You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Should news companies stop selling to HFT's ??

An Introducation to Trading Strategy (based on dailyfx article)

Each trader must develop their own unique trading style. Normally traders will choose a style based off of the times they trade and the assets the select for trading. Ultimately these strategies will fall into one of three categories. Today we will briefly review the basis of range, trend, and breakout trading and what traders implementing these strategies look for.

Range Trading Strategies

First, range traders use technical analysis to trade sideways moving markets. This is done by identifying price trading horizontally between two areas of support and resistance. Once these values are found, traders can begin to trade between them. Normally ranges are known to occur during times during of low volatility.

The benefit of trading ranging markets is that traders can take a directionless trading strategy. This means range traders will look to initiate both buy orders (at support) and sell positions (as price reaches resistance). As well risk can be clearly defined to exit ranging positions in the event of a price breakout.

Breakout Strategies

A Price breakout occurs when price action either rises above resistance or drops below support. Normally a breakout is preceded by a consolidating pattern or sideways movements such as a range mentioned above. Savy traders that are aware of these conditions can quickly adapt their trading plan and be prepared to take advantage of the next market move with a use of an entry order while waiting for a breakout.

The advantage of this style of trading is that breakout t traders have the ability to trade with entry orders. This means even if you are not in front of your computer, entries can be set to enter the market if price breaches a certain level. The idea is to enter the market on a surge in price in the direction of market momentum. In the event that price continues to consolidate these entry orders can easily be deleted and traders may then look for trades elsewhere.

The Retracement Strategies

Lastly, trend traders look to take advantage of strong directional movements in the market. Trading a retracement is probably one of the most popular methods of doing so. Retracements traders will wait patiently for a pullback in the trend and then enter into the market.

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

newdigital, 2013.01.22 14:18

1. Trend following

1.1. Primary trend

- Uptrend (bullish)

- Downtrend (bearish)

1.2. Secondary trend.

- Correction

- Bear Market Rally

- Flat (non-trading)

- Ranging

2. Overbough/oversold ('top-and-bottom')

3. Breakout

2013-03-19 21:45 GMT (or 22:45 MQ MT5 time) | [NZD - GDP]

if actual > forecast = good for currency (for NZD in our case)

==========

New Zealand GDP Rises 0.9% On Quarter

New Zealand's gross domestic product added 0.9 percent on quarter in the fourth quarter of 2013, Statistics New Zealand said on Thursday.

That was in line with expectations and slowing from 1.4 percent in the third quarter.

From Alibaba To Weibo: Your A-Z Guide To China's Hottest Internet IPOs (based on Forbes article)

From Google and Amazon to Facebook and Twitter, Silicon Valley has had its time to shine on Wall Street. Now it’s China’s turn.

More and more Chinese firms are filing for initial public offerings and investors are clamoring to get their hands on valuable web properties attached to China’s burgeoning middle class. Even if the country only gets half its population online, that will still be more than double the entire US market.

But from Alibaba to Weibo, Baidu to Youku, it can be hard to keep track of each company’s products and connections. Here’s a handy A-Z guide to help you out.

Alibaba: Massive Chinese online marketplace based in Hangzhou handles more sales than Amazon and eBay combined, over $160 billion. Doesn’t sell directly to consumers, so profit margins can exceed 40%. Expected to debut in US at valuation exceeding $150 billion, with IPO proceeds potentially higher than $15 billion.

AliPay: Alibaba’s PayPal with over 300 million users in China, where the vast majority of consumers still don’t have credit cards. Launched in 2004, processed about $660 billion in transactions in 2012.

Autohome: Chinese auto information website popped over 75% on its first day of public trading in December.

AutoNavi: In February, Alibaba offered $1.13 billion to buy the remaining 72% stake it didn’t already own of this Chinese online map company. Went public on its own back in July 2010.

Baidu : The leading Chinese-language web search provider, often compared to Google GOOG -0.92%, has the fifth-largest global web audience. Stock up over 1000% since its August 2005 IPO.

BAT: Common nickname for dominating triumvirate of Baidu, Alibaba, and Tencent.

