You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

remember

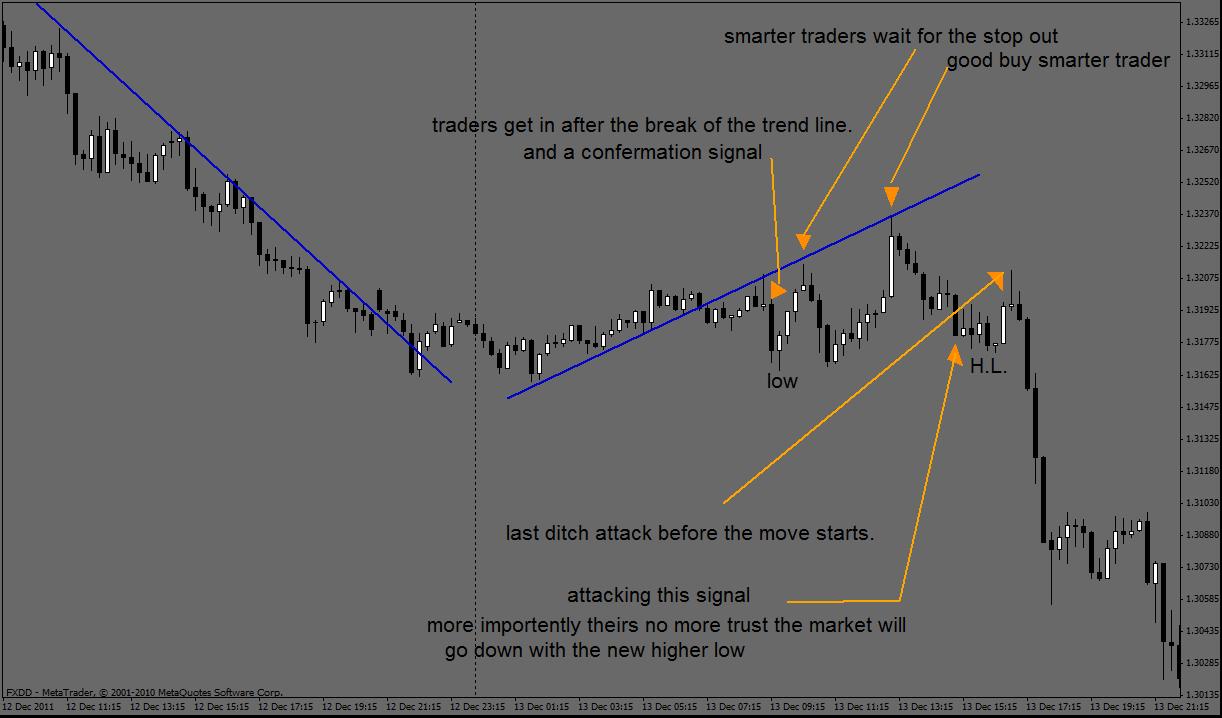

remember we were looking to go short off the trap above the range of the advertised closed candle.

well here is the shot of that trap, moving from the daily down to the

oops

here is the shot.

now remember the daily chart!!

looking at the daily chart its time to exit the short, why? because the psychology of that market

is saying go with the trend on the daily, in this shot. this is where i look for what i call a high two.

on the daily time frame, in other words the market most likely will break the high where we just went short again. in order to sell now and join the trend we need a daily long signal trap.

or the market will go short right now before ever reaching the trend line keeping traders off balance.

traders waiting for the market to play off the trend line, big mistake, either you will be stopped out,

or the trade will leave without you short now, before ever reaching the trend line.

now trading is a combination of things, knowing whats going on, what the market likes to do!!

what the market could do, and where to take risks and when to take risks. how to take risks.

if i wanted to risk short now(believing the market will leave traders off guard) i would have to lower my freq. and look for a long trap there!!

i do not believe that right now!! i believe the more extreme view of the market showing off a daily

candle long trap before going short.

trading is about risk i could risk both trades 25 pips each, i am control here!! you see i know what

to expect so loosing the first risk is no problem because i will get the trades short anyways!!

you see how real trading works, their is know real emotion when you know what to do!!

here is the psychology of the market right now shot.

will see what happens

but lets get back on track here, enough about the right side of the chart for now.

we need to cover strength and weakness in depth further, you learned about advertised closes.

now lets take a look at a trap verses the truth.

in order to know this you must get a few things strait first:

#1 a break out (or reversal) are the same thing!!!!!!!!!!!

a break out is always a reversal on some freq. depends on what freq. your looking at

#2 a break out always starts on the lowest freq. the tick!! then progresses from there

involving higher freq. as it moves.

