Mainly the outlook is provided on daily basis becuase It's useful to understand what's could happen on coming section.

For this and coming days:

GBPUSD: key level is 1.5700 to short and target would be located near 1.4700, 1000 pips below  .

.

NZDUSD: we need break level confirmation to jump in.

AUDUSD: Strange inverted whale. Stay out.

Mainly the outlook is provided on daily basis becuase It's useful to understand what's could happen on coming section.

For this and coming days:

GBPUSD: key level is 1.5700 to short and target would be located near 1.4700, 1000 pips below  .

.

NZDUSD: we need break level confirmation to jump in.

AUDUSD: Strange inverted whale. Stay out.Ok, Cable tested our beloved level: 1.5700.

Hourlies look deep OS. But bigger TF prevails on trend always.

You could go short after breack 1.5700 with SL above 1.5860

Kiwi confirmed break and we can short this below 0.6840 with SL at 0.700

On same situation as Kiwi is Aussie but for nest levels: short at 0.8600 and SL at 0.8730

These last two will follow DOW evolution on basic materials.

Note: During last and coming months Aussie and Kiwi will be related with good than the hihgh correlation maintained during 2008 and before with carry trades. So, we do not look (and we don't really care) interest rates.

Last one. On this Aussie chart. Do you see the inverted whale?

Trade safe.

Exact analysis, Linuxser

Hello all,

Only two days after NFP market is analyzing data from Friday session. Data was worst than expected but a bit confusing.

Market have discounting that during 2010 the US economy will keep losing jobs even with a rebound on economy activity.

I hope you're following cable right now.

Well, weekend start with cable going up. It's expected!

Why? After a full week of falling a rebound is needed, specially when Asian trades close some short position and several stops were hit during Friday trough American session (and when Asian market was closed).

Our entry point was 1.5700 and you can move your stop to there. Just to go out even if price wants to test 1.5700.

That possibility exist because (not few) bulls want to trigger our stops and move the market into doubt.

Welcome to psychological analysis of the market.

If you move your stop (I wouldn't) to 1.5700 feel safe to reenter later.

MACD lost momentum during last two days but isn't enough to worry us yet.

EURO looks complicated by this time. But bears are prevailing.

We don't have much data coming from Europe on Monday, but crisis prospective on some members of EU is going analyzed carefully by trades (Greek, Spain, Italy)

I will write about Aussie and Kiwi later.

Till tomorrow.

Hello all,

As promised on last post, Kiwi and Aussie situation.

Patience. It's just question of time to get best moment to jump in.

Well well well,

Seems economist are servants of politicians who does not understand at all what economy is all about.

Today rumors of a rescue to Greek move up major stocks and indexes. Currencies followed the move and our Cable trade is on water.

If you moved your stop to 1.5700 you're out. Ok, let's wait for new entry time. Is presume we should have a couple approaching to Friday.

Market is bear for now. Is not convenient to take longs but wait for better times.

Until tomorrow.

Hello all,

If you move your stop (I wouldn't) to 1.5700 feel safe to reenter later.

MACD lost momentum during last two days but isn't enough to worry us yet.

Till tomorrow.One of worst errors of any trader is to lose confidence on himself. I had learned this on the hard way: losing money.

When after you do best and hard analysts, you resume all values, and finally enters on a trade, a few hour later market becomes against you. Have you been on that situation? I say yes.

Well, is your mind telling you're wrong due to fear nothing else, nothing more. Learning to control that impulse to close a trade and going inverse is what you have to learn if want success.

I don't have the resources of Paul Rotter* and I also trade on forex, not bonds. And that's why my choice is not scalping** but hourlies.

My decision to stay with the trade and not to close is something like I trust on my judgment. And my experience says on market smart traders eats feared traders.

By now our trade is going with 400 pips on less than 20 days and avoid to hit SL by 40 pips.

Not few people want our position but many of them ran inverse at he first signal of countertrade.

Market plays with bigger stops than us, the small boys. And we need to learn to accept advantage is not on our side. By following the big levels we can stay safe at some point. But, of course, this implies smaller amounts to trade.

For next week I expect Euro on right position but I will stay with cable for now. Euro will be the next losers because Euro fathers are acting as always, too much speaking, too few action. Greek and Spain will send the currency to 1.2400 (100% Fibonacci retraction) helped by the words of the leaders of EU.

*I will write later about this guy and success on scalping

**scalping on forex: I already write too many times on forum why is more dangerous than any other market

If i may intrude

One of worst errors of any trader is to lose confidence on himself. I had learned this on the hard way: losing money.

When after you do best and hard analysts, you resume all values, and finally enters on a trade, a few hour later market becomes against you. Have you been on that situation? I say yes.

Well, is your mind telling you're wrong due to fear nothing else, nothing more. Learning to control that impulse to close a trade and going inverse is what you have to learn if want success.

I don't have the resources of Paul Rotter* and I also trade on forex, not bonds. And that's why my choice is not scalping** but hourlies.

My decision to stay with the trade and not to close is something like I trust on my judgment. And my experience says on market smart traders eats feared traders.

By now our trade is going with 400 pips on less than 20 days and avoid to hit SL by 40 pips.

Not few people want our position but many of them ran inverse at he first signal of countertrade.

