Kun Li / Profile

This article considers using the Rattle package for automatic search of patterns for predicting long and short positions of currency pairs on Forex. This article can be useful both for novice and experienced traders.

The article provides a description of a universal method for analyzing and converting data from HTML documents based on CSS selectors. Trading reports, tester reports, your favorite economic calendars, public signals, account monitoring and additional online quote sources will become available straight from MQL.

Finding rules for a trade system and programming them in an Expert Advisor is a half of the job. Somehow, you need to correct the operation of the Expert Advisor as it accumulates the results of trading. This article describes one of approaches, which allows improving performance of an Expert Advisor through creation of a feedback that measures slope of the balance curve.

In this article, I will consider the possibility of upgrading the CCI indicator. Besides, I will present a modification of the indicator.

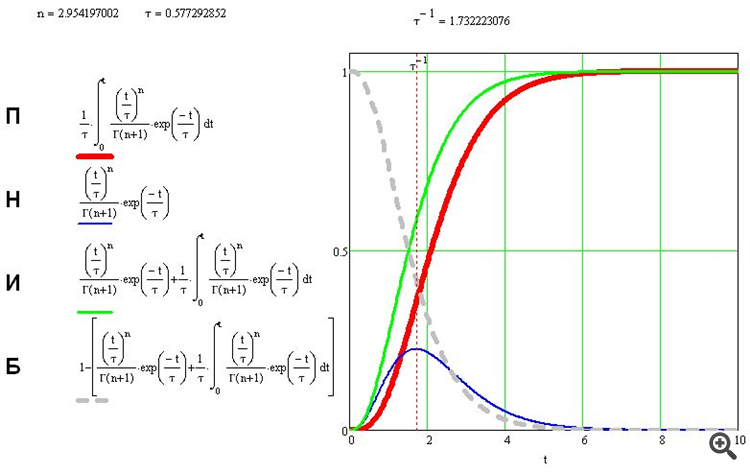

This article suggests the ways of improving manual trading strategy by applying fuzzy set theory. As an example we have provided a step-by-step description of the strategy search and the selection of its parameters, followed by fuzzy logic application to blur overly formal criteria for the market entry. This way, after strategy modification we obtain flexible conditions for opening a position that has a reasonable reaction to a market situation.

Decision trees imitate the way humans think to classify data. Let's see how to build trees and use them to classify and predict some data. The main goal of the decision trees algorithm is to separate the data with impurity and into pure or close to nodes.

The use of computer vision allows training neural networks on the visual representation of the price chart and indicators. This method enables wider operations with the whole complex of technical indicators, since there is no need to feed them digitally into the neural network.

This article aims to teach the reader how to make a Deep Neural Network from scratch using the MQL4/5 language.

I continue filling the algorithm with the minimum necessary functionality and testing the results. The profitability is quite low but the articles demonstrate the model of the fully automated profitable trading on completely different instruments traded on fundamentally different markets.

We usually analyze the market using candlesticks or bars that slice the price series into regular intervals. Doesn't such discretization method distort the real structure of market movements? Discretization of an audio signal at regular intervals is an acceptable solution because an audio signal is a function that changes over time. The signal itself is an amplitude which depends on time. This signal property is fundamental.

Overbought/oversold zones characterize a certain state of the market, differentiating through weaker changes in the prices of securities. This adverse change in the synamics is pronounced most at the final stage in the development of trends of any scales. Since the profit value in trading depends directly on the capability of covering as large trend amplitude as possible, the accuracy of detecting such zones is a key task in trading with any securities whatsoever.

Nowadays, voice assistants play a prominent role in human life, as we often use navigators, voice search and translators. In this article, I will try to develop a simple and user friendly system of voice notifications for various trade events, market states or signals generated by trading signals.

In the fifth article related to the creation of a trading signal monitor, we will consider composite signals and will implement the necessary functionality. In earlier versions, we used simple signals, such as RSI, WPR and CCI, and we also introduced the possibility to use custom indicators.

In this article, we will consider popular candlestick patterns and will try to find out if they are still relevant and effective in today's markets. Candlestick analysis appeared more than 20 years ago and has since become quite popular. Many traders consider Japanese candlesticks the most convenient and easily understandable asset price visualization form.