SciFi..........

The Fed Announces Its Latest Decision Tomorrow — Here's What To Expect

The Federal Open Market Committee (FOMC) begins its meeting today. The FOMC meeting announcement and forecasts are out at 2 p.m. ET on Wednesday, followed by remarks from Federal Reserve chair, Janet Yellen, at 2:30 p.m. ET.

The FOMC is largely expected to taper its asset purchase program by $10 billion to $35 billion.

Effective July 1, the Fed is expected to lower its asset purchases to $15 billion in agency mortgage backed securities (MBS) and $20 billion in Treasuries.

The Fed is also expected to maintain its current forward guidance language on federal funds rate support.

Inflation concerns

The latest consumer price report showed that inflation is starting to tick higher. Following the report, Ian Shepherdson at Pantheon Macroeconomics wrote that he doesn't expect a "knee-jerk Fed reaction," but "If these emerging trends continue, markets and policymakers will soon be changing their tunes."

"It undoubtedly will color the discussion on the FOMC, and may embolden some of the hawks to push up their inflation and interest rate forecasts," writes Michael Hanson at Bank of America. "While we don’t expect a hawkish dissent at this meeting, today’s numbers mildly increases those odds."

Unemployment and growth

Yellen is clearly looking beyond the headline unemployment rate. Her "eclectic" approach, writes David Rosenberg at Gluskin Sheff, includes quit rates as a sign of investor confidence, and part-time and long-term employment data.

"The bottom line, though, is that employment lags the cycle, unemployment rates lag employment, and wages lag everything," writes Rosenberg. "So what we have is a Fed that is committed to targeting lagging indicators — this can only end up building more inflationary pressures down the pike."

The FOMC "will maintain its focus on the potential for a cyclical growth pick up and a further reduction in labor market slack," writes Mohamed El-Erian. "It will also note the importance of removing the slack given its more holistic assessment of the labor market (which includes part time activities, long-term joblessness, and wage growth)."

Another number FOMC members will be tossing around is the slowdown in the first quarter, though this is likely to be considered a one-off. El-Erian writes that this is likely to show "some softening in the shorter term growth projections but no material change to longer-term expectations."

In fact, in some regards the Fed looks close to achieving its employment and inflation goals. Recently, Goldman Sachs' Jan Hatzius wrote that "despite the 1% drop in real GDP in the first quarter, we believe that the US economy is now growing at an above-trend pace." This could have bulls antsy about the Fed's accommodative stance.

New Fed faces and the Dot Plot

There is a little uncertainty about the policy debate going in to this meeting since Lael Brainard and Stanley Fischer, who were confirmed last Thursday, will be stepping up as new voters. Meanwhile, Loretta Mester, who took over from Cleveland Fed President Sandra Pianalto, is also stepping up as a voter. Hatzius argues that these new faces could result in a "dovish shift."

"This change-over will add some uncertainty to the policy debate and the distribution of the June 'dot plot,'" writes Michael Hanson at Bank of America. "We don’t expect these current or potential future personnel changes to fundamentally alter the majority support for a gradual exit with rates below their historical average for some time."

Michael Hanson and Ethan Harris expect that Yellen will downplay the "dot plot" as not being a policy tool. This refers to the the dot chart that shows the predicted path of the federal funds rate, where each dot represents where an FOMC member sees the federal funds rate at the end of each year. They expect the first rate hike in Q4 2015.

