Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.17 12:46

Forex Weekly Outlook August 18-22US housing data, Inflation data in the UK, the US and Canada, FOMC Meeting Minutes, Philly Fed Manufacturing Index, Janet Yellen’s speech are a few of the major events on Forex calendar. Follow along as we explore the Forex market movers for this week.

Last week US retail sales disappointed with a flat reading in July, a poor start to the third quarter, suggesting some loss of momentum. Economists expected 0.2% increase. The unchanged reading was the weakest since January, preceded by a 0.2% gain in June. However, despite the lukewarm release, sales are expected to rise in the coming months thanks to the growth trend in the labor market, strengthening domestic demand. The uneven economic growth will enable Fed Chair Janet Yellen to keep interest rates low for a longer period.

- UK Inflation data: Tuesday, 8:30. UK consumer prices edged up 1.9% in June, reaching a five year high amid price rises in food and summer clothes. The reading was higher than the 1.6% climb forecasted by analysts and topped May’s 1.5% increase. This rise may prompt the BOE to increase rates sooner than estimated. Inflation is expected to remain tame in the coming months, however, inflation threat will rise if wages increase. UK consumer prices are expected to reach 1.8% this time.

- US Building Permits: Tuesday, 12:20. U.S. housing starts and building permits unexpectedly fell in June, indicating uneven growth in the housing market, following the slowdown in late 2013. Permits declined 4.2% to a 963,000-unit pace in June, while economists expected them to rise to a 1.04-million unit pace. Permits for single-family homes edged up 2.6% to a 631,000 unit-pace, the highest level since November. Permits for multi-family housing plunged 14.9% to a 332,000-unit pace. A rise to on million unit pace is forecasted now.

- US Inflation data: Tuesday, 12:30. U.S. consumer prices gained 0.3% in June, following 0.4% increase in May, amid a rise in gasoline prices. The rise was in line with market forecast. On a yearly base CPI edged up 2.1% as in May, indicating inflationary pressures are building up. Fed Chair Janet warned the Fed may raise interest rates sooner than estimated if the job market continued to improve. Meanwhile, core inflation excluding energy prices rose 0.1% after rising 0.3% in May. In the 12 months through June, the core CPI increased 1.9 % after climbing 2.0% in May. Consumer prices are expected to rise 0.1% , while core prices are expected to gain 0.2%.

- US FOMC Meeting Minutes: Wednesday, 18:00. The FOMC minutes from June meeting showed that taper continued as scheduled, expecting to end in October, if all goes well. The Fed is forecasted to stop reinvestment of paid principal on bonds as soon as the first rate hike is announced. For controlling the pace of unwinding, interest on excess reserves (IOER) will be the key tool and reverse repos will play a supporting role. The Fed noted a rise in inflation, however the lob market recovery is not complete despite recent improvements.

- US Unemployment Claims: Thursday, 12:30. The number of Americans applying for U.S. unemployment benefits increased last week to 311,000 from 290,000 in the previous week. Despite the 21,000 climb, jobless claims remain close to pre-recession levels. The four-week average, a less volatile measure, increased 2,000 to 295,750, nearing the averages before the Great Recession in late 2007. The number of jobless claims is expected to grow by 299,000.

- US Existing Home Sales: Thursday, 14:00. The U.S. existing home sales edged up in June to a seasonally adjusted annualized rate of 5.04 million units, rising 2.6% from May, however still below the 5.16 million-unit rate seen last year. Economists expected a lower figure of 4.98 million units. Inventories remained high and price gains slowed in many parts of the country increasing transactions. Nevertheless, the housing sector remains a concern for the Federal Reserve ever since the rise in mortgage rates in 2013. Existing home sales are expected to reach 5.01 million units.

- US Philly Fed Manufacturing Index: Thursday, 14:00. Manufacturing activity in the Philadelphia-region picked up in July to 23.9 points, rising 6.1 points from June. This was the fastest gain in more than three years. Analysts expected the index to drop to15.6 in July. The current new orders component increased 17 points. The current indicators for labor market conditions to improve. Philly Fed Manufacturing Index is expected to reach 20.3.

