Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.18 22:34

Forex Fundamentals - Weekly Outlook Apr. 21-25The pound and the dollar emerged as winners in a week that saw the euro and the yen retreat. US housing data, the rate decision in New Zealand, German business sentiment, US Durable Goods Orders and Unemployment Claims are the main highlights on Forex calendar. Here is an outlook on the market-movers for this week.

The US economy emerged from the cold winter registering gains in retail sales and manufacturing activity as well as continuous improvement in the labor market. . The Philly Fed Index exceeded expectations in April, providing more evidence of a spring bounce. Overall, the US economy is steadily advancing. In the euro’zone, Mario Draghi managed to send the euro down in a Sunday gap, and the common currency never recovered. GBP enjoyed a sharp drop in the UK unemployment rate to reach new multi year highs. The kiwi stayed behind after weak inflation figures and the loonie took the other direction on positive ones

- US Existing Home Sales: Tuesday, 14:00. U.S. existing home sales declined slightly in February to a 19 month-low reaching an annual rate of 4.60 million units, following 4.62 million in January. A combination of cold weather and dwindling inventory of homes for sake, discouraged potential buyers. Economists expected a higher figure of 4.65 million. However, as the cold winter is over, analysts believe the pace of sales will accelerate this time. U.S. home sales are expected to rise to 4.57 million.

- Chinese HSBC Flash Manufacturing PMI: Wednesday, 1:45. The independent purchasing managers’ index is considered one of the most reliable gauges for the Chinese economy, the world’s no. 2 economy. After a disappointing drop to 48 points, a small rise to 48.4 is expected. Note that this is below the 50 point mark separating growth and contraction.

- US New Home Sales: Wednesday, 14:00. The number of transactions for buying new U.S. homes in February declined to 440,000 (annualized) due to the unusually cold winter. Sales of new homes declined 3.3% from a revised rate of 455,000 in January. Nevertheless, economists forecast a pick-up in sales this spring. A further improvement in the US job market and a better consumer confidence will help boost numbers in March. New home sales are expected to reach 455,000.

- NZ rate decision: Wednesday, 21:00. The Reserve Bank of New Zealand raised its official cash rate by 25 basis points to 2.75%, in line with market forecast. RBNZ Governor Graeme Wheeler said in a statement that inflation pressures have increased and expected to continue doing so over the next two years. Raising rates was important to keep inflation under control. Wheeler left the door open for further rate hikes within the next two years. The Reserve Bank of New Zealand is expected to raise its benchmark rate to 3%. Recent weak inflation data suggests that the RBNZ may become somewhat more dovish.

- German Ifo Business Climate: Thursday, 8:00. German business sentiment declined for the first time in five months in March reaching 110.7 from 111.3 in February, amid the Russian- Ukraine conflict. Businesses are worried that this ongoing crisis might affect Germany’s economic recovery since Germany receives more than a third of its gas and oil from Russia. In case of conflict escalation, many German firms are at danger. German business sentiment is expected to edge down to110.5.

- Mario Draghi speaks: Thursday, 9:00. ECB President Mario Draghi will speak at a conference in Amsterdam. He may comment on the low inflation in the Eurozone. Market volatility is expected. We have seen his heavy hand on the euro and we might see this happen again.

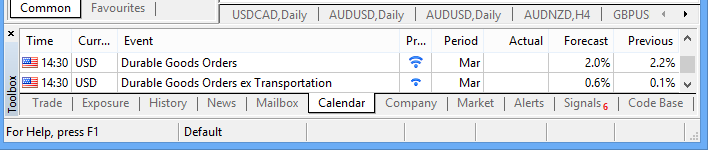

- US Core Durable Goods Orders: Thursday, 12:30. Orders for long-lasting U.S. manufactured goods regained strength in February with a 2.2% increase following a 1.3% decline in the previous month. Meantime, Core durable goods orders increased by 0.2% after posting a 0.9% rise in January, falling below expectations of a 0.3% rise. Economic growth in the first quarter is expected to be weaker than the fourth quarter’s annualized 2.4% rise, due to the cold weather. Orders for transportation equipment increased 6.9% while transportation orders had declined 6.2% in January. Durable goods orders are expected to climb 2.1%, while Core durable goods orders are expected to edge up 0.6%.

