You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

one more thing about ranges for now.

we know range candles have some type of over lap 99% of the time.

we also know what type of candles overlap more in range than others.

we know what type of price action to expect after spinning top closes.

we have learned a lot about when to change frequencies and why.

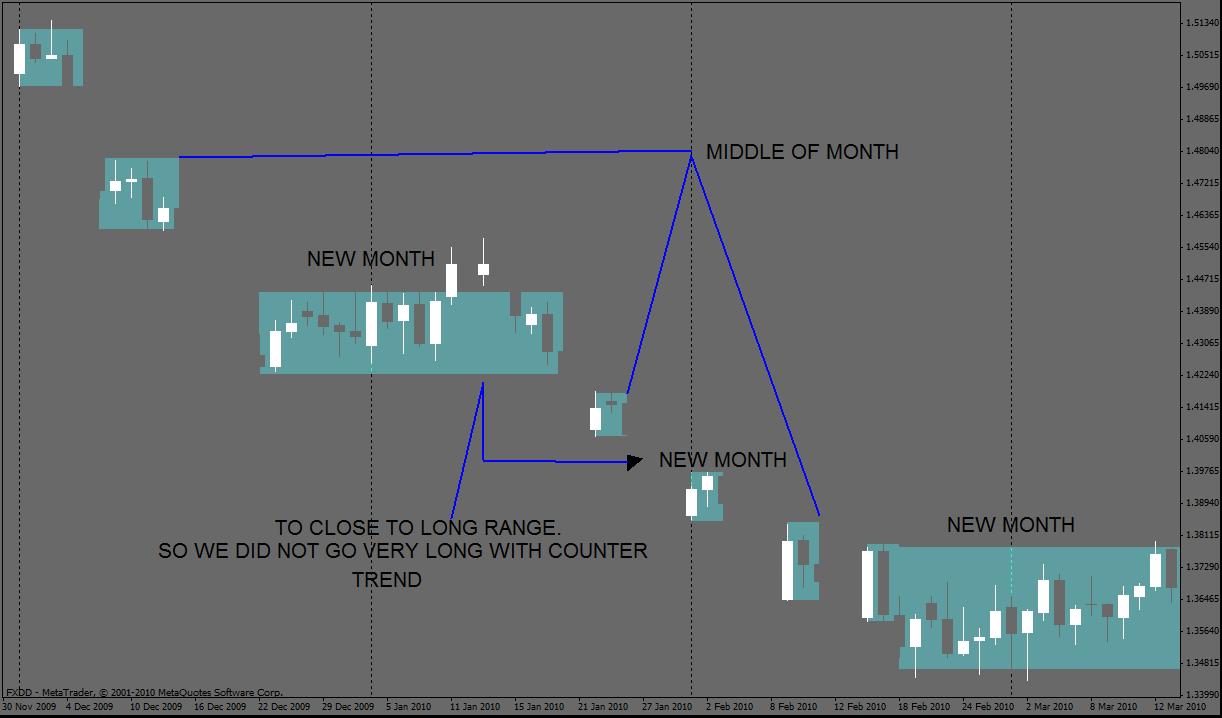

not taking into account time or candles lets look at this chart as an exercise in

what the reality of trend over lap!!

the reason for this exercise is this: TRADERS STOP CHASING DOWN TRENDS WITH DOWN

EVIDENCE, SELL IN DOWN TREND WITH UP EVIDENCE.

KEYS, TO THIS IS: AS THE TREND MATURES, THE TRAPS GET LARGER IN RANGE, OR LARGER IN

LENGTH OF TIME A RANGE CONTINUES. OR BOTH!!

USUALLY AT THE OPENS AND CLOSES OF LARGER TIME FRAME!!( RANGERS ARE LONGER AND LARGER),

BUT NOT ALWAYS, NOT WHEN THE PREVIOUS MONTH RANGED MOST OF THE MONTH AND TRENDED

AT THE VERY END ONLY.

AFTER THIS WE WILL TALK ABOUT CONTEXT. READING THE MARKET IN CONTEXT.

ALSO CLARIFICATION ABOUT A POST EARLIER WHEN I SAID LOOK FOR COUNTER TRENDS

IN THE BEGINNING- MIDDLE AND END OF THE MONTH, I WAS TALKING ABOUT THAT MONTHS

WITH TREND SWING. SO I MEANT THE MIDDLE, OF THE MONTHS TRENDING SWING.