Forecasts

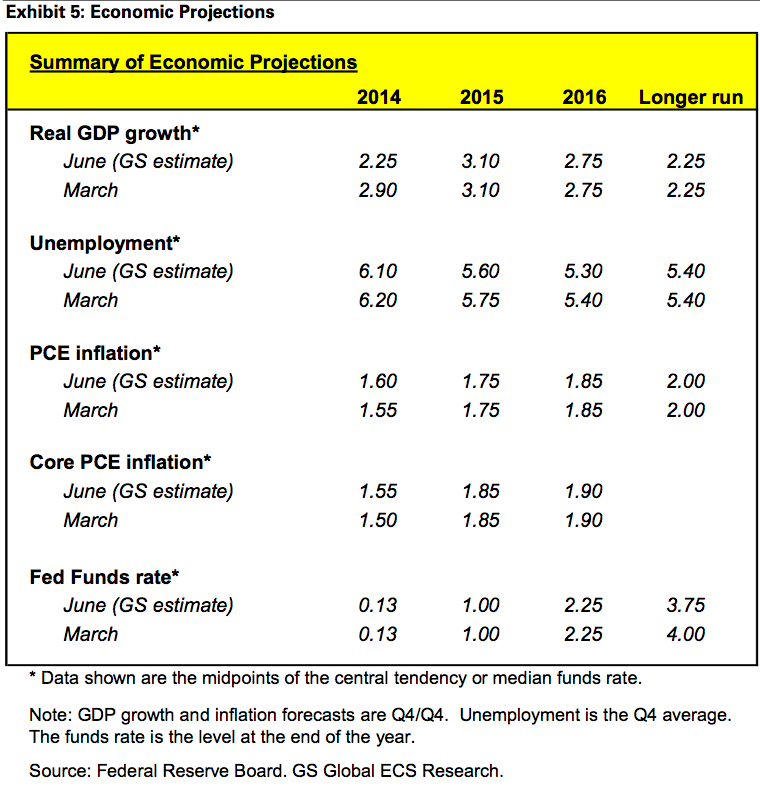

"The committee is likely to make some upgrades to its description of the economic outlook in the post-meeting statement and its economic projections," writes Hatzius. "Although the committee will need to reduce its 2014 real GDP growth forecast to take into account the Q1 disappointment, we would expect the committee to reduce its unemployment rate forecast and lift its inflation forecast slightly."

Here's a quick look at what Goldman expects:

Fed Decision Day Guide From Dot Plots To Exit Strategy

Here’s what to look for when the Federal Open Market Committee releases its policy statement at 2 p.m. today in Washington along with new economic projections. Federal Reserve Chair Janet Yellen plans to give a press conference at 2:30 p.m.

-- Sticking to zero: Yellen will probably emphasize that the Fed will keep its main interest rate close to zero for at least a year even with inflation rising toward the Fed’s 2 percent goal and the job market improving faster than officials expected, said Roberto Perli, a partner at Cornerstone Macro LP in Washington.

-- The 6.3 percent unemployment rate is already at the top end of the range that most officials in March forecast for the end of this year.

-- Similarly, the personal consumption expenditures price index, the Fed’s preferred inflation gauge, rose 1.6 percent in the year through April, a rate most officials expected at year-end. The consumer price index, a separate inflation measure, rose last month by 0.4 percent, the biggest gain since February 2013.

-- Yellen will probably say “rate hikes are at least a year away,” said Perli, former associate director of monetary affairs at the Fed. “Fed policy is likely to remain very supportive of equities,” he said in a note to clients.

-- Lingering chill: Fed officials will probably lower their estimates of 2014 gross domestic product growth to account for a first-quarter contraction caused in part by harsh winter weather, said Michael Gapen, a senior U.S. economist at Barclays Plc in New York.

Growth Estimate

-- Fed officials’ estimates for growth this year will probably fall to a range of about 2.6 percent to 2.8 percent from 2.8 percent to 3 percent in March, Gapen said.

-- Still, officials will probably stick to an estimate of 3 percent growth for “the second half of this year and beyond” amid signs the economy is gaining strength, said Millan Mulraine, deputy head of U.S. research and strategy at TD Securities USA LLC in New York.

Will The Fed Disappoint The Markets Today?

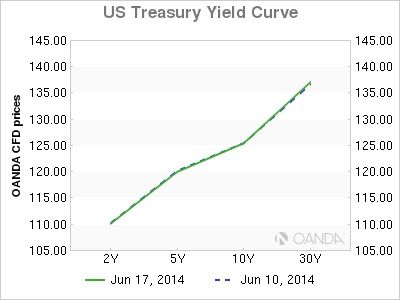

Today's market focus is all about the Federal Reserve and how aggressive it is likely to be. The fixed-income market in particular has been pricing in a more forceful showing by U.S. policymakers later this afternoon (U.S. 10's backed up +5bp to +2.645%), most notably on the back of yesterday's somewhat surprising American inflation report, but will they be disappointed with the Fed outcome?

The May U.S. consumer-price index (CPI) headline came in stronger-than-expected (+0.4%, month-over-month, and +2.1%, year-over-year), even the less volatile core beat forecasts (+0.3%, month-over-month, and +2.0%, year-over-year), confirming the fastest one-month gain in nearly two years. This unexpectedly large increase will obviously provide fodder for the Federal Open Market Committee 'hawks'. Despite much evidence of wage pressures, the CPI data implies demand-pull inflation is leading to an earlier arrival at the Fed's policy objectives. As being the case for much of the U.S. recovery and expansion, services prices are leading the increases in the CPI.

Services prices represent nearly +60% of the consumer basket, and they rose +0.4%, month-over-month, and a hearty +2.8%, year-over-year. What will not be lost on the hawks is the fact that core prices have accelerated in the past three months and are up to +2.8%, the highest level since January, 2008. This may be the evidence that the policymakers have been waiting for to begin the conversation on "removing" policy accommodation within the next two to three quarters – much sooner than the four to six quarters that the fixed-income market has been pricing in. Since yesterday, fixed-income traders are bracing themselves for an assertive Fed and have been flattening the U.S. curve aggressively – by selling U.S. short paper and pushing their yields higher.