- US Unemployment Claims: Thursday, 12:30. The number of new jobless claims registered last week remained low at 304,000, near their pre-recession levels, following 302,000 posted in the previous week. Manufacturing activity has accelerated in April, indicating growth momentum after the cold winter. Economists forecasted jobless claims to reach 315,000. The four-week moving average for new claims, dropped to its lowest level since October 2007 with a 312,000 claims. Jobless claims are expected to increase by 5,000 to 309,000.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.19 17:17

EUR/USD forecast for the week of April 21, 2014, Technical AnalysisThe EUR/USD pair had a negative week over the last five sessions, but did find the 1.38 level as supportive. Because of this, it feels of the market is going to possibly drop from here, but not very much. With that, we feel that the market should continue to go higher over the longer term though, as it certainly has an uptrend feel to it. Nonetheless, is going to be very difficult to the average trader to hang onto a trade. We feel that this market is going to be difficult as it is so choppy.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.22 07:12

EURUSD Technical Analysis (adapted from dailyfx article)

EUR/USD in consolidation mode below key level

- EUR/USD has traded in a sideways to lower range since failing earlier in the month at the 78.6% retracement of the March to April decline in the 1.3900 area

- Our near-term trend bias is positive in the Euro while over 1.3730

- A move through 1.3900 is required to signal that a new move higher is underway

- A very minor cycle turn window is seen today

- Only weakness below the 2nd square root relationship of the year’s high at 1.3730 would turn us negative on the Euro

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.20 17:35

Forex - Weekly outlook: April 21 - 25The dollar ended the week higher against the yen on Friday as market sentiment was boosted by easing tensions over Ukraine, while upbeat U.S. economic reports also supported the dollar.

USD/JPY touched highs of 102.57 on Friday, before ending the session at 102.40, rising 0.49% for the week. Trade volumes remained thin on Friday, with most markets closed for the Easter weekend, although markets in Tokyo were open.

Concerns over the crisis in eastern Ukraine eased on Thursday after Russia, Ukraine, the U.S. and the European Union said an agreement on steps to "de-escalate" the crisis had been reached.

The dollar also received a boost after upbeat U.S. data on manufacturing and employment on Thursday pointed to underlying strength in the economy.

The Labor Department reported the number of people filing for unemployment benefits edged up to 304,000, below analysts’ forecasts and not far from the six-and-a-half year low of 300,000 touched the previous week.

GBP/USD edged up 0.06% to 1.6798 at Friday’s close, and ended the week 0.45% higher. The pair rose to highs of 1.6840 on Thursday, the strongest since November 18 2009. Sterling strengthened broadly after data earlier in the week showed that the U.K. unemployment rate fell to a five year low of 6.9% in the three months to February.

The upbeat data bolstered expectations that the Bank of England could raise interest rates as soon as the first quarter of 2015.

The euro was little changed against the dollar on Friday, with EUR/USD settling at 1.3810.

The euro’s gains were held in check after recent comments by European Central Bank officials flagged concerns over the impact of the strong currency on the inflation outlook.

On Thursday, ECB Executive Board member Yves Mersch said that if foreign exchange developments with an impact on inflation continue it would trigger a reaction by the central bank.

Elsewhere, the New Zealand dollar posted its largest weekly decline against the greenback since January, with NZD/USD ending the week down 1.24% to 0.8576, ahead of the Reserve Bank’s rate review on Thursday.

In the week ahead, market watchers will be focusing on U.S. data on housing and manufacturing activity, while manufacturing data from China will also be closely watched. The euro zone is to release data on private sector activity, while the U.K. is to produce a report on retail sales.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 21

- Markets in Australia, New Zealand, the U.K. and the euro zone are to remain closed for Easter Monday. Meanwhile, Japan is to release data on the trade balance.

- Australia is to publish an index of leading economic indicators.

- Canada is to produce data on wholesale sales.

- The U.S. is to release private sector data on existing home sales.

- Australia is to publish data on consumer price inflation, which accounts for the majority of overall inflation.

- China is to release the preliminary estimate of the HSBC manufacturing index, a leading indicator of economic health.

- The euro zone is to release preliminary data on manufacturing and service sector activity, a leading indicator of economic health. Germany and France are also to release individual reports.

- The U.K. is to release data on public sector borrowing, while the BoE is to publish the minutes of its April meeting. The nation is also to publish private sector data on industrial order expectations.

- Canada is to produce official data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.S. is to publish reports on new home sales and manufacturing activity.

- The Reserve Bank of New Zealand is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision.

- In the euro zone, Germany is to release the Ifo report on business climate.

- ECB President Mario Draghi is to speak at an event in Amsterdam; his comments will be closely watched.

- The U.S. is to publish data on durable goods orders and the weekly report on initial jobless claims.

- Markets in Australia and New Zealand will be closed for the Anzac Day holiday.

- Japan is to release data on consumer inflation.

- The U.K. is to produce data on retail sales.

- The U.S. is to round up the week with revised data on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.24 10:01

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

- U.S. Durable Goods Orders to Rise for Second Consecutive Month.

- Non-Defense Capital Goods Orders to Rebound Following 1.4% Decline in February.

Another 2.0% rise in orders for U.S. Durable Goods may generate a bullish reaction in the dollar as it raises the outlook for growth and inflation.

Why Is This Event Important:

Data prints pointing to a stronger recovery may put increased pressure

on the Federal Open Market Committee (FOMC) to normalize policy sooner

rather than later, and we may see Fed Chair Janet Yellen soften her

dovish tone for monetary policy as a growing number of central bank turn

increasingly upbeat towards the economy.

The expansion in private sector credit along with the ongoing

improvement in household sentiment may highlight increased demand for

large-ticket items, and a positive development may foster a bullish

outlook for the greenback as growth prospects improve.

However, subdued wage growth paired with the persistent slack in the

real economy may continue to drag on private consumption, and a dismal

Durable Goods report may heighten the bearish sentiment surrounding the

greenback as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: Orders Climb 2.0% or Greater

- Need to see red, five-minute candle following the print to consider a long dollar trade

- If market reaction favors a short EUR/USD position, sell pair with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable objective

