Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.02 10:26

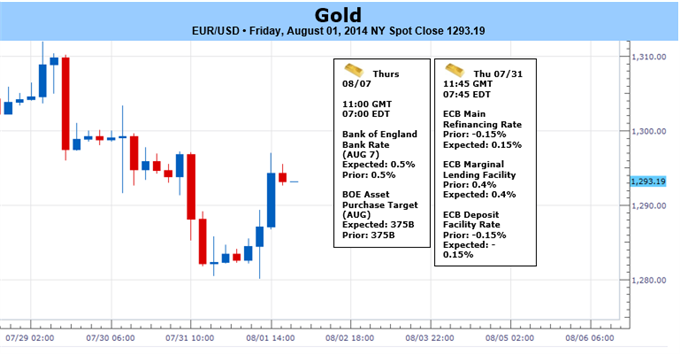

Forex Weekly Outlook August 4-8The US dollar was the star during most of the week, although it lost some of its shine towards the end. Rate decisions in Australia, the UK, Japan and the Eurozone, Employment data, in Australia, Canada and US trade data are some of the highlight events on Forex calendar. Here is an outlook on the main market movers for this week.

The US dollar was on a roll in the past week: the excellent GDP report that showed 4% Q2 growth (annualized) and speculation about an upcoming rate hike (despite a not-too hawkish Fed) boosted the greenback. The below expectations Non-Farm Payrolls report took out some of the shine of the greenback, but the US economy continues doing well. In the euro-zone, inflation fell deeper, to 0.4%, and cast a dark cloud on not-too-shabby employment and consumption data. The pound continued falling on more weak data in what looks like a u-turn rather than a correction. Weak data in Japan helped USD/JPY move higher and weak Australian data finally sent the Aussie below 0.93. The kiwi and the loonie were not spared, but also managed to stage a recovery in an exciting week.

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia maintained rates at 2.5% on its last meeting in July, despite rumors of a possible rate cut. RBA Governor Glenn Stevens declared the currency was “overvalued” but kept monetary policy unchanged. Stevens noted the growth signs and the pickup in demand saying accommodative policy would continue to boost economic activity. It is unlikely that the RBA would step in again with further stimulus measures. No change in rates is expected this time.

- US ISM Non-Manufacturing PMI: Tuesday, 14:00. Service sector activity expanded slower than expected in June, reaching 56 after posting 56.3 in May, amid bleak economic outlook. Economists expected a smaller drop to 56.2. New Orders Index increased by 0.7 points to 61.2. Employment Index increased 2.0 points to 54.4. Overall, the non-Manufacturing sector reported growth in June. A rise to 56.6 is expected now.

- New Zealand employment data: Tuesday, 22:45. Unemployment in New Zealand remained unchanged at 6% in the first quarter, with an increase in labor force and the highest participation rate in New Zealand’s history. Economists expected the unemployment rate to fall to 5.8%. However, the participation rate edged up 0.4% to 69.3%, reaching a record high for New Zealand. Wages increased an annualized 1.6% (including overtime) in the March quarter, unchanged from the previous quarter. New Zealand job market is expected to rise by 0.7%, while the unemployment rate is predicted to tick down to 5.8%.

- US Trade Balance: Wednesday, 12:30. The U.S. trade deficit narrowed to $44.4 billion in May as U.S. exports expanded to an all-time high of $195.5 billion, while, imports declined slightly. The trade deficit narrowed 5.6% in May after hitting a two-year high of $47 billion in the prior month. The low trade deficit ensures better growth rate. The U.S. trade deficit is expected to shrink further to 44.2B this time.

- Australian employment data: Thursday, 1:30. Australia’s jobless rate increased to 6.0% in June following 5.9 registered in the previous month. However the labor force increased by 15,900, beating forecast for a 13,200 job addition. The number of full-time jobs declined by 3,800, and part-time employment edged up by 19,700. Australia’s participation rate climbed to 64.7% in June from 64.6% in May. Australia is expected to add 13,500 jobs, while the unemployment rate is expected to remain at 6%.

- UK rate decision: Thursday, 11:00. The Bank of England maintained its benchmark interest rates at a record low of 0.5% in July. However economic activity has greatly improved, bouncing back from a long period of stagnation, raising calls for a rate hike at the end of this year or in early 2015. BoE’s Quarterly Inflation Report will be released this month and may act as a catalyst for the more hawkish members of the committee to contemplate voting for a tightening. The BOE is not expected to change its monetary policy this time.

- Eurozone rate decision: Thursday, 11:45. The ECB kept rates on hold in July’s meeting after cutting them to boost economic growth. Mr. Draghi said interest rates will remain put for an “extended period of time in view of the current outlook for inflation“. Inflation remained at the “danger zone” below 1% in June, reaching 0.5%. However Markit’s survey shows a pickup in new orders suggesting economic activity will grow in the second half of the year. No change in rates is forecasted.

- US Unemployment Claims: Thursday, 12:20. The number of people seeking U.S. unemployment benefits edged up by 23,000 last week reaching 302,000. The reading was broadly in line with market forecast while remaining at pre-recession levels. The four-week average, a less volatile measure, fell 3,500 to 297,250, posing the lowest average since April 2006. Fewer layoffs and strong confidence in the US economic outlook strengthens the US labor market. The number of jobless claims is expected to rise to 305,000.

- Japan rate decision: Friday. The Bank of Japan decided to continue increasing monetary base at an annual pace of ¥60 trillion to ¥70 trillion and lowered its growth forecast for the fiscal year of 2014 to 1%. The pace of recovery was in line with forecasts, despite a decline in domestic demand following the consumption tax hike. The BOE forecasts economic growth will increase in the coming months. Rates are expected to remain unchanged.

- Canadian employment data: Friday, 12:30. Canadian workforce narrowed by 9,400 jobs in June after a 25,800 addition registered in the previous month. The unemployment rate increased to 7.1% following 7.0% in May. On a yearly base, Canada’s labor market increased 0.4%, the lowest growth rate since February 2010. Canada added 33,500 full-time jobs, while part-time jobs and positions held by youths aged 15-24 dropped 43,000. Youth unemployment remains a major problem. Canadian workforce is expected a job gain of 25,400, while the unemployment rate is expected to reach 7%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.03 15:21

XAUUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: Neutral- Gold the Commodity or Gold the Currency?

- Weekly Price & Time: Critical Test Coming Up For Gold

Gold prices are lower for a third consecutive week with the precious

metal off by 0.90% to trade at $1295 ahead of the New York close on

Friday. The losses mark a 2.47% decline for the month of July and come

amid renewed strength in the greenback with the Dow Jones FXCM Dollar

Index breaking through trendline resistance dating back to the 2013

high on the back of a stellar 2Q GDP print and a more upbeat assessment

of the economy from the Federal Reserve. However with a miss on the

July employment report and a massive sell-off in broader equity

markets, the gold bulls may not be ready to give up just yet.

The release of the second quarter GDP figures on Wednesday fueled a

massive rally in the US Dollar after the print showed an annualized

growth rate of 4% q/q, far surpassing expectations of a 3% read. The

release also saw an upward revision to the 1Q print from -2.9% to -2.1%

with personal consumption and also topping market estimates. The FOMC

interest rate decision released later that day further exacerbated the

dollar’s move with the policy statement citing a more cautiously

optimistic assessment of the labor markets and inflation while

explicitly noting the reasons for the sole descent from Mr Charles

Plosser, “who objected to the guidance indicating that it likely will be

appropriate to maintain the current target range for the federal funds

rate for "a considerable time after the asset purchase program ends,"

because such language is time dependent and does not reflect the

considerable economic progress that has been made toward the Committee's

goals.” The developments saw interest expectations bought in with the

greenback mounting an offensive that took to the dollar index to highs

not seen since April as US Treasury yields moved higher.

The July NFP report came in short of market expectations with a print

of 209K missing calls for a read of 230K with the headline unemployment

rate ticking higher to 6.2% from 6.1%. Despite the uptick however,

it’s important to note that the move was accompanied by a broadening of

the labor force with the participation rate moving up to 62.9% from

62.8% and an upward revision to last month’s blowout print NFP print

from 288K to 298K. With the dollar seemingly well supported here,

topside advances in gold are likely to remain limited with the biggest

variable for gold traders being the recent sell-off in risk assets.

Looking ahead to next week, traders will be closely eying the slew of

central bank rate decision on tap with the RBA, BoJ, ECB and BoE on

tap. Look for broader market sentiment to steer gold prices with a more

significant sell-off in stocks likely to help support the battered

metal in the near-term.

From a technical standpoint, the July calendar month proved to be a

textbook opening range play with the break of the initial monthly lows

on the 14th shifting the bias to the short side mid-month. The end

result saw gold close July AT THE LOWS before rebounding off near-term

support on the back of Friday’s NFP miss. Support now stands at the

61.8% retracement of the June advance at $1280 and this level will now

serve as our initial range low as we open up August trade. Key support

and our bullish invalidation threshold rests just lower in the

zone between $1260-$1270- a region which is defined by key longer-term

Fibonacci ratios and has served as a major pivot in gold dating back to

June of 2013. Resistance stands at last week’s high at $1312 and is

backed by our bearish invalidation level at $1320/21. Friday’s rally

has now pared the entire Thursday decline and with the USDOLLAR index

looking to post an outside reversal candle at fresh three-month highs,

the risk for a near-term continued push higher in Gold (lower in USD)

to open the month remains. As such, while our broader outlook remains

weighted to the downside we’ll maintain a more neutral tone heading into

the start of the month pending a break of the initial July opening

ranged. Bottom line: looking for an early-mid month rally to sell.

forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.05 06:23

2014-08-05 01:45 gmt (or 03:45 mq mt5 time) | [cny - hsbc services pmi]

- past data is 53.1

- forecast data is n/a

- actual data is 50.0 according to the latest press release

if actual > forecast = good for currency (for aud in our case)

[cny - hsbc services pmi] = level of a diffusion index based on surveyed purchasing managers in the services industry. it's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

china services pmi slides to flat in july

the services sector in china slipped to no change in july, the latest survey from markit economics revealed on tuesday in its latest performance of service index - which came in with a score of 50.0.

that's down from 53.1 in june.

a score below 50 signals contraction in a sector, while a reading above 50 means expansion.

metatrader trading platform screenshots

metaquotes software corp., metatrader 5, demo

xauusd m5 : gold price movement by cny - hsbc services pmi news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.03 16:01

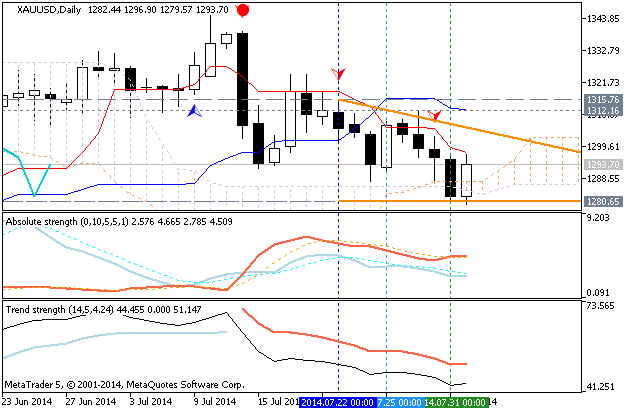

Gold (XAUUSD) Technical Analysis for the week of August 4, 2014

The gold markets as you can see fell during the course of the week, but

overall found enough support just below the $1300 level to bounce and

form something along the lines of a hammer. This hammer of course isn’t

perfect, but it does tell us that the market still has a bit of a fight

in it as far as keeping somewhat afloat. Ultimately, we believe that the

market has back towards the $1350 level, and as a result we have no

interest in selling. We think it could be choppy, but ultimately this

market is fairly bullish.

newdigital:

- Recommendation for short: watch D1 price for breaking 1280.65 support level on close bar for possible sell trade

- Recommendation

to go long: n/a

- Trading Summary: ranging

XAUUSD D1 price did not break 1280.65 support from above to below - we are having opposite situation for now: ranging market condition.

The nearest support level (instead of 1280.65) is 1279.57 for now, and the neatest resistance level is 1303.39 with 1312.16 as the key resistance.

- If D1 price will break 1303.39 on close D1 bar so we may see the reversal of the price movement from bearish to primary bullish.

- If D1 price will break 1312.16 resistance it will indicate the strong bullish trend

- If D1 price will break 1279.57 support level from above to below - we may see the reversal of the price from ranging bearish to strong bearish.\

- Ranging for now = the price is between 1312.16 resistance and 1279.57 support.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.07 10:48

Price & Time Analysis for GOLD (based on dailyfx article)

- XAUUSD is in consolidation mode above 1280

- Our near-term trend bias is lower while below 1300

- Critical support is eyed between 1280 and 1262 with weakness below needed to kick off a more important move lower

- A cycle turn window is eyed late this week

- A move over 1300 would turn us positive on the metal

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| XAU/USD | 1262 | 1280 | 1286 | 1300 | 1321 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.07 17:09

2014-08-07 11:00 GMT (or 13:00 MQ MT5 time) | [GBP - Official Bank Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which banks lend balances held at the BOE to other banks. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

Bank Of England Holds Rates Steady As Expected

The Bank of England once again kept its key rate at a record low on Thursday, sticking to its forward guidance even as the strong pace of economic recovery has augmented speculation for a rate hike late this year.

The nine-member Monetary Policy Committee decided to keep its key bank rate unchanged at 0.50 percent and the asset purchase programme at GBP 375 billion.

With the strong economic recovery and unemployment falling more sharply than estimated, some members of the panel are likely to have favored a rate hike. The minutes of the previous meeting also signaled that some policymakers are getting closer to a rate hike call.

The current 0.50 interest rate is the lowest since the central bank was established in 1694 and it has heavily reduced the interest income of savers. The unconventional measures were announced during the financial crisis to shore up the economy.

At several instance BoE Chief Mark Carney said the interest rate will have to start rising to maintain price stability as the economy normalizes, but there is no pre-set timing for that action.

Today's decision may not have been unanimous and a rate hike this year cannot be ruled out, said Samuel Tombs, a senior UK economist at Capital Economics. Even so, the outlook of low inflation and sluggish wage growth suggests that interest rates will rise only gradually.

The minutes, due on August 20, will give insight into factors that compelled policymakers to call for an early action. James Knightley, an ING Bank NV economist said he would expect to see one, possibly two members of the MPC having voted for a rate hike at today's meeting.

XAUUSD D1 price did not break 1280.65 support from above to below - we are having opposite situation for now: ranging market condition.

The nearest support level (instead of 1280.65) is 1279.57 for now, and the neatest resistance level is 1303.39 with 1312.16 as the key resistance.

- If D1 price will break 1303.39 on close D1 bar so we may see the reversal of the price movement from bearish to primary bullish.

- If D1 price will break 1312.16 resistance it will indicate the strong bullish trend

- If D1 price will break 1279.57 support level from above to below - we may see the reversal of the price from ranging bearish to strong bearish.\

- Ranging for now = the price is between 1312.16 resistance and 1279.57 support.

D1 bar was opened at 1312 today and did not break 1312 on close bar yet.

Yes, it is reversal from primary bearish to the primary bullish market condition for GOLD on D1 trimeframe. But it is not strong bullish yet sorry. Seems we need to wait some days more to know about it exactly for example:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is ranging between 1315.76 resistance and 1280.65 support level trying to break Sinkou Span A line of Ichimoku indicator for the price to be fully reversed from primary bullish to the primary bearish market condition.

W1 price is inside Ichimoku cloud with Chinkou Span line which is near to be crossing with the price for good breakdown to primary bearish by Sinkou Span A crossing.

H4 price is ranging between 1296.90 resistance and 1279.57 support levels with primary bearish.

If D1 price will break 1280.65 support level on close bar so we may see the reversal of the price movement to primary bearish market condition.

If not so it will be ranging market condition within primary bullish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on XAUUSD price movement for this coming week)

2014-08-05 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Services PMI]2014-08-05 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

2014-08-05 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-08-06 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-08-07 11:00 GMT (or 13:00 MQ MT5 time) | [GBP - Official Bank Rate]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on XAUUSD price movement2014-08-08 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - RBA Monetary Policy Statement]

SUMMARY : bearish

TREND : ranging

Intraday Chart