ChinaVision Media Group: In March, Alibaba purchased 60% stake in this TV and movie company for $804 million. ChinaVision’s content should power new Ali TV operating system and mobile gaming platform.

Chukong: Mobile game maker makes popular Chinese title Fishing Joy, attracting more than 200 million users. Plans to raise $150 million in US IPO later this year.

Hong Kong Stock Exchange: Alibaba only turned to the US for its IPO after negotiations with Hong Kong broke down over a corporate structure that includes super-voting shares.

JD.com: China’s second-largest e-commerce site behind Alibaba had over $16 billion in sales last year. Filed in January to go public in the US. In March, Tencent bought 15% stake for $214 million to leverage on its mobile platforms.

Jumei.com: Chinese cosmetics retailer mainly employs flash sales, generated $400 million in revenue in 2012. Plans to IPO in the US later this year at a valuation upwards of $3 billion.

Lei Jun: Chairman of YY and co-founder of Xiaomi. Net worth of $4 billion, #19 richest in China.

Robin Li (Li Yanhong): 45-year-old co-founder and CEO of Baidu. Net worth of $12.1 billion, #3 richest in China.

Richard Liu (Liu Qiangdong): Founder and CEO of JD.com, of which he still controls 46%. Net worth of $2.7 billion, #36 richest in China.

Jack Ma (Ma Yun): Main founder and Chairman of Alibaba. Net worth of $10 billion, #6 richest in China. 49-year-old former English teacher founded company in 1999 out of his apartment. On Forbes cover in April 2011.

Pony Ma (Ma Huateng): Founder and CEO of Tencent. Net worth of $13.4 billion, #2 richest in China.

Qihoo360: China’s largest Internet security provider with more than 460 million monthly active users. Also second to Baidu in search engine queries, and maintains growing mobile app store. Founded in 2005, went public on NYSE in April 2011. Current market cap exceeds $27 billion.

QQ: Instant messaging service owned by Tencent with nearly 800 million active accounts. Monetizes through games, music, shopping.

Qunar: Chinese travel booking service majority controlled by Baidu. Surged 89% on the first day of its November US IPO. Current market cap over $3.3 billion.

Sina: China’s largest web-portal resembles Yahoo YHOO -2.13%. Went public in 2000, now has $4.5 billion market cap. Biggest asset is Weibo microblogging service, set to spin off this year.

SoftBank: Broadband company (founded by Japanese billionaire Masayoshi Son) secured control of 37% of Alibaba based on a mere $20 million investment back in 2000.

Sogou: In September 2013, Tencent paid $448 million for a 36% stake in this Chinese web search company. Handles 5.5% of all Chinese search engine queries.

Sungy Mobile: Mobile app maker developed popular GO Launcher for Android. Stock up 140% from its November IPO.

Tencent: China’s largest publicly-traded Internet company by market cap went public in Hong Kong in 2004, now worth over $130 billion. Made most of money so far via games, also owns stake in American video game company Activision Blizzard . Now leveraging popular social networks/messaging services QQ and WeChat into mobile dominance.

TenPay: Tencent’s PayPal and smaller rival to Alibaba’s AliPay.

Taobao: Created in 2003, it’s now Alibaba’s biggest website, an online bazaar of 760 million product listings from about 7 million sellers. No fee for businesses to list products, just advertising. Most similar to EBay, but not an auction site.

Tmall: Alibaba website for larger merchants, including international brands (about 70,000). Charges fees for sellers, as well as percentage commission of each transaction. Taobao and Tmall accounted for more than half of all Chinese parcels delivered in 2012.

Joseph Tsai: Vice Chairman of Alibaba, helped found company in 1999. Taiwan-born, lived in US before moving to Hong Kong in 1995. Net worth of $3.7 billion, #9 richest in China, 50 years old.

V.I.E.: “Variable interest entity” is the complex investment vehicle that allows Chinese companies like Alibaba to skirt government regulations against foreign investors. China has given tacit approval for such rule-bending corporate structures so far, but risks remain.

WeChat: Tencent’s hit mobile messaging service (and WhatsApp rival) is spreading fast beyond China, with more than 350 million monthly active users. Monetizing with e-payments, gaming, and more.