SOMETIMES I JUST ASSUME EVERY ONE KNEW THIS BUT I WANTED TO MAKE THAT CLEAR.

ranges

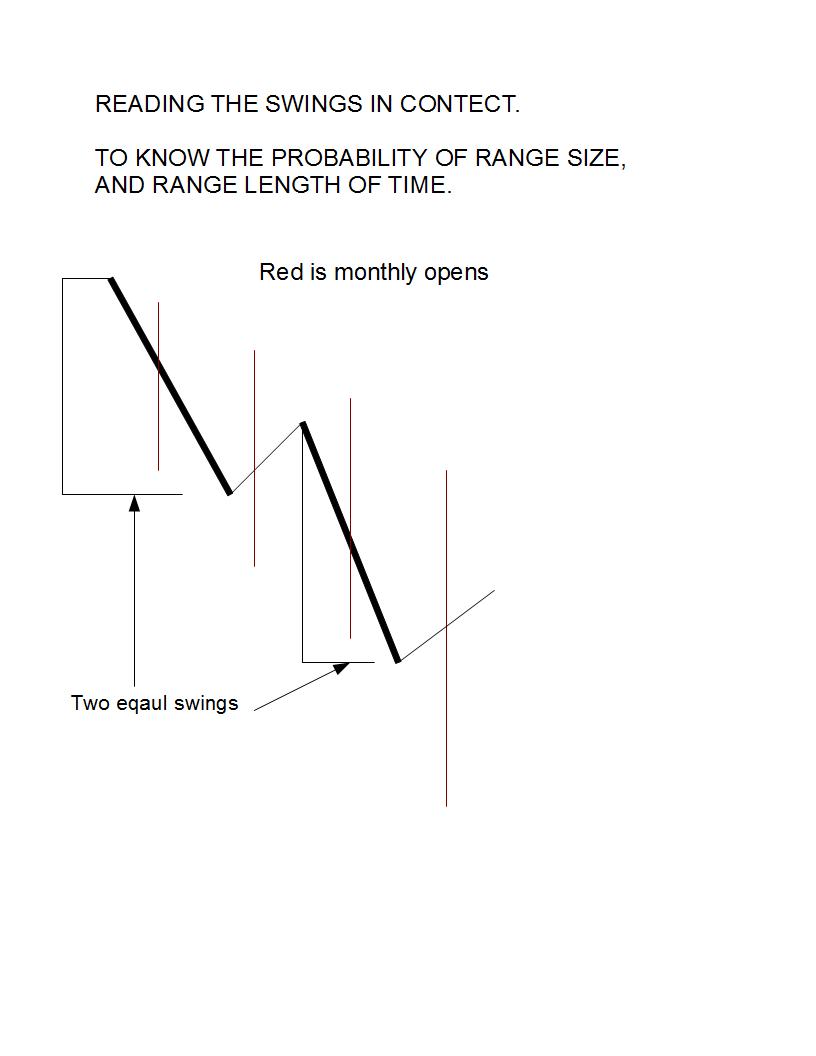

so the swings will stay pretty close to EQUAL!!!!! ON THE DAILY IN THIS EXAMPLE, AND

MANY MORE EXAMPLES.

SO WHEN YOU HAVE DAILY SWING THAT IS ONLY HALF THE SIZE IN POTENTIAL COMPARED

TO YOUR LAST SWING THEN THE NEW MONTH IS FORCED TO START WITH A SHORTER AND

SMALLER COUNTER TREND.

Reading the markets in context.

#1 . Markets are read by measuring swings length.

#2. Advertised closings. ( when the market closes so close to the trend line

it has no choice but open on the other side of the trend line with the next open.)

and what time frame that just happened on!!

# 3. It also is read by price action. Reading the market in context here is impotent.

Never an exact science.

In fact i will be as bold to say i am not perfect at this, but i am way better at

this than any pro i have known.

If you want to continue with this next section and you are already overwhelmed

then please just save the info for a later date.

This next section gets kind of complicated. It takes some learning. It takes some

trust on your part, trust to unlearn things we all were taught for years, and

now we have to learn it differently.

If we are going to do that, then dang it this better be a lot better than the stuff

i paid for over the years!! I hope it will be for you, but you have to go the distance

to learn it!!

Lets start with the pin bar!!

Price action can be viewed by:

#1 swing form.

#2 candle form.

Pin bars, are what a lot of traders learn are a rejection of the markets.

Rejection of horizontal levels, and false break outs.

This is all true!! But how much of a rejection? Is it temporary false break out ?

Is it temporary rejection of some level. That will not hold?

I will add this:

Pin bars are also traps.

Pin bars can be a reversal signal.

Pin bars can be a signal the market is about to range.

So reading where and when the pin bars form is impotent.

Reading the market in context.

It is late , tomorrow x- mass so i may continue later.

the banks!

what their goal's are!

#1. to protect there capital.

how?

#1. to move the market in plain site yet protect it from hordes of intelligent people.

how do they do this?

A. by making the moves delayed by being temperately in correct on a consistent basis.

in other words most traders are correct about the direction of the market. but find

it difficult to get into the trend with out getting caught up in a trade that is going

the wrong way.

well if you really listen to this statement, and i think all of you had heard something

like this before . THEN STOP RIGHT THERE. THIS IS TRUE!! THE MARKET WANTS YOU

TO SEE AND KNOW THE TRUTH, BUT ATTACK YOU WHEN YOU SEE IT CLEARLY.

ATTACKING ONLY TEMPERATELY THEN THE MARKETS MOVES.