Traders Await Fed Guidance

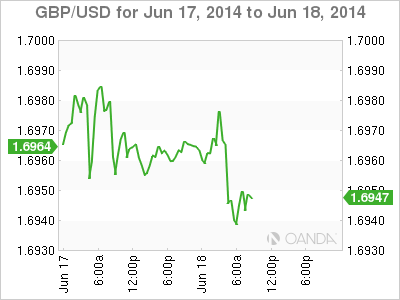

Nonetheless, the Fed will not be looking to abruptly adjust market expectations in the manner that the Bank of England’s (BoE) Governor Mark Carney did last week, which saw the sterling soar (£1.6834-£1.7004) following his comments about a possible rate hike much sooner than the market had been pricing. There is risk of a subtle change at Fed Chair Janet Yellen's post-meet press conference (2:30 p.m. ET) – the market will be looking for any indication that the debate will be shifting from reducing to removing policy accommodation. In reality, a pre-emptive Fed cannot afford to wait to achieve its goals before changing tact to removing accommodation. Yellen and company will not want to be caught behind the curve and force a Carney-style shift in policy – market transparency is important; it's there so as not to provide any antagonistic knock-on effect to the U.S. economy. To date, market consensus believes that unless American economic data -- especially employment and inflation -- sharply surprises to the upside, the Fed will stick to the comfortable script on tapering, ending quantitative easing, and begin tightening sometime in the second half of 2015. Any changes by Yellen and her rate-setting team should be accurately telegraphed.

What Did The Fed Do To The Dollar?

What Did the Fed Say to Drive the Dollar Lower?

Based on the performance of currencies and Treasuries, investors were disappointed by the Federal Reserve’s monetary policy announcement. The central bank tapered asset purchases by $10 billion, lowered their unemployment rate forecast and raised their inflation forecast but the changes were small especially when compared to the sharp cut to their 2014 GDP outlook. Not only did the dollar sell off across the board, but 10-year Treasury yields also dropped below 2.6%. It wasn’t so much what the Fed said that drove the dollar lower but rather what they didn’t say. Janet Yellen acknowledged the improvements in the economy, indicated that the central bank is discussing tools for normalizing monetary policy and said that there would be a considerable period of time between the end of QE to the first rate hike. When pressed for a definition of “considerable time,” she refused to provide any details, saying only that there is no formula for what considerable time means. In other words, unlike other central banks that have recently expressed their desire to become more active, the Fed remains comfortable with their current course and has no desire to alter the market’s expectations. Their acknowledgement of the improvements in the economy and the prospect of steady monetary policy also drove U.S. stocks to a record high Wednesday. While we don’t expect a significant sell-off in the dollar, the greenback should extend its losses against the currencies of central banks who are looking to tighten.

We’ve compiled our Top-10 Takeaways from the June FOMC statement but the bottom line is that nothing has changed. Yellen promised to provide details on normalization later this year and we’ll have to wait until then for more clarity on U.S. monetary policy.

Top-10 Takeaways from June FOMC Statement

1. Monthly bond purchases cut by $10B to $35B

2. Forecast changes – lower unemployment rate, higher inflation and significantly weaker growth

a. 2014 Unemployment forecast cut to 6%-6.1% vs. 6.1%-6.3% in March

b. 2014 Inflation forecast raised to 1.5%-1.7% vs. 1.5%-1.6% in March

c. 2014 GDP growth cut to 2.1%-2.3% from 2.8%-3% in March

3. Fed sees slightly higher Fed Funds rate in 2015 (1.2% vs. 1.125% in March)

4. Majority expect first rate hike in 2015

5. Nearly all of the changes in the FOMC statement was in the first paragraph description of economy

6. No Dissents – All new members vote in line with majority

7. Policy remains accommodative, Fed repeats low rates likely

8. Fed notes rebound in economic activity and improvement in labor market

9. Unemployment rate though lower, remains elevated

10. Household spending appears to be rising more quickly, business investment resumed its advance

Yellen In No Hurry to Hike Rates

Dots all, folks.

Forget the graph of dots that represent the expectations of the Federal Open Market Committee for where the federal funds rate will be at the end of 2015 and 2016. The timing and extent of eventual hikes in short-term interest rates "depends" on the assessment of the economy, Federal Reserve Chair Janet Yellen made clear at her press conference following the two-day meeting of the central bank's policy-setting panel.

It rather sounds like the Supreme Court's definition of pornography; they can't say exactly what it is, but they know it when they see it.

