You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBPCHF 30m bat pattern which I forcasted here yesterday got filled on my limit order at PRZ 192.9% which is a daily support

so far it reacted nicely to that level and pattern.

NZDUSD agressive C(or safety C) just finish it's way down(as for my analysis) for about 100 pips, now maybe going up.

That C was amazing. I thought you cared about time since you stated "it may not be like harmonics".

So in your pinion, what is your ideal time length? I'm asking those who pay attention to time.

@RyuShin

i acknowledge with @lanorinHawklight time is importnat in HP

Your several posts are fantastic but i thing its interesting also to know why some patterns failed ...and i suppose we will find this tilme rule.Take a look to snapshots posted by @pourchik and @harrymonic

@RyuShin i acknowledge with @lanorinHawklight time is importnat in HP Your several posts are fantastic but i thing its interesting also to know why some patterns failed ...and i suppose we will find this tilme rule.Take a look to snapshots posted by @pourchik and @harrymonic

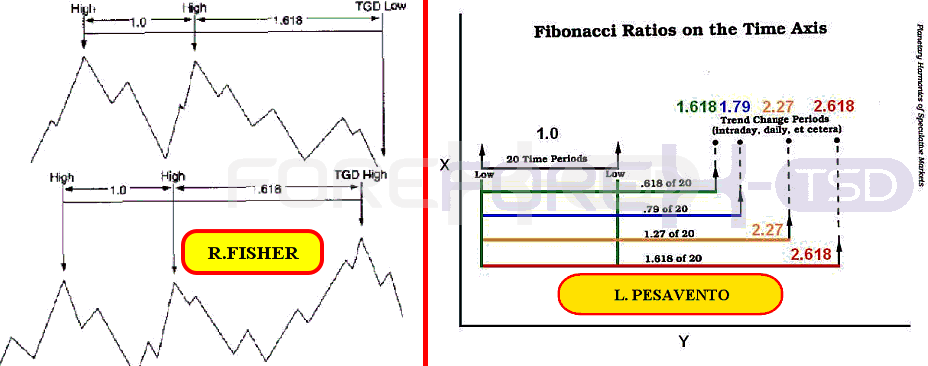

It's funny because I started going through the thread I saw those pictures and I added the N200 pattern to my pattern list. I'll do some experiment on correlation between harmonics and time.

I saw those pictures and I added the N200 pattern to my pattern list. I'll do some experiment on correlation between harmonics and time.

Being attentive is important I think. I was not attentive enough and missed aggressive C on EURUSD.

That C was amazing. I thought you cared about time since you stated "it may not be like harmonics".

yeah, I prefer that it would look clean perfect and tidy, but in the lower timeframes i think are too volatile to measure time.

yeah, I prefer that it would look clean perfect and tidy, but in the lower timeframes i think are too volatile to measure time.

I totally agree with you. +M15 timeframes are preferable for this I suppose. I'm sorry if I've asked you this before but do you always look for 61.8 retracement for agg C or 50 sometimes? I see 50 retracement + divergence for agg C from time to time. Like today on GBPUSD M15. Maybe it's risky but if there's support or resistance, it might be a chance.

I totally agree with you. +M15 timeframes are preferable for this I suppose. I'm sorry if I've asked you this before but do you always look for 61.8 retracement for agg C or 50 sometimes? I see 50 retracement + divergence for agg C from time to time. Like today on GBPUSD M15. Maybe it's risky but if there's support or resistance, it might be a chance.

well I took off profit @ 78.6 I actually didn't want to close it but than I saw all that price starting to consolidate and I looked left and saw there is some support so I took half of my position out.

anyway I don't have solid rules for aggressive C

GBPUSD M30. Potential cypher. I applied my new rule for cypher.

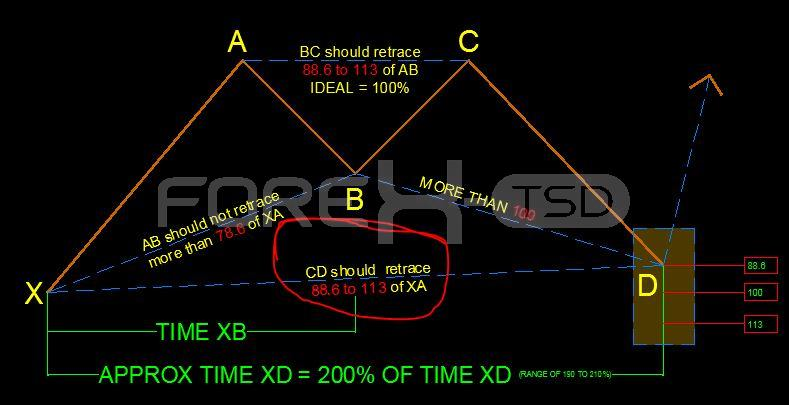

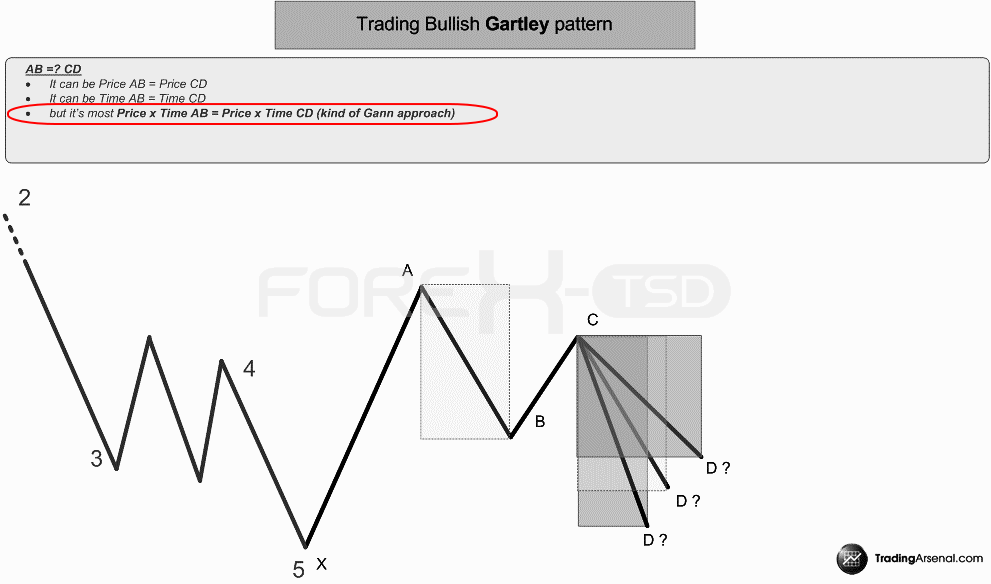

Good example of gartley ABCD.