published on MQL5.

If you’d like early access:

Send me a message here on MQL5.

I’ll reply with:

The AP AlphaLog AI MT5 EA (journal engine)

The analyser link and short “how to use” guide

Details on the 60-day free AI reporting window

This is my view of how AI should be used in trading:

Not as a black box that replaces your decisions, but as a clear, brutally honest mirror of what you are really doing in the market.

You’ve probably seen the ads:

• “Quantum AI trading engine”

• “Neural network EA that learns from every mistake”

• “GPT-powered robot with no losing trades in backtests”

On the surface, it sounds amazing: install an EA, turn it on, let “AI” do the thinking, and watch the equity curve go up in a straight line.

There are several reasons I don’t build, sell or rely on that kind of black-box “AI robot”, and why my own tools and teaching take a very different approach.

I want to walk you through those reasons clearly, so you know exactly where I stand.

________________________________________

1. What I mean by “black-box AI robots”

When I say black-box AI robots, I mean EAs that:

• Hide their real logic behind buzzwords: quantum, neuro-fractal, deep AI, GPT control, big data, no losses, etc.

• Provide no clear explanation of:

o What the underlying trading logic actually is.

o How risk is controlled.

o How the model was tested out of sample.

• Often show perfect or near-perfect backtests, sometimes with:

o No visible losses.

o Extremely smooth equity curves.

o Tiny drawdowns that look “too good to be true”.

The key problem is not that they use some machine-learning technique; it’s that you, the trader, cannot see or understand what’s actually happening.

You’re being asked to trust the marketing and hand over your account to a black box.

________________________________________

2. The core technical problems with these systems

a) Overfitting: it’s easy to make a pretty backtest

With enough parameters, any algorithm (AI or not) can be tuned to fit the past:

• You can perfectly “explain” yesterday’s price action.

• But that does not mean you can survive tomorrow’s.

When you combine complex neural networks with a lot of optimisation and then test on the same data you trained on, you get:

• Stunning historical performance.

• Very little robustness out of sample.

If an EA claims that it “learns from every past mistake” and presents you with a backtest where those mistakes simply no longer exist, you are often just looking at the final, heavily optimised version that has been tailored to that exact history.

That’s not learning; it’s curve-fitting.

b) Non-stationary markets: what worked then may not work now

Markets change. Volatility regimes shift. Liquidity and behaviour of participants evolve.

Any learning model is a product of the data it saw:

• If a model was trained mostly on one kind of environment, its decisions may be wrong in a different environment.

• A black-box ML system with no transparent logic can fail abruptly when the regime shifts.

A rule-based EA with clear logic can also suffer in new regimes, of course — but at least you can see where and why, and decide whether to adjust or pause it.

c) “No losses in backtests” is a red flag, not a feature

If a robot can lose in live trading, then in an honest simulation it should also be able to lose.

Claims like:

• “The system corrects its mistakes so they disappear in the backtest”

• “The EA prevents losing patterns from ever repeating”

are incompatible with how random, noisy markets actually behave.

Losses are not bugs to be coded away; they’re part of the distribution of outcomes. A system can aim to manage losses, not magically eliminate them.

When you see “no losses” or “almost no drawdown” in a retail backtest, it usually tells you more about the testing process than about the true robustness of the system.

________________________________________

3. Practical problems for you as a trader

Even if we ignore the technical discussion, black-box AI robots cause very practical issues:

a) You can’t see the risk engine

If you don’t know:

• How lot size is chosen,

• How many positions can be open,

• Whether there is hidden grid, martingale, or “recovery” logic,

you cannot meaningfully control risk.

You only find out what the EA can do after you’ve placed real money behind it — and sometimes after a catastrophic move.

b) You can’t meaningfully debug or improve it

When all you have is:

• Marketing text about “quantum AI” and

• A DLL or compiled EA that hides all logic,

you cannot:

• Understand why a bad trade happened.

• Adjust rules in a targeted way.

• Build your own edge on top of the system.