- Janet Yellen speaks: Friday, 14:00. Federal Reserve Chair Janet Yellen will speak to the central bank’s symposium in Jackson Hole, Wyoming. Yellen will deliver a speech titled “Labor Markets.” She will not answer questions from the audience. The Fed’s three-day gathering of central bankers and economists will be titled “Re-evaluating Labor Market Dynamics.” The conference has foreshadowed some of the Fed’s major policy shifts. Market volatility is expected.

- Mario Draghi speaks: Friday, 18:30. European Central Bank head Mario Draghi will follow Federal Reserve Chair Janet Yellen’s speech at the Jackson Hole Symposium and talk about employment issues. Market volatility is expected.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.18 06:09

EURUSD Technical Analysis: Holding Short in Consolidation (based on dailyfx article)

- EURUSD Technical Strategy: Short at 1.3644

- Support: 1.3345, 1.3291, 1.3248

- Resistance:1.3419, 1.3472, 1.3516

The Euro may be preparing for a rebound against the US Dollar having declined as expected

after showing a bearish Evening Star candlestick pattern. The

appearance of a Hammer candle coupled with positive RSI divergence now

argues for an on-coming correction. Near-term resistance is at 1.3419,

the 23.6% Fibonacci retracement, with a daily close above that exposing

the intersection of the 38.2% level and a falling channel top at 1.3472.

Alternatively, a reversal below the 23.6% Fib expansion at 1.3345

clears the way for a challenge of the 38.2% threshold at 1.3291.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.18 12:39

2014-08-18 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Trade Balance]- past data is 15.2B

- forecast data is 15.0B

- actual data is 13.8B according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

Eurozone Trade Surplus Rises Unexpectedly In June

Eurozone's trade surplus increased unexpectedly in June, data showed Monday.

The trade surplus rose to EUR 16.8 billion in June from EUR 15.4 billion in May, Eurostat reported. Economists had expected the trade surplus to decrease to EUR 15.1 billion.

Exports increased 3 percent year-over-year and imports grew 2 percent in June.

On a seasonally adjusted basis, the trade surplus fell to EUR 13.8 billion in June from EUR 15.2 billion in May.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 10 pips price movement by EUR - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.19 15:58

2014-08-19 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]- past data is 0.3%

- forecast data is 0.1%

- actual data is 0.1% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

U.S. Consumer Prices Inch Up Just 0.1% In July

Consumer prices saw only a modest increase in the month of July, according to a report released by the Labor Department on Tuesday, with higher prices for shelter and food offset by decreases in prices for energy and airline fares.

The Labor Department said its consumer price index ticked up by 0.1 percent in July after rising by 0.3 percent in June. The modest increase by the index matched economist estimates.

The uptick in consumer prices was partly due to higher food prices, which climbed by 0.4 percent in July after inching up by 0.1 percent in June.

The other food at home index increased by 0.7 percent, its largest increase since August of 2011, while the index for non-alcoholic beverages rose by 0.5 percent.

Meanwhile, the report showed that the energy index pulled back by 0.3 percent in July after surging up by 1.6 percent in the previous month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 36 pips price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.17 14:40

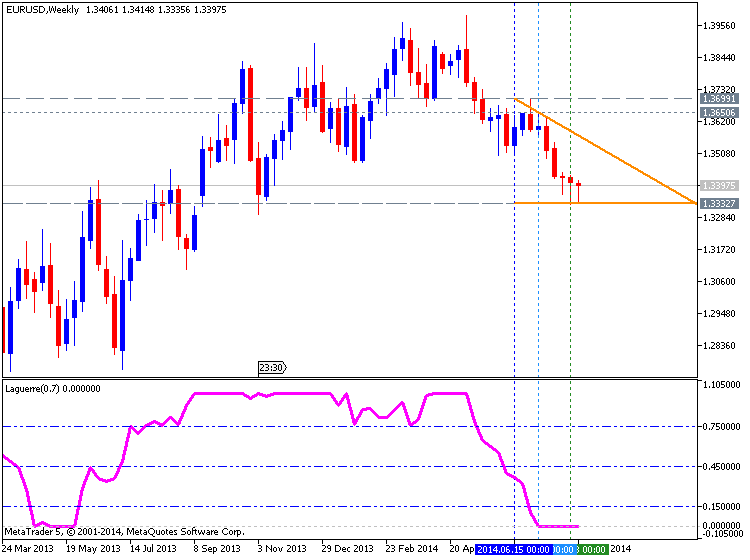

EURUSD Technical Analysis forecast for the week of August 18, 2014 (based on fxempire article)