# 3 in order for a breakout to lead to a larger time frame break outs or larger freq. breaks

the lower freq. must fake the break then hunt stops first, while hunting stops a break of

the trend line on that lower freq is likely, faking a reversal or false break at the same time.

this is how the market moves!!

#4 the market as it grows involves higher freq. traps and fake reversals.

#5 protecting the moves with pin bar reversal signals. trending candles against the move.

#6 constant trend line breaks.

this lets the trend make money as it progresses!!

the market moves with the steeper angles, just after taking the stops out!! high two, or high

three in down trend. just after the first down signal!!!! they have to show there hand

then take out the traders they showed there hand too. but not just once but twice, or three times.

this is step one.learn this know it!!

even after all that

the market almost always, likes to attack the perfect entry to some degree.

causing traders emotionally charged second thoughts. this is how you can look for

entries, take advantage of there shenanigans. let's look at another shot.

this time the 5 minute time frame at the beginning of a break out.

first know this, an unexpected move does not need to take a lot of trap fuel

to move, but once expected, things change fast. know this learn it!!!!

ok 5 min. break out after it is expected.

Interesting thread Boe...

I agree 100% with what you are posting, I congratualte you with your insights into sharing the real truth!!!

the first thing traders must do before learning to trade is this: you must

except the real markets for what it is!!

their will be no changing thees facts about the markets.

1. the markets are be manipulated, in a very advanced way.

2. your stops are being hunted most of the time!

3. the market tricks people into #1 wrong decisions, or #2 early decisions, that seam emotionally wrong for periods of time.

4. no matter what people through at the markets or what they do to make decisions they still seam to work themselves

into dead ends, then start over again, looking for not so much the holly grail but real answers.

5. psychology of markets is huge part of trading, and there is lots of books and lots of quacks teaching this part of trading

(yet not one of those so called doctors relate psychology of trading directly to the charts, and directly to strategy.

6. most everything you have learned about trading comes true when looking at the past but not right side!!

7. 99.99% of traders do not know for sure what time frame to trade from. the ones that claim they only trade from this

one time frame, or just these two time frames, are probably very smart and nice traders, but are not being honest.

because successful traders have to constantly adjust the time frame they trade from. If you don't know how and when

to do this you are at the Mercy of the banks true intentions.

8. most everything you have learned about trading works some times, but most of the time it does not. when a person

looks at a chart their brain automatically is programed to look for what they are taught, so you will find the places on the chart

easily, not noticing how many time their signal failed before being correct.

Ok that's a good start i think. read this a few times you must understand, with me eventually i am going to open your minds

up, expose the truth.so you have to be prepared for a completely different view of the markets then you had ever seen before.

this is not a shallow empty shell statement, this is what is going to happen here, and the new view you will take on the markets

will be the truth about how it works and what to watch out for!!

welcome traders!!!!!!!!!!Hi Boe,

I wanted to read over your topic but I stopped because I quickly saw that you make claims that just do not make any sence what so ever:

1. the markets are be manipulated, in a very advanced way.

Market price is set by a consensus or a disagrement between buyers or sellers. If that is done by banks or by goverments or by traders that does not matter. Price moves up and down. Price is in trend or consolidates.

That goes for energy like oil or for currencys like the interventions on the swiss franc or on stock markets who have company news etc...etc...

As said price goes up or down. And there will always be something that will push price up or down. But an intervention of news or a bank or a goverment can not be seen as manipulation

" The ethical use of crowd manipulation is debatable and depends on such factors as the intention of and the means used by the manipulator, as well as the ends achieved " WIKIPEDIA........ Not one bank or goverment or institute does an intervention so that people would loos money.

2. your stops are being hunted most of the time!

No they are not. Stop orders are orders that are waiting in the market. If you look into a level II you will see just orders waiting. Nobody can see the difference between an order that is an on open buy ( just to go long) or a close short ( a long to close a short) beside your broker--but they can not move the whole market so they can have some advantage on that).

Everybody has stoplosses all over the market. Meaning there are traders that trade from 1min. from 5min from 15min from 30min from 1Hour and 4H and daily and work with fixed values or work with stops on strategic points. But a stoploss on a strategic point on a 5 min. can not be noticed if you look to a 1H chart ...etc...etc....

And on top of that, on all the different kind of pairs. Market moves because of orders waiting in the market or taken in on market price. PERIOD.

