You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

How about VisualStudio?

(API, rewrite the platform, and all that stuff.

)

National Instruments gives api to their cards, all you have to do is wrap the data on the card (buy or order from NI) and read the finished result.

Many cunning calculations and methods approximate to their execution time and cost of this execution time anyway, i.e. other fast/cheap calculations/methods.

When applied to ticks it is the following benchmark - 1500 ticks per minute, i.e. an average of 0.04s between ticks, or maybe more, or maybe less. The sheriff's Indians questions are of no interest, i.e. the broker/metacotes have provided quick updates of the quotes - how will we calculate them quickly?

Accept a maximum calculation time of 0.01s, the number of symbols either multiply this time or multiply the number of kernels to calculate.

What maximal calculation time is accepted by the author of the topic? What properties (and for what purpose) should the curve have? How long does it take to calculate by the author's algorithm?

Sooner or later, the filtering issues had to be addressed - and so they were.

The conversation on this topic took place in 2012. It's been five years now... Time flies fast...

"Adaptive Filters.Applications in Trading"

http://procapital.ru/showthread.php?t=45897

A lot of useful information. And many will discover a lot of new things.

See

I hope that it will not be deleted.

Hi

If the owner of the branch thinks it is superfluous, I will delete it myself.

Manipulations on the level of single ticks do not influence at all processes that take tens of thousands of ticks (=your trades). Just as grains of sand on the road cannot significantly affect the course of a car. The scale is incomparable. You seem to be a "real physicist", but you "do not understand" such elementary things - it's strange).

Well said! That's exactly what I'm talking about.

OK, some of the things I say are "for the sake of spice". It just became a shame for those people who work on microtrends. It's hard enough for them, t2-distribution is already a serious adversary (just look at its quantile function), and now it's doing such tricks... Therefore, you're absolutely right - one should work with large sample volumes. In this case the trader understands that he is fighting the market face to face, force to force, and the brokerage company is not involved.

Sooner or later, the filtering issues had to be addressed - and so they were.

The conversation on this topic took place in 2012. It's been five years now... Time flies fast...

"Adaptive Filters.Applications in Trading"

http://procapital.ru/showthread.php?t=45897

A lot of useful information. And many will discover a lot of new things.

See

I hope that it will not be deleted.

Hi

If the owner of a branch will consider it superfluous, I will delete it.

No, Oleg, I will not delete anything. This thread is especially for physicists and mathematicians and for those people who want to learn more about these sciences.

To the question - isn't the author taking too much on himself here and why is he telling everything here?

The answer - I don't feel sorry for the algorithm for solving this problem, someone told it sooner or later anyway. But the technical details of the implementation of this algorithm - they can be different. And here it is not the fact that I am right in choosing a particular mechanism for solving this or that problem.

For example, the fundamental question - is the process of formation of increments stationary or not?

I, for example, think that it is stationary or almost stationary. That's why I use for non-stationary process of Bid or Ask prices themselves the weighted average WMA in which weights are taken from the formula of probability density of increments, etc. etc.

But, this certainly needs proof. HereOleg avtomat and SanSanych are absolutely right - a competent, academic proof of this fact is needed.

I appeal to young people studying at universities - take this topic for your term or graduation papers. Only use non-parametric statistics in your analysis - median. persentiles, interquartile range, etc., etc. Does the specific distribution of increments change over time for a particular currency pair in a strictly defined sample size of tick data? I.e. do the main characteristics of this process change in terms of parametric and non-parametric statistics?

I may be wrong - for a trader it would mean that in the algorithm suggested in this forum thread it would be better to use another moving average than WMA.

That's why I'm telling you everything - despite the obviousness of the algorithm for solving this problem in general, there are still some controversial points that require proof. So - go for it!

Does it mean that I began to doubt something and look in advance for excuses for possible failures?

Well, I always have doubts about something - it's normal for any person.