Weibo: Chinese microblogging site most often compared to Twitter generated $188 million in revenue in 2013 from about 130 million monthly active users. Filed preliminary prospectus in March for $500 million IPO. Subsidiary of Sina Corp, which owns over 77%, and Alibaba, which bought a 19% stake for nearly $600 million in April 2013.

Xiaomi: Privately-held smartphone maker has gained market share with its Android-based operating system. Only founded in 2010, the company registered over $5 billion in revenue last year, plans to ship 40 million phones in 2014. Valued at $10 billion based on August 2013 funding round.

Yahoo: Owns 24% of Alibaba from initial investment in 2005 and has seen its own stock rise as a result. Plans to sell some of stake in the IPO.

Yu’e Bao: Alibaba/AliPay’s Internet money market fund launched in June 2013. Already has 80 million investors and deposits topping $80 billion, making it the fourth largest money market fund in the world. Boasts average account holder age of just 26 years old. Name means “leftover treasure.”

Youku Tudou YOKU -2.8%: China’s YouTube. 2012 merger of Youku and Tudou created country’s biggest video site. Public company trades at value over $5.5 billion.

YY YY -3.03%: Social video and music platform based in Guangzhou, China. Stock up over 600% since debuting on NASDAQ in November 2012.

58.com: China’s Craigslist-like online marketplace netted $187 million in its October US IPO. Current market cap over $3.8 billion.

Alibaba founder Jack Ma stands to benefit when his e-commerce behemoth goes public :

2013-03-20 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]

if actual > forecast = good for currency (for EUR in our case)

==========

German Producer Prices Decline For Seventh Month

Germany's producer prices fell for the seventh successive month in February, and the rate of decline matched economists' forecast, latest data revealed Thursday.

The industrial producer price index decreased 0.9 percent in February from the same month of last year, the Federal Statistical Office said. This followed a 1.1 percent contraction in January.

The February outcome matched economists' expectations. Prices have now fallen for the seventh consecutive month.

The development in February was influenced most by a 2.6 percent fall in energy prices, and a 1.9 percent drop in prices of intermediate goods. Meanwhile, capital goods prices grew by 0.5 percent, and consumer goods prices recorded a 1.3 percent gain.

Month-on-month, producer prices held steady in February, after dropping 0.1 percent in the beginning of the year. Expectations were for a 0.1 percent increase.

Technicals and Fundamentals for USD/TRY (based on forexminute article)

US Dollar (USD) on Wednesday rose sharply against the Turkish Lira (TRY) after the Federal Reserve’s announcement to reduce the Quantitative Easing (QE) and Yellen’s unexpected remarks about the first interest rate hike. The pair is poised for a major upside breakout.

Technical Analysis

USD/TRY is being traded around 2.2365 at 07:30 GMT in Asia. The pair is expected to face immediate hurdle near 1.2465, the channel resistance of the rising wedge formation on the daily. A break and daily closing above the 1.2465 resistance shall push the pair into relatively stronger bullish trend targeting the all-time high level 2.3891.

On the downside, the pair might find support around 2.2133, the 23.6% fib level, ahead of 2.2037 that is the channel support of the wedge. A daily closing below the channel support could open doors for 2.1610.

Major Upcoming Reports in Turkish Basket

On March 25, Turkey’s central bank is due to release the business confidence report. According to the forecast of different analysts, the business confidence rose to 108.17 in March compared with 104.6 in the previous month. The same day, Turkey’s capacity utilization report is also scheduled for release; analysts have predicted 73.01% reading for March compared with 73.3% in the previous month.

On March 28, the central bank will release the consumer confidence report for the month of March. The consumer confidence rose to 73.1 points in March compared with 69.2 points in the previous month. Better than expected Turkish reports will be seen as bearish for USD/TRY and vice versa.

Fed Tapering

The Federal Reserve reduced the pace of the monthly stimulus by $10 billion to $55 billion, on the third monetary policy meeting in a row. The tapering decision signaled that the economy was recovering rapidly from the 2008 recession even without the stimulus. The US Dollar (USD) shot up against major peers after the tapering decision. The same trend might continue in the near future, keeping USD/TRY under considerable buying pressure.