The EUR/USD pair initially fell during the course of the week, but for the third week in a row found support below, and ended up forming a hammer. Because of that, we believe that the Euro is about to get a bounce, not only because of this chart, but because of some other EUR related charts. With that, we think that we are heading to the 1.35 handle first, and then will have to make more significant decisions at that level. In the meantime, we would not be interested in selling this market until we get below the 1.33 level.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.20 06:26

Strategy Video: EURUSD Breaks Support to Extend Fundamental, Technical Trend

- EURUSD marked a technical break of recent wedge support and a 50% Fib at 1.3325

- The medium and long-term outlook for the Euro and US Dollar are on very divergent paths

- However, the momentum for this recent continuation effort may prove uneven given its catalyst

EURUSD has cleared support and

further progressed a four-month reversal into a fully developed bear

trend. However, does this most recent push promise momentum? The medium

and long-term fundamental and technical picture paint a very appealing

view. The turn off resistance from a decade-long wedge pattern has

aligned itself to a larger change in underlying fundamentals: through

growth, rate speculation and perhaps eventually risk trends and capital

flows. The opportunity is significant, but the market's momentum behind

the theme is still lacking. What should we look for in an active trade?

How quickly should we expect a setup to play out under these

circumstances? We focus on the EURUSD in today's Strategy Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.20 18:06

USD Breakout Led by EURUSD - Next?- EURUSD breaks through 1.3335 support and cracks to 1.3290.

- USDCAD, USDCHF flags may signal next USD-pairs to run.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.20 21:03

EURUSD touched multi-month low (based on dailyfx article)

- EUR/USD has come under further pressure to touch its lowest level since late September

- Our near-term trend bias is lower in the euro while below 1.3430

- The 6th square root relationship of the year’s high at 1.3280 is a key pivot with a daily close below needed to confirm that a new leg lower is underway

- A cycle turn window is eyed on Thursday

- A move over 1.3430 would turn us positive on the euro

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.3240 | 1.3280 | 1.3280 | 1.3335 | 1.3340 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.21 10:18

2014-08-21 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]- past data is 52.4

- forecast data is 51.7

- actual data is 52.0 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

[EUR - German Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

==========

German Private Sector Growth Slows In August

Germany's private sector growth slowed in August as contraction in manufacturing deepened further, flash data from Markit Economics showed Thursday.

The composite output index dropped to 54.9 in August from 55.7 in July. The current sequence of continuous activity growth now stretches to 16 months.

The service sector remained the driving force behind the overall expansion in August. Although the services Purchasing Managers' Index fell to 56.4 from 56.7 in July, it remained above the expected score of 55.5.

Meanwhile, the manufacturing PMI dropped to 52 in August from 52.4 a month ago. The index was expected to fall more sharply to 51.5.

"The PMI data available for the third quarter so far point to a swift recovery in GDP from the ground lost during the second quarter," Oliver Kolodseike, an economist at Markit, said.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 19 pips price movement by EUR - German Manufacturing PMI news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish with flat for ranging between 1.3432 resistance and 1.3332 support levels.

W1 price is located within Ichimoku cloud below Sinkou Span A line which is indicating the secondary ranging within primary bearish market condition.

H4 price may be on breakout: Chinkou Span line of Ichimoku indicator is crossing the price from below to above, and the price is located above Ichimoku cloud for bullish.

If D1 price will break 1.3432 resistance level on close bar so we may see the rally within the bearish (good to open buy trade for counter trend traders).

If not - the bearish market condition will be continuing with possble secondary ranging.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-08-18 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Trade Balance]

2014-08-18 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - German Buba Monthly Report]

2014-08-19 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Current Account]

2014-08-19 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2014-08-19 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-08-20 18:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

2014-08-21 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-08-21 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2014-08-21 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2014-08-21 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - Manufacturing PMI]

2014-08-21 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-08-21 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-08-21 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

2014-08-22 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-08-22 18:30 GMT (or 20:30 MQ MT5 time) | [EUR - ECB President Draghi Speech]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : ranging

Intraday Chart