Can anyone report anything useful about "trend following trading systems for the foreign exchange market"?

What are you interested in?

Useful to you what?

What are you interested in?

Useful to you in what way?

First and foremost - how they work, or how they should work, purely theoretically and practically. And the end result - the maximum achievable yield on single lots, for example.

First and foremost, how they work, or how they should work, purely theoretically and practically. And the final result - the maximum achievable profitability on single lots, for example.

The principle of their work follows from the name: to determine the trend and keep the deal in its direction. As soon as the trend fades or the opposite is detected - the deal is closed. The problem, as always, is determining whether or not there is a trend.

Their operating principle follows from the name: identify the trend and keep the trade in its direction. As soon as the trend fades or the opposite trend is detected, the trade is closed. The problem, as always, is determining whether or not there is a trend.

The trick is that the trend is difficult to determine, and especially when it is over. However, errors in determining the Trend Beginning are also possible, but they are less painful.

Therefore it would be desirable to have some more reliable signs, than, for example, wipers or ZigZag.

First and foremost, how they work, or how they should work, purely theoretically and practically. And the end result - the maximum achievable profitability on single lots, for example.

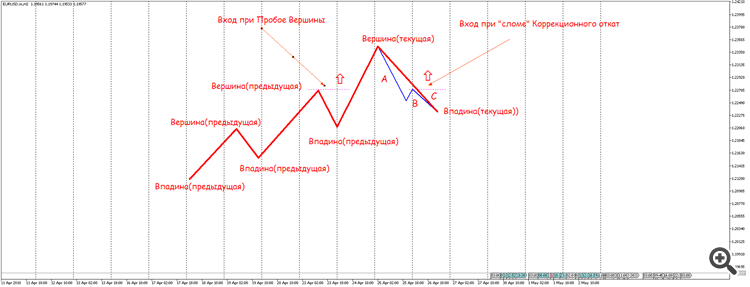

There are two types of entry points when trading on the Trend.

1) We have an uptrend (every subsequent top and trough is higher than the previous one), after the price has gone into a correction, we put an order for breakdown of this top, and a stop-loss for the current trough.

This method is not economical, price rarely makes a long move after the previous top, stop-loss is big.

2) After the price has updated the previous peak, we wait for correction, then correction completion (breaking it) and only after that we open in the direction of the Trend, with stop-loss on the current trough. In this case, the size of the expected move is higher, and the stop-loss is smaller.

---------------

What are the single lots? And what does the end result mean?

The trick is that a trend is difficult to define, especially when it ends. However, errors are also possible when determining the start of the trend, but they are less painful.

Therefore it would be desirable to have some more reliable indicators than, for example, dips or ZigZags.

The trend is determined by the location of tops and troughs... without Indicators...

The trend is determined by the location of the Peaks and Troughs... without Indicators...

You need an EA that works quickly and correctly, i.e. an EA that makes Profits, not Losses.

The size of the profit, among other things, directly depends on the size (lot size) of the opened trade.

Somebody once called deals of the size of one lot (100 000 units of quoted currency) "one-time",

I have found this value to be convenient for accounting and comparison in many cases, that is why I am using it.

It is desirable to aim for the greatest BENEFIT as the best ratio of running costs

and the profit generated.

Charts are a very useful thing for analysis, and there is no disputing that. But the intraday flow requires

a closer approximation to the BIT of the work being done!

You need an EA that works quickly and correctly, i.e. an EA that makes Profits, not Losses.

The amount of profit, among other things, directly depends on the size (lot size) of the opened trade.

Somebody once called deals of the size of one lot (100 000 units of quoted currency) "one-time",

I have found this value to be convenient for accounting and comparison in many cases, that is why I am using it.

It is desirable to aim for the greatest BENEFIT as the best ratio of running costs

and the profit to be made.

Charts are a very useful thing for analysis, and there is no disputing that. But the intraday flow requires

more closely approximation to the essence of the work to be done!

I don't know a Trend Advisor (that brings profit), I know trading strategies (manual) that bring profit ... To make a good robot, it will take a lot of time and money... Because there are so many nuances, the primitive type, if the price is above the average and the Stochastic reversed, it simply doesn't work...

You need an EA that works quickly and correctly, i.e. an EA that generates Profits, not Losses.

...

They all work fast, but the profit part is fantastic.

You need an EA that works quickly and correctly, i.e. an EA that generates Profits, not Losses.

Everyone needs one, but no one has one. At least, those who have one won't admit it. And those who say they do are crooks.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use