Surprise Remarks by Yellen

Janet Yellen surprised the financial markets yesterday at her first press conference as Fed chief. She said the central bank might consider the first increase in the benchmark interest rate as soon as the next six-month period. The remarks were totally opposed to the forward guidance. The central bank had repeatedly assured that the interest rate would remain unchanged at the record low level of 0.25% well after the unemployment rate falls below the 6.5% threshold. In other words, Yellen’s remarks scrapped the forward guidance, leaving investors in an absolute shock.

What Does Tapering Mean for Turkey

In 2008 when the Federal Reserve launched the QE program worth $85 billion to cope with the recession, Turkey and other emerging-market economies witnessed huge capital inflows amid rapid Foreign Direct Investment (FDI). Now with gradual trimming in the stimulus by the Fed, the whole process is being reversed in the emerging-market economies, leaving their currencies vulnerable.

2013-03-20 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Philadelphia Fed Manufacturing Survey]

if actual > forecast = good for currency (for USD in our case)

==========

Philly Fed Index Bounces Back Into Positive Territory In March

Manufacturing activity in the Philadelphia-area rebounded in March, according to the firms responding to the Federal Reserve Bank of Philadelphia's Business Outlook Survey.

The Philly Fed released a report Thursday showing that its diffusion index of current activity jumped to a positive 9.0 in March from a negative 6.3 in February. A positive reading indicates an increase in regional manufacturing activity.

Economists had been expecting the Philly Fed index to show a much more modest rebound to a positive reading of 3.2.

From Alibaba To Weibo: Your A-Z Guide To China's Hottest Internet IPOs (based on Forbes article)

From Google and Amazon to Facebook and Twitter, Silicon Valley has had its time to shine on Wall Street. Now it’s China’s turn.

More and more Chinese firms are filing for initial public offerings and investors are clamoring to get their hands on valuable web properties attached to China’s burgeoning middle class. Even if the country only gets half its population online, that will still be more than double the entire US market.

But from Alibaba to Weibo, Baidu to Youku, it can be hard to keep track of each company’s products and connections. Here’s a handy A-Z guide to help you out.

Alibaba: Massive Chinese online marketplace based in Hangzhou handles more sales than Amazon and eBay combined, over $160 billion. Doesn’t sell directly to consumers, so profit margins can exceed 40%. Expected to debut in US at valuation exceeding $150 billion, with IPO proceeds potentially higher than $15 billion.

AliPay: Alibaba’s PayPal with over 300 million users in China, where the vast majority of consumers still don’t have credit cards. Launched in 2004, processed about $660 billion in transactions in 2012.

Autohome: Chinese auto information website popped over 75% on its first day of public trading in December.

AutoNavi: In February, Alibaba offered $1.13 billion to buy the remaining 72% stake it didn’t already own of this Chinese online map company. Went public on its own back in July 2010.

Baidu : The leading Chinese-language web search provider, often compared to Google GOOG -0.92%, has the fifth-largest global web audience. Stock up over 1000% since its August 2005 IPO.

BAT: Common nickname for dominating triumvirate of Baidu, Alibaba, and Tencent.

ChinaVision Media Group: In March, Alibaba purchased 60% stake in this TV and movie company for $804 million. ChinaVision’s content should power new Ali TV operating system and mobile gaming platform.

Chukong: Mobile game maker makes popular Chinese title Fishing Joy, attracting more than 200 million users. Plans to raise $150 million in US IPO later this year.

Hong Kong Stock Exchange: Alibaba only turned to the US for its IPO after negotiations with Hong Kong broke down over a corporate structure that includes super-voting shares.

JD.com: China’s second-largest e-commerce site behind Alibaba had over $16 billion in sales last year. Filed in January to go public in the US. In March, Tencent bought 15% stake for $214 million to leverage on its mobile platforms.

Jumei.com: Chinese cosmetics retailer mainly employs flash sales, generated $400 million in revenue in 2012. Plans to IPO in the US later this year at a valuation upwards of $3 billion.

Lei Jun: Chairman of YY and co-founder of Xiaomi. Net worth of $4 billion, #19 richest in China.

Robin Li (Li Yanhong): 45-year-old co-founder and CEO of Baidu. Net worth of $12.1 billion, #3 richest in China.

Richard Liu (Liu Qiangdong): Founder and CEO of JD.com, of which he still controls 46%. Net worth of $2.7 billion, #36 richest in China.

Jack Ma (Ma Yun): Main founder and Chairman of Alibaba. Net worth of $10 billion, #6 richest in China. 49-year-old former English teacher founded company in 1999 out of his apartment. On Forbes cover in April 2011.

Pony Ma (Ma Huateng): Founder and CEO of Tencent. Net worth of $13.4 billion, #2 richest in China.

Qihoo360: China’s largest Internet security provider with more than 460 million monthly active users. Also second to Baidu in search engine queries, and maintains growing mobile app store. Founded in 2005, went public on NYSE in April 2011. Current market cap exceeds $27 billion.

QQ: Instant messaging service owned by Tencent with nearly 800 million active accounts. Monetizes through games, music, shopping.

Qunar: Chinese travel booking service majority controlled by Baidu. Surged 89% on the first day of its November US IPO. Current market cap over $3.3 billion.

Sina: China’s largest web-portal resembles Yahoo YHOO -2.13%. Went public in 2000, now has $4.5 billion market cap. Biggest asset is Weibo microblogging service, set to spin off this year.

SoftBank: Broadband company (founded by Japanese billionaire Masayoshi Son) secured control of 37% of Alibaba based on a mere $20 million investment back in 2000.

Sogou: In September 2013, Tencent paid $448 million for a 36% stake in this Chinese web search company. Handles 5.5% of all Chinese search engine queries.

Sungy Mobile: Mobile app maker developed popular GO Launcher for Android. Stock up 140% from its November IPO.

Tencent: China’s largest publicly-traded Internet company by market cap went public in Hong Kong in 2004, now worth over $130 billion. Made most of money so far via games, also owns stake in American video game company Activision Blizzard . Now leveraging popular social networks/messaging services QQ and WeChat into mobile dominance.

TenPay: Tencent’s PayPal and smaller rival to Alibaba’s AliPay.

Taobao: Created in 2003, it’s now Alibaba’s biggest website, an online bazaar of 760 million product listings from about 7 million sellers. No fee for businesses to list products, just advertising. Most similar to EBay, but not an auction site.

Tmall: Alibaba website for larger merchants, including international brands (about 70,000). Charges fees for sellers, as well as percentage commission of each transaction. Taobao and Tmall accounted for more than half of all Chinese parcels delivered in 2012.

Joseph Tsai: Vice Chairman of Alibaba, helped found company in 1999. Taiwan-born, lived in US before moving to Hong Kong in 1995. Net worth of $3.7 billion, #9 richest in China, 50 years old.

V.I.E.: “Variable interest entity” is the complex investment vehicle that allows Chinese companies like Alibaba to skirt government regulations against foreign investors. China has given tacit approval for such rule-bending corporate structures so far, but risks remain.

WeChat: Tencent’s hit mobile messaging service (and WhatsApp rival) is spreading fast beyond China, with more than 350 million monthly active users. Monetizing with e-payments, gaming, and more.

Weibo: Chinese microblogging site most often compared to Twitter generated $188 million in revenue in 2013 from about 130 million monthly active users. Filed preliminary prospectus in March for $500 million IPO. Subsidiary of Sina Corp, which owns over 77%, and Alibaba, which bought a 19% stake for nearly $600 million in April 2013.

Xiaomi: Privately-held smartphone maker has gained market share with its Android-based operating system. Only founded in 2010, the company registered over $5 billion in revenue last year, plans to ship 40 million phones in 2014. Valued at $10 billion based on August 2013 funding round.

Yahoo: Owns 24% of Alibaba from initial investment in 2005 and has seen its own stock rise as a result. Plans to sell some of stake in the IPO.

Yu’e Bao: Alibaba/AliPay’s Internet money market fund launched in June 2013. Already has 80 million investors and deposits topping $80 billion, making it the fourth largest money market fund in the world. Boasts average account holder age of just 26 years old. Name means “leftover treasure.”