But I am not looking for excuses - Forex will be defeated, and that's it! But only by our joint efforts - I have no doubt about that for a second. That's it!

Sincerely,

Oleksandr.

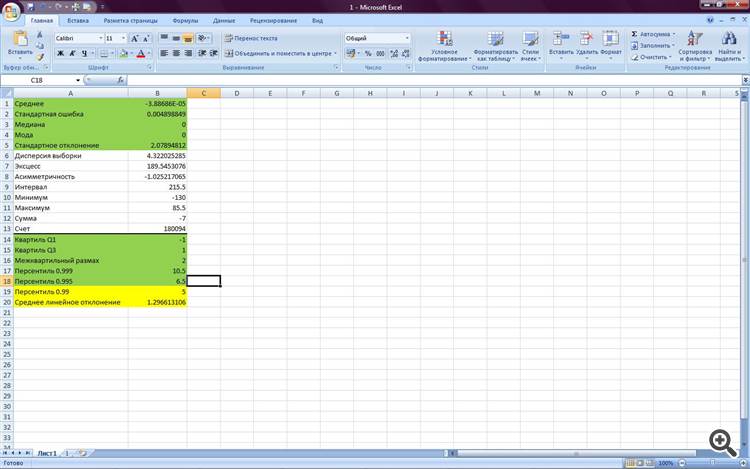

Look at these statistics of one month ago for EURJPY

Here we consider averages between two successively received quotes at exponentially distributed time intervals of their reception(Hello DC's children with their shameful tricks with ticks and all spreads):

And these are the statistics for the past week with the same way of receiving tick data

Note that for most stats we have almost complete identity. The difference in persentile 0.99 and the average linear deviation is explained only by a different sample volume.

Now, I hope, it is clear to all that the process of increment formation is stationary and we are on the right way?

And I can tell schoolchildren from DC - with such a way of data reception, your childish efforts to distort the information we need are ridiculous.

No? Don't you get it yet?

:))))))))))

............

No? Don't you get it yet?

:))))))))))

Alexander, such words only come from insult.

Either you lost a lot or you put on rose-colored glasses.

I would not recommend charging more than one dollar at the start to test this theory in real tradingAlexander, such words only come from resentment

Either you've lost too much money or you have put on rose-coloured glasses.

No, I haven't drained anything yet - that's yet to come to me, I guess :))) Just saw a clear distortion in the tick stream - I think, wow! The task is hard enough as it is, and here it is... It's like a professional challenge for me.

And about the real account - yes, I think you have to be careful and use minimal lots in the beginning.

And my words are too abrupt - my manager almost every day warns me that after the New Year I'm not going to do real trades, they will start charging interest. That's how it is!

No, I haven't drained anything yet - that has yet to happen, I guess :))) Just saw a clear distortion in the tick stream - I thought, wow! It's not an easy task as it is, and here it is... It's like a professional challenge for me.

And about the real account - yes, I think you have to be careful and use minimal lots in the beginning.

And my words are too abrupt - my manager almost every day warns me that after the New Year I'm not going to do real trades, they will start charging interest. That's how!

Distortions?

Tick-flow is chaotic and depends only on traders' activity and will always be so, what are you looking for there?

I told you: the rate will go up, and the rate will go down.

Here is the basic process that moves the rate, start again with this

Hello DC kids with their shameful tricks with ticks and all sorts of spreads):

Tezka, with deep respect for you and your approach, I would not rush to conclusions and salutations. Any theoretical conclusions and evidence require practical testing. In this case it should look like a monotonically increasing curve of real account, which I sincerely wish you.

... My brokerage company manager warns me almost every day that if I do not start real trading after the New Year they will start withdrawing interest. That's how!

This is some kind of lawlessness. This is the first time I have heard of such a thing with over 17 years of trading experience. My advice to you: withdraw funds and close the account immediately. Open it only at internationally regulated brokers. Better start testing a new TS with a DEMO account. Then switch to cent, and then to a real account. This way you minimize the risks of loss.