3. the market tricks people into #1 wrong decisions, or #2 early decisions, that seam emotionally wrong for periods of time.

The market does not trick anyone. If you feel you are tricked then that is because you made a loss. I have explained this already so many times here that 2 people can go long and short on the exact same moment and both close their trade with a profit depending what their goals are and from what time frame they trade.

The less losses you make the more profits you make but you will accept that losses are connected to trading as breathing is to life and has nothing to do with been tricked to take in a trade. The entry you make to go long can be for me on that same moment the proper moment to take in the opposite direction. Who is tricked then ?.... Did the market trick us or did one of us two take a wrong decision ?... Each position that somebody takes, there is a counter party that is taking the other direction. So who was tricked then ?....

I stop here because I could go one with my disagrements on what you write or claim...

I do not speak for the rest of your postings where you explain you trading suggestions. They could be very helpful but your knowledge on market psychology....?.....

Friendly regards...iGoR

well i know some will disagree

the truth defiantly comes with experience, a lots of hard work.

some will disagree that's ok and you find arguments on both sides weather the markets

are manipulated.

how i learned to trade is put all the mumbo jumbo aside and started looking at the reality of

the market, what does it do and why and when, i purposely search and tracked, logged trades

observed what was constant, what was random, and why, years paying attention every detail.

reading every great traders books. listening and meeting with brokers. making trading friends in the inner circle, listening to an x- trader for Bank of England. believe me when i say that price is

artificially moved by banks, i know this is fact. if don't believe me ask my good friend Dean Malone,

ask Dr. Bary burns.. listen to Al Brooks..please don't confuse people here it's ok to disagree with

me. but do not disagree with reality and the charts please!! i want to help give me chance here me out. deal?

if you moved millions of dollars every the world what would you do to protect it?

do you think if you have the ability to move price, you do not have the ability to protect it?

of course you do!!

as far as stop orders go

they do not need to see the masses stops, they do not care where your stop is,

they use the psychology of market manipulation to entice traders then stop out the

enticement. they know that's where the stops are silly. they don't need to see them.

market makers have the very best working for them, the best minds in trading, and

they want hired them to protect their money. and they thought of everything

under the sun. theirs is no way they would allow people to trade and win.

Al brooks said to me" people think the market key is simple, and there is nothing simple

about the markets" that was a few years ago. That stuck with me to this day.

a simple system, or fallowing this indicator, or that system, can work and it will work!

but you have to know what the market does before you practice the system, and

thats whats hard work my friend.

they do not need to see the masses stops, they do not care where your stop is,

they use the psychology of market manipulation to entice traders then stop out the

enticement. they know that's where the stops are silly. they don't need to see them.

market makers have the very best working for them, the best minds in trading, and

they want hired them to protect their money. and they thought of everything

under the sun. theirs is no way they would allow people to trade and win.

Al brooks said to me" people think the market key is simple, and there is nothing simple

about the markets" that was a few years ago. That stuck with me to this day.

a simple system, or fallowing this indicator, or that system, can work and it will work!

but you have to know what the market does before you practice the system, and

thats whats hard work my friend.Hi Boe,

I feel that you are experienced. But even between experinced people one can disagree.

Some scientist are sure that the higs-boson particle will be there and some other scientists believe or even wish that it would not be there because that will make it far more exciting...

You see or look to price and markets as some sort of beast which can be pushed and commanded and nearly has some sort of a will on its own and that you want to know what goes on in the mind of that beast. Who is talking to that beast ?...That if you know who is talking to that beast or what commands they give it, that it would give you more knowledge or an edge or know what to do in a more accurate way.

I myself, I see the market as a line or price just going up or down. That the price we see on our chart for all the same could be the average daily temparture that we messure on the north or south part of our world. Or a chart on the average of amount of people that eat a hamburger or go for a swim or get killed of cancer.

I trade now at this moment with 1.5 Million$ and never claim that markets are simple. They are in a constant change as the world is and as the laws of entropy expect it to be. Order leads to chaos. But I am sure if you would just leave all the higher forces and powers out of the picture it would become clearer in your head. I always teached in my trading rooms (that I had in the past): Trade what you see...that is already more then difficult enough without thinking what is driving every move.

You can not and will never be able to predict the markets. They are absolutly random. If you accept to just be a part of the market and not ahead of the markets then you will open your mind in a big way. You will be able to see the trees trought the woods.

Friendly regards... FXiGoR