Youku Tudou YOKU -2.8%: China’s YouTube. 2012 merger of Youku and Tudou created country’s biggest video site. Public company trades at value over $5.5 billion.

YY YY -3.03%: Social video and music platform based in Guangzhou, China. Stock up over 600% since debuting on NASDAQ in November 2012.

58.com: China’s Craigslist-like online marketplace netted $187 million in its October US IPO. Current market cap over $3.8 billion.

Alibaba founder Jack Ma stands to benefit when his e-commerce behemoth goes public :

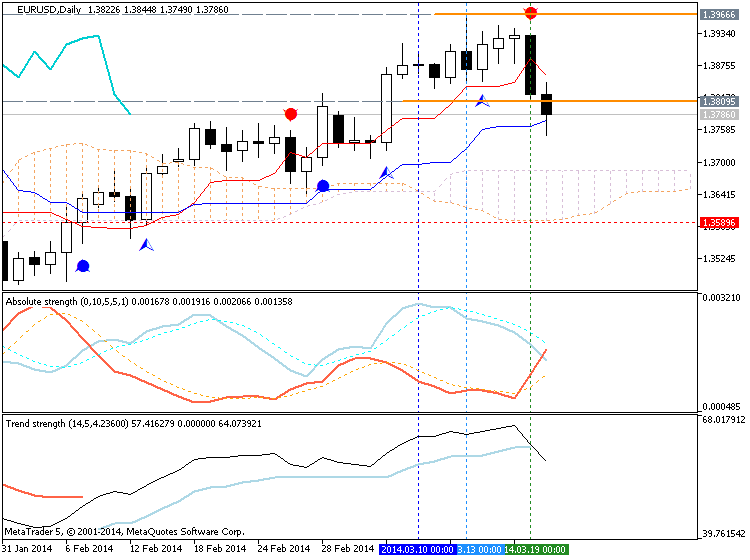

EURUSD Technicals for 2014.03.20 (based on investing article)

The euro was trading close to two-week lows against the dollar on Thursday as prospects for an earlier than expected rate hike by the Federal Reserve saw the dollar strengthen across the board.

EUR/USD was last down 0.47% to 1.3766, after falling to session lows of 1.3750 earlier. The euro fell more than 0.8% against the dollar on Wednesday.

The dollar rallied against the other main currencies after Fed Chair Janet Yellen indicated that the bank could begin to raise interest rates about six months after its bond-buying program winds up, which is expected to happen this fall.

The Fed also cut its monthly bond purchases by an additional $10 billion to $55 billion at the conclusion of its two-day policy setting meeting on Wednesday.

The comments prompted investors to bring forward expectations for a rate hike to as soon as April of next year.

Meanwhile, data on Thursday showed that U.S. initial jobless claims rose less-then-expected last week.

The Department of Labor reported that the number of people filing for initial jobless benefits in the week ending March 15 rose by 5,000 to 320,000 from the previous week’s total of 315,000. Analysts had expected jobless claims to rise by 10,000 last week.

Elsewhere, the common currency was also weaker against the yen and the pound, with EUR/JPY down 0.43% to 140.92, and EUR/GBP shedding 0.19% to trade at 0.8343.

Trading the News: Canada Consumer Price Index (based on dailyfx article)

A marked decline in Canada inflation may prompt a further advance in the USD/CAD as it raises the Bank of Canada’s (BoC) scope to revert back to its easing cycle.

What’s Expected:

Why Is This Event Important:

Indeed, BoC Governor Stephen Poloz showed a greater willingness to lower the benchmark interest rate further in an effort to encourage a ‘soft landing’ for the region, and the ongoing threat for disinflation may continue to dampen the outlook for the Canadian dollar as the central bank adopts a more dovish tone for monetary policy.

Nevertheless, higher home prices along with rising input costs may limit the downside risk for price growth, and a positive development may generate a near-term rebound in the loonie as it raises the fundamental outlook for the Canadian economy.

How To Trade This Event Risk

Bearish CAD Trade: Price Growth Slips to 1.0% or Lower

- Need green, five-minute candle after the CPI report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish CAD Trade: Canada Inflation Tops Market ForecastPotential Price Targets For The Release

January 2014 Canada Consumer Price Index :