- Need green, five-minute candle to favor a short dollar trade

- Implement same setup as the bullish USD trade, just in reverse

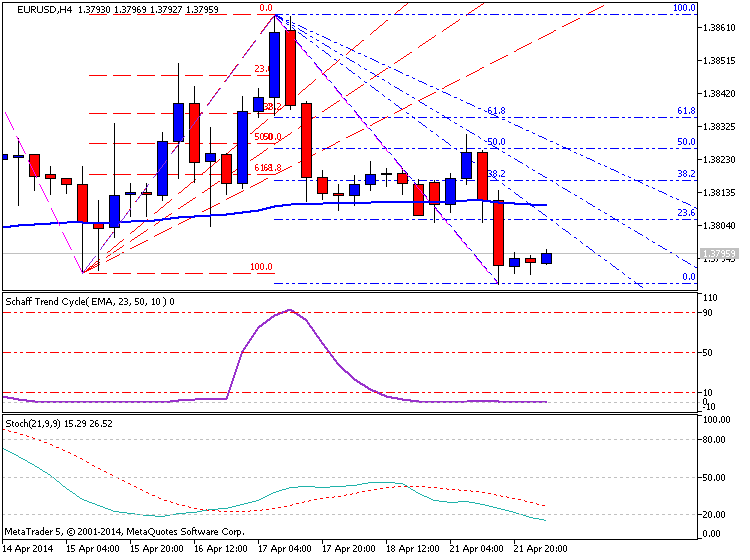

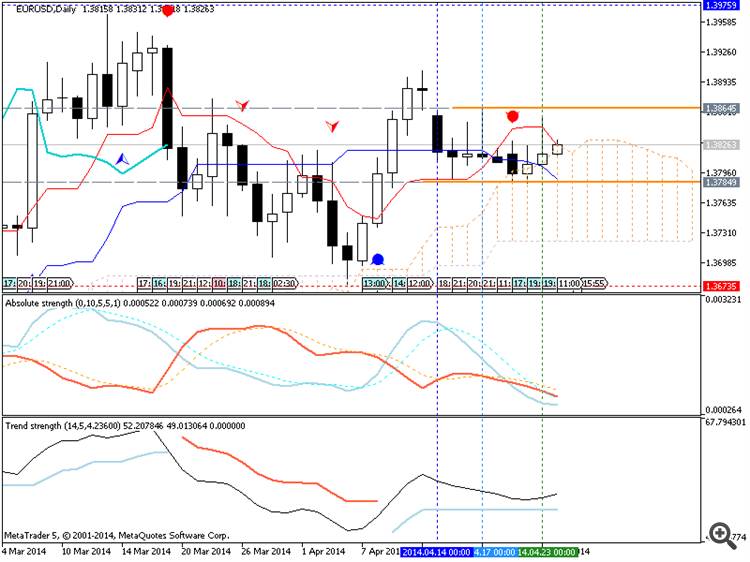

EUR/USD Daily

- Remains in Bullish Trend, But Currently Stuck in Wedge/Triangle Formation

- Interim Resistance: 1.3960-70 (61.8% expansion)

- Interim Support: 1.3650 (78.6 expansion) to 1.3660 (23.6 retracement)

February 2014 U.S. Durable Goods Orders :

With volatility at lows not seen since just before the financial crisis in the EUR/USD pair, it is no surprise that the last Durable Goods orders figure did not move markets substantially. The release came in at 2.2%, above market expectations calling for a 0.8% increase. In the context of yesterday’s disappointing housing print, we may see greater follow through if we do see the print diverge from market expectations of 2.0% for March.

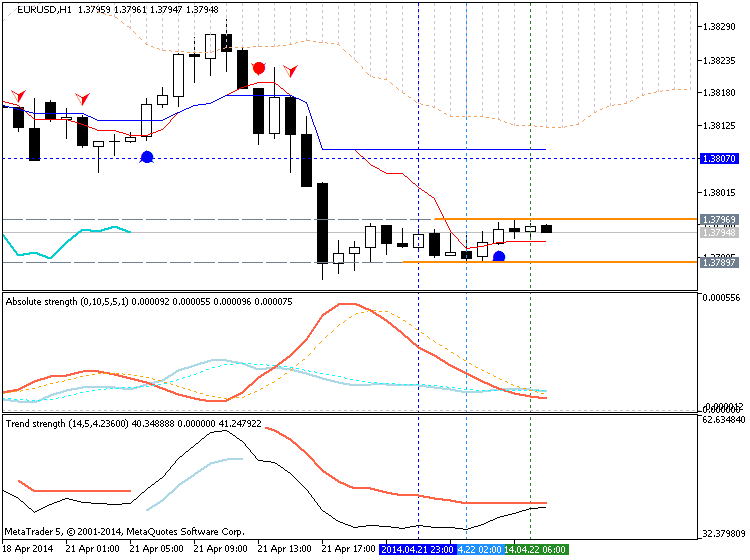

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

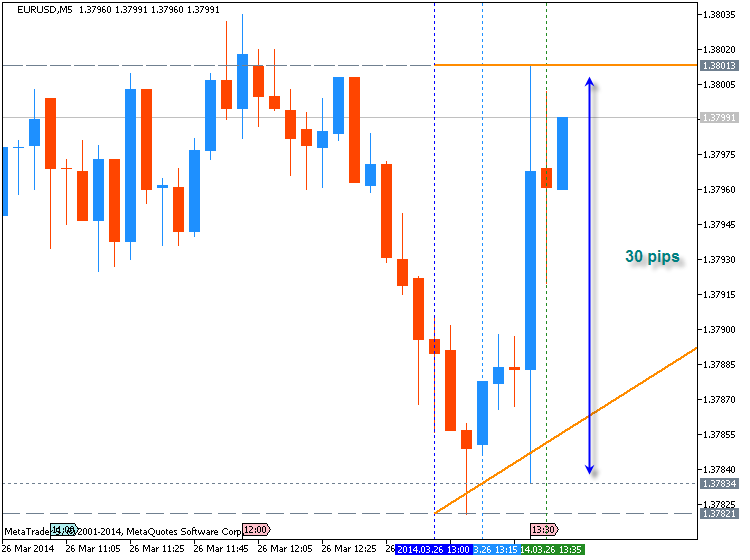

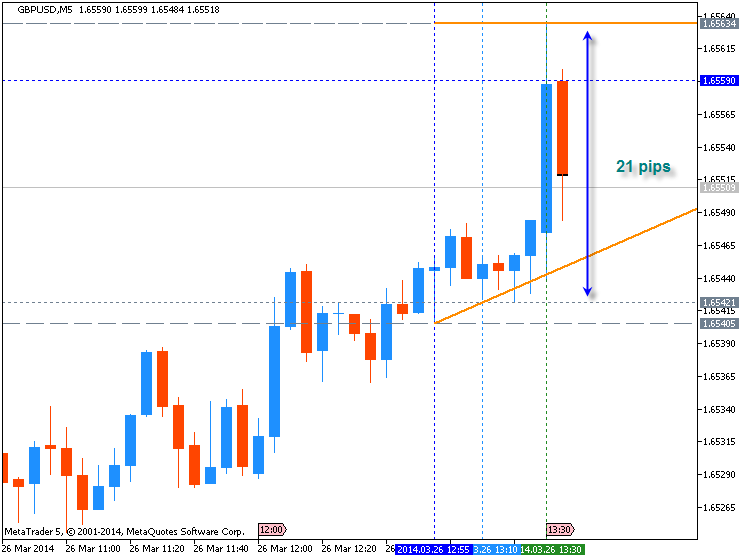

EURUSD M5 : 24 pipss price movement by USD - Durable Goods Orders news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.24 19:09

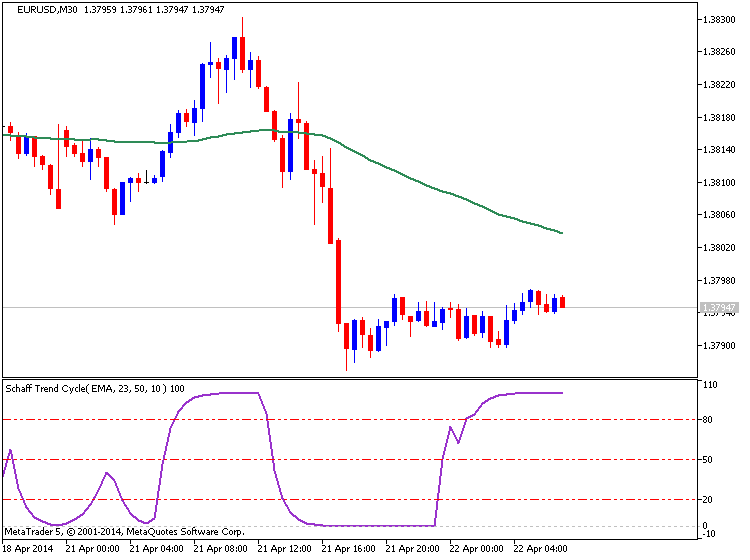

EURUSD Tec hnical Analysis (based on dailyfx article)

The EUR/USD fell briefly below 1.3800 following mixed US data but quickly bounced to trade nearly flat on the day.

The

EUR/USD fell to a low of 1.3790 but found support and managed to regain

the 1.3800 mark. At time of writing, the EUR/USD is trading at 1.3815,

little changed since opening. From a wider perspective however, the

EUR/USD continues to trade within this week's range lacking

follow-through either side of the board. In the macroeconomic domain, US

durable goods orders came in above expectations while Draghi sounded

quite dovish earlier today.

EUR/USD levels to watch

In

terms of technical levels, next supports are seen at 1.3790 (Apr 24

low), 1.3736 (Apr 8 low) and 1.3700 (psychological level). On the flip

side, resistances are seen at 1.3842 (Apr 24 high), 1.3854 (Apr 23

high), 1.3864 (Apr 17 high) and 1.3880 (Apr 11 closing price).

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

This will be difficult week for EURUSD:

If D1 price will break 1.3789 support level on close bar so we will get the ranging market condition with the price to be Ichimoku cloud.

If D1 price will break 1.3905 resistance level from below to above sothe primary bullish will be continuing (good to open buy trade), if not - we will see the ranging market condition on D1 timeframe (and for some other timeframes as well)/

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-04-22 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sale]

2014-04-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-04-23 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - French Manufacturing PMI]

2014-04-23 07:30 GMT (or 09:30 MQ MT5 time) | [EUR - German Manufacturing PMI]

2014-04-23 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2014-04-24 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2014-04-24 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2014-04-24 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-04-25 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bullish

TREND : ranging

Intraday Chart