THIS IS ANALYSIS!! THIS WHAT YOU NEED TO KNOW!! YOU NEED TO KNOW: YOU

ARE USUALLY CORRECT ABOUT THE MOVE, BUT WHEN IT IS CLEARLY KNOWN.

THE MARKET WILL ATTACK YOU. lots of times traders see the attack as the real move!

big mistake.

4 years ago i needed a good trade so bad, i planed and knew exactly when to enter the market

i went short in the most smart ass place i could find, nasty tricky i thought. i got into the

market on the very pip the market turned around at. i was shocked!! devastated!!

what did i do wrong? later looking back at that trade i realized something. something important

the market likes to go to the point of the trickiest smartest cautious places when people

are lurking for reversals, this is the spot when the market joins the trend.

the market joins the trend when smart people are lured into thinking a reversal is a good possibility

but they are smart so they do things like smart people would, trying to get smaller freq. confirmation

above the high of the larger freq. signal.

who has been there? i think we all have.

as we mature in this game we get better in better with time.time and lots of effort.

we keep with us some memories that are funny now, but then they were not.

mary x mass see you Tuesday, family time.

Iread that

what did i do wrong? later looking back at that trade i realized something. something important

the market likes to go to the point of the trickiest smartest cautious places when people

are lurking for reversals, this is the spot when the market joins the trend.

the market joins the trend when smart people are lured into thinking a reversal is a good possibility

but they are smart so they do things like smart people would, trying to get smaller freq. confirmation

above the high of the larger freq. signal.

yes it can happen xx

the thing is sometimes you have to stop looking at the market with cynical eye.

if you keep looking at the market with mistrust, you become a bystander.

the only way to make money is go with the flow, or be supper gutsy!!!

i do both.

traders who want to play reversals in their minds eye, will learn some hard lessons.

part of being successful is changing their mind set to the trend will last forever. which

is not true, but is far and above a better point of view that reversal lurking.

but changing to lower freq. to lurk for a smaller time frame, to reverse and join the

trend is smart business. my point here is some where at some time you have to pull the trigger.

emotions with money play a powerful game with traders heads.

so here is your choices:

gutsy entries! that carry little or no emotion!!

confirmation entries, that can carry substantial emotion for periods of time.

so depends on the personality of the trader. a good trader learns to deal with there

emotions. by listing convictions of the trade, to avoid second guessing themselves.

while they are down off entry. larger stop loss levels.

a great trader is nasty as the market is: making gutsy moves, knowing with in a matter

of minutes,this is all it should take to begin thinking about moving the stop into favor.

or get a small loss.

so traders if you want to trade you have to decide whats best for you. what fits your

emotional capability!

one of best friend and trading partner for years takes the same trades i do. He knows

every thing i know. except i call him up with shots, picking trades within a few pips

before turning around.

lots of times he is on the same trade but got in later then i did. some times he is still

not able to move his stop into favor yet and is still waiting for momentum.

he curses me a lot but he seams to be right with me at the end of the trade cashing in.

fun stuff!!

i was going to take break for x mass but

but i have some free time for moment.

pin bars... i was going to save this for the end of the pin bar subject but changed my mind!!

pin bars... spinning tops....dojis.... and week closing trend bars; all have the same functions!!!

they all are the fallowing:

reversal signals.

counter trend signals

could signal a range.

could be a trap.

Al brooks calls them all Doji bars, why because he knows they all represent the same type

of results.

this gives you only four distinctions,large range trending, medium range trending, small range trending,

or doji bar.

so when we go into reading price action, you will know right away!!

i do hold one view differently from my friend Al. they do have all the same capabilities, but

they hold different psychological values!!! that's impotent to me!!

price action

there are several courses on reading price action.

reading price action in swing form.

reading price action in candle form.

i do both, but i read price action in what i call reality form. not by color or some exact shape!!!

to focus only on what is important, leaving all the second guessing for some other course!!

i do not like to guess; hope; or speculate on crap shoot.

this will take some time for me to go threw so be patient with me please.

hopefully i will make clear understanding for all!!! i will try!!

Pin bars

psychological value of a pin bar = traders believe price has rejected some horizontal level , or a false break out.

this can be true!!! but when it comes to momentum the pins only hold temperately at thees levels!!!!!!!!!!!!

the first thing traders have to know is where thees levels real are!! traders draw all kinds of lines on swing lows and

highs. that's ok but not exactly accurate.

here is how you find true horizontal levels:

they are always two or more frequencies above the freq. you are on. they are highs and lows of previous closed candles.

and they are opens and closes of previous candles closed!! THEY ARE TWO TIME FRAMES HIGHER THEN THE ONE YOU ARE ON.

( WHEN IT COMES TO MOMENTUM THE PIN BARS ARE NOTHING MORE THAN TRAPS.)

all the blue lines are two time frames higher opens and closes lows and highs, notice where the real reactions happen!!

i overlaid the weekly time frame on the 4 hr here!