Market plays with bigger stops than us, the small boys. And we need to learn to accept advantage is not on our side. By following the big levels we can stay safe at some point. But, of course, this implies smaller amounts to trade.

For next week I expect Euro on right position but I will stay with cable for now. Euro will be the next losers because Euro fathers are acting as always, too much speaking, too few action. Greek and Spain will send the currency to 1.2400 (100% Fibonacci retraction) helped by the words of the leaders of EU.

*I will write later about this guy and success on scalping

**scalping on forex: I already write too many times on forum why is more dangerous than any other marketLinuxser,

Thanks for this beautiful thread,there is at least somebody that thinks long term here  Whenever I talk about using h4 charts and I see people posting examples at my threads using 5 minutes charts,I despair,so,when I see you using daily ,weekly and fundamental concepts,I can only applaud your comments.

Whenever I talk about using h4 charts and I see people posting examples at my threads using 5 minutes charts,I despair,so,when I see you using daily ,weekly and fundamental concepts,I can only applaud your comments.

I wanted to add a couple of things..first Spain is in no way a similar situation to Greece..Spain has a much lower indebtment level,actuallly,lower than the average of CEE countries(Debt/GNP)...Spain`s problem is that the current account deficit is 12%(INCOME-EXPENSE)...additionally,Spain has one of the safest banking systems in the world,with a very tough Bank of Spain that "forces" banks to provision losses for potential defaults beforehand..second,Greece is a very small economy within the CEE,They have corruption everywhere,but,still,they are so very small that they will be helped out of the hole they cave for themselves.

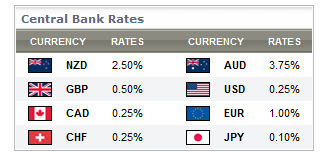

Second comment...This is going to be the "quarter of the USD"...USD is going to go up against all other currencies,at least until April..and the reason why is not Spain,nor Greece,nor Mr whatever at the bank of England..no,the reason why is that the FED has started to increase interest rates again,and that both the ECB and the BOE Will not...that`s all.

So,your GBPUSD and XXXUSD shorts are very good conceptual trades,and they will probably end up as very big winners.

Regards

S

Linuxser,

Thanks for this beautiful thread,there is at least somebody that thinks long term here

Whenever I talk about using h4 charts and I see people posting examples at my threads using 5 minutes charts,I despair,so,when I see you using daily ,weekly and fundamental concepts,I can only applaud your comments.

I wanted to add a couple of things..first Spain is in no way a similar situation to Greece..Spain has a much lower indebtment level,actuallly,lower than the average of CEE countries(Debt/GNP)...Spain`s problem is that the current account deficit is 12%(INCOME-EXPENSE)...additionally,Spain has one of the safest banking systems in the world,with a very tough Bank of Spain that "forces" banks to provision losses for potential defaults beforehand..second,Greece is a very small economy within the CEE,They have corruption everywhere,but,still,they are so very small that they will be helped out of the hole they cave for themselves.

Second comment...This is going to be the "quarter of the USD"...USD is going to go up against all other currencies,at least until April..and the reason why is not Spain,nor Greece,nor Mr whatever at the bank of England..no,the reason why is that the FED has started to increase interest rates again,and that both the ECB and the BOE Will not...that`s all.

So,your GBPUSD and XXXUSD shorts are very good conceptual trades,and they will probably end up as very big winners.

Regards

SBeautiful and pro comments SIMBA.

Thatnks for data about Spain. I knew about Bank system but the rest of data is juicy and let me add a couple of things to you already written truth.

We follow the news as we follow the price. We're always on step back unless some job on NSA or MI6.

Reporters are paid to say some news and to shut up about others.

Everybody plays money games.

Problem for Euro is not Economics it's Politics. The conception of EU fall into troubles if some sons does not do the homework. By status deficit should be lower as 3% GDP (Correct me Simba) for being member of EU.

Of course the punished on the news are only two countries. However, France is on a complicated situation (even Germany, Italy is worst) and nobody says nothing.

I said the problem is Politic because you can't put a gun into Greek's government to cut down expenses (or any other country).

What can generate doubt into markets is the lack of some mechanism to proceed on exceptional cases as these countries are suffering.

Also, EU had a better performance on inflation than US on last year. Inflation under control = no chance to rate hikes

This prevents traders and banks that meantime crisis is lowering on US a possible rate hike is coming and "we need to go there first". So, we close euro trades and position on greenback before everybody.

Meanwhile, ECB is under pressure to keep rates lower because recover is behind the values of US economy.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello Advanced members.

Due to success, contacts and question about my trading systems on Elite section I will post possible trades here inside.

Mostly future trades will be based on this technique: https://www.mql5.com/en/forum/178666

Some on this system: https://www.mql5.com/en/forum/178487

Some exclusively based on fundamentals. However, all analysis is 50/50 or maybe 40/60 (technical/fundamental)

The idea is to post entry levels with SL and TP near one day before the move.

To get an idea of what's coming you can check my blog: Forex-TSD - Linuxser FX on Forex TSD or thread on Elite section.

Only majors will be traded looking for weekly or monthly trades if possible. To test and follow these trades I suggest 25K demo account and leverage of 50:1

Keep safe.