You are locked into trusting that the black box knows better than you, and that is not how I believe trading should be approached.

c) It encourages the wrong mindset

Black-box AI marketing is often designed to sell a dream:

• No effort.

• No understanding needed.

• Just install, press start, and “the AI will handle it”.

This pushes traders towards gambling behaviour:

• No risk plan.

• No respect for drawdown.

• No understanding of when to pause, adjust, or stop.

The more you give away your decision-making to something you don’t understand, the more likely you are to panic or interfere at exactly the wrong time.

________________________________________

4. What I do instead

I’m not against automation or algorithms. I write and use EAs myself.

The difference is in how they’re designed and how transparent they are.

Here’s the approach I take with my own tools and course:

a) Strategy first, automation second

• I start from a clear, human-understandable strategy:

o Example: London breakout box, defined session window, fixed rules for entry, SL, TP.

• The EA is there to execute that plan consistently:

o Placing the correct pending orders.

o Managing stops and targets.

o Following your risk rules.

You should be able to explain the strategy in simple language, without any AI buzzwords.

b) Simple, testable logic

• Every key rule can be described in plain English.

• You can test it on demo.

• You can see:

o When the EA will trade.

o When it will stand aside.

o What each setting does.

There is no hidden martingale mode, no secret grid, no “magic” behaviour that only shows up under stress.

c) Risk first, not curve aesthetics

I care more about:

• Controlled position sizing.

• Known maximum exposure.

• Honest drawdown expectations.

than about producing a perfectly smooth equity curve in a marketing screenshot.

You will still see losing trades, losing weeks, and drawdowns — because that’s real trading. The point is to survive them and understand what’s happening, not pretend they don’t exist.

d) Education alongside the tool

I don’t want you to be dependent on me or any single EA. That’s why the course and tools are designed to:

• Teach you what the strategy is actually doing.

• Teach you basic risk management.

• Show you how to test and evaluate performance.

If you decide to stop using any EA, you still keep the understanding and can apply it elsewhere.

________________________________________

5. If you still want to experiment with “AI” robots

If you are curious and want to test AI-branded EAs anyway, I’d strongly recommend:

• Demo first, always.

• Use the smallest possible real exposure if you ever go live.

• Avoid any system that:

Hides risk controls.

Requires you to enable DLLs without careful explanation.

Shows “no losses” or truly unrealistic backtests.

• Look for:

Honest description of logic.

Clear risk management.

Real forward-test history, not just a perfect backtest image.

Treat them as experiments, not as the core of your trading plan.

________________________________________

6. Summary

I don’t use or promote black-box AI robots because:

• They often rely on heavy overfitting and marketing rather than robust design.

• They hide crucial details about risk and logic.

• They encourage a “turn it on and pray” mindset that is dangerous for traders.

• They make it impossible for you to learn, understand, and ultimately take responsibility for your own trading.

Instead, I focus on:

• Clear, rule-based strategies that you can understand.

• Transparent EAs that automate those rules without hidden tricks.

• Risk management and education as the foundation.

Automation is a powerful tool — but it should work for you, not replace your understanding.

AP Session Boxes — Asian / London / NY Range Overlay (MT5 Indicator) Clean session boxes on your chart. This lightweight indicator draws the Asian , London , and New York time windows directly on the chart, including each box’s high and low as dashed lines. It’s perfect for quick context, breakout planning, and clean screenshots. Instant structure: See where the market ranged during key sessions. Breakout prep: Use the hi/lo

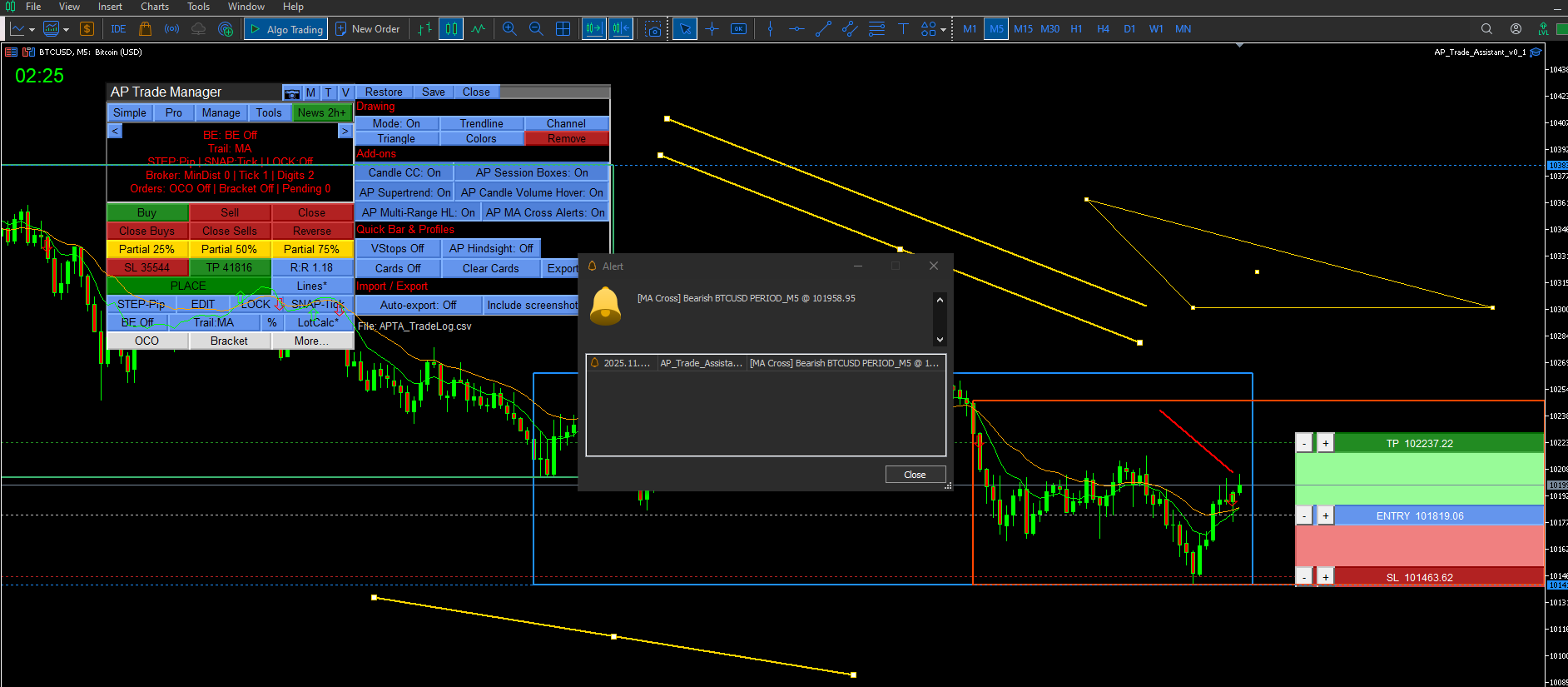

AP Trade Manager — Product Description AP Trade Manager is a compact, broker-safe MT5 utility that turns your chart into a fast, disciplined trade workstation. It handles entries, exits, partials, breakeven+, OCO/Bracket logic, trailing stops, and scheduled-style actions from a clean panel you can dock anywhere. It’s pure MQL5 (no DLL, no WebRequest), and designed for live charts. What it does One-tap execution. Buy/Sell market and all four pending types (Buy/Sell Stop, Buy/Sell Limit)

Intraday engine for XAUUSD (Gold). Builds a time-window “box”, waits for a decisive move beyond it, then places a pending order to participate on the pullback. Tight risk controls, no grid, no martingale. How it operates You define one or more time windows (e.g., London, NY, or custom hours). After a window closes, the EA checks for a clean move beyond the box by a user buffer. Optional gates: EMA trend check and volume impulse filter. Places a pending order near the broken edge with an

AP Day-Week-Month High-Low MT4 Lightweight overlay that draws the prior Day, Week, and Month highs/lows on any chart. Great for session planning, confluence, and alerting when price comes back to important swing levels. What it does Plots 6 lines: Day High/Low, Week High/Low, Month High/Low (from the previous completed sessions). Touch/near alerts when price reaches a selected line (with a user-set tolerance). Works on any symbol and timeframe. Zero external libraries. How to use Drop it on the

AP VWAP Bands Pro (MT4) Volume-weighted average price with ±σ bands for clear intraday bias, mean-reversion zones, and dynamic support/resistance. Works on crypto (incl. BTC), FX, indices, and metals. Uses tick-volume when real volume isn’t available. What it shows VWAP line (volume-weighted mean price). Two envelopes around VWAP (default ±1σ and ±2σ) to highlight balance vs. extension. Reset modes: Day, Week, or Anchor Time (HH:MM) to start VWAP where you need it (e.g., exchange open). Why

AP VWAP Bands Pro (MT5) Volume-weighted average price with ±σ bands for clear intraday bias, mean-reversion zones, and dynamic support/resistance. Works on crypto (incl. BTC) , FX , indices , and metals . Uses tick-volume when real volume isn’t available. What it shows VWAP line (volume-weighted mean price). Two envelopes around VWAP (default ±1σ and ±2σ) to highlight balance vs. extension. Reset modes : Day , Week , or Anchor Time (HH:MM) to start VWAP where you need it (e.g., exchange open)

AP Day-Week-Month High-Low overlay that draws the prior Day, Week, and Month highs/lows on any chart. Great for session planning, confluence, and alerting when price comes back to important swing levels. What it does Plots 6 lines: Day High/Low , Week High/Low , Month High/Low (from the previous completed sessions). Touch/near alerts when price reaches a selected line (with a user-set tolerance). Works on any symbol and timeframe. Zero external libraries. How to use Drop it on the chart you

AP Oil Navigator PRO (MT4) What it is AP Oil Navigator PRO is a rules-based Expert Advisor designed specifically for energy symbols such as XTIUSD (WTI) and UKOIL (Brent). The EA looks for a directional bias using a higher-timeframe trend filter, then times entries on the working timeframe using a volatility gate and a structure break. Orders are placed with broker-safe checks and fixed risk. No martingale, no grid, and no averaging. How it trades • Bias: EMA alignment and swing structure on the

AP London Breakout MT4 trades the first impulse when Europe hands over and London liquidity hits. It builds a pre-London range (02:00–07:00 server), checks the box height and spread, then posts one clean breakout with fixed risk. No martingale, no grid, no chasing; once filled, it cancels the other side and stands down for the day. Designed for majors and gold on M5–M15, with broker-safe placement (Stops/Freeze aware), lot rounding, and a daily cap. Quick start • Chart: M5 (reads higher

AP DayTrader Impulse Box MT4 What it does Intraday engine that combines a session “box” range (M5) with an impulse filter (EMA/RSI on M15). When price escapes the box with momentum confirmation, the EA places a single market order in that direction. One position per symbol. Simple logic, few knobs Box + impulse confirmation No martingale, no grid, no averaging Works on netting accounts How entries are decided Build a time-window

AP DayTrader Impulse Box (MT5) What it does Intraday engine that combines a session “box” range (M5) with an impulse filter (EMA/RSI on M15). When price escapes the box with momentum confirmation, the EA places a single market order in that direction. Simple logic, few knobs Box + impulse confirmation No martingale, no grid, no averaging Works on netting accounts How entries are decided Build a time-window “box” from recent session hours (start/end inputs). Wait for price to escape the

AP BTC Bullish Retest (MT5) Long-only BTC EA. Waits for a decisive close above resistance , confirms trend/volume quality, then places a BUY LIMIT on the pullback to the broken level. One setup at a time. No grid, no martingale. No DLL/WebRequest. What it is A breakout-and-retest engine for BTC. It builds meaningful resistance handles (body-high clusters) on a higher TF, requires a clean close through that handle, then buys the retest with disciplined risk and strict broker-safe checks. How it