So it seems with the Fed satisfying its dual mandate of full employment and low inflation. Strictly by the numbers, Yellen & Co. would appear to have met those goals.

Previously, the Fed said it wouldn't consider raising short-term rates until the jobless rate dropped to 6.5%; May's reading was 6.3%. That numerical target was scuttled when it became clear the jobless rate was reduced in part by fewer folks looking for jobs.

Inflation, meanwhile, also appears to be on the verge of reaching the Fed's 2% target. As noted here, the consumer price index has been climbing at a better than 2% pace for the past 12 months and actually has been accelerating in 2014.

Asked about this at the press conference, Yellen dismissed the latest numbers as "noisy," implying they were influenced by some fluky readings and thus less reliable. But, as the aforementioned column pointed out, price increases actually are becoming more pervasive across goods and services.

In any case, the Fed follows a different inflation gauge, the personal consumption expenditures deflator, which remains below its 2% target. And the FOMC's forecasts show the PCE deflator remaining well contained through 2016.

But, Yellen emphasized, the Fed's forecasts were fraught with uncertainty, so monetary policy "depends" on how the central bank sizes up how the economy's doing. Moreover, she neglected to mention the Fed's forecasts have been consistently too optimistic.

Far from rolling out a "Mission Accomplished" banner, Yellen gave the strong impression that the central bank is in no hurry to raise the fed funds target from the 0-0.25% level that has prevailed for nearly five-and-a-half years since it was pinned to the floor at the nadir of the financial crisis. (As universally expected, the FOMC again tapered its monthly purchases of Treasury and agency securities by $10 billion to $35 billion.)

In actuality, the dot plot of fed funds expectations for the next two years was boosted a bit. The "trimmed mean" of the FOMC's projections was up 15 basis points, to 1.13%, for the end of 2015 and up 25 basis points, to 2.58%, according to Royal Bank of Scotland economists. (The trimmed mean throws out the high and low readings to eliminate outliers.)

Yellen noted the change in the roster at the Fed, which she suggested might have moved the dots since the previous meeting. Stanley Fischer joined as the new Vice Chairman and Lael Brainard as Board Governor, while Jeremy Stein resigned to return to Harvard. In addition, Loretta Mester succeeded Sandra Pianalto, who retired as president of the Cleveland Fed.

In any case, the fed-funds futures market doesn't believe rates will be hiked nearly as much. It is pricing in a funds rate of just 0.775% at the end of 2015 and 1.825% at the end of 2016.

For the longer term, however, the FOMC nudged down its estimate for the equilibrium funds rate, to about 3.75% from 4%. That's still a lot higher than the equilibrium envisaged by Pimco's "New Neutral" hypothesis, which posits a neutral Fed policy for the post-financial crisis world would be 2%, or zero in real terms after inflation.

But the message the market took away is the Yellen Fed will maintain its accommodative stance until it sees the labor market has recovered to its satisfaction and so long as inflation remains within its bounds.

Moreover, the Chair also made clear the central bank wouldn't be bound by any "mechanical" formulas for the initial rate hikes. After the April confab, Yellen mused that the first rate increase could follow the end of the Fed's bond purchases (likely this fall) by about six months.

Bottom line: the Fed won't tighten until it is good and ready. That's the opposite to the chord struck recently by Yellen's counterpart at the Bank of England, Mark Carney, who suggested U.K. rate hikes may be coming more quickly than the market expects.

And with the Fed having their backs, markets responded positively. Yellen opined there were few signs of speculative excess, and not in the stock market. The Standard & Poor's 500 closed at another record while the Nasdaq composite ended at a 14-year high.

Most stunning was the further collapse in volatility, with the CBOE Volatility Index—better known by its ticker, VIX, and colloquially as the market's "fear gauge" -- collapsed more than 12%, to 10.61, the lowest since February 2007. That, of course, was just months before the beginning of the credit crisis.

After all, why would investors pay for protection in the form of put options if they expect the Fed to continue to backstop the markets with nearly free money that Yellen & Co. shows little inclination of ending any time soon?

A Fed chairman of a generation ago, the late William McChesney Martin, said the job of a central banker is to take away the punch bowl just as the party is getting going. Yellen made clear it's still a long time until "Last Call."

Yellen shall not be in a hurry any longer...it won't matter what she does or does not do anyway...

They never had an idea what exactly to do

But they are going to produce some proof that they know everything (like the sentence when Yellen said something and after that it was an argument that she predicted the crisis).

Fed Minutes Ahead, Governed By Two Words: 'Considerable Time'

The USDollar is attempting to snap a two day losing streak this morning as the market gears up for the publication of the latest round of minutes from the Federal Reserve. The Fed meeting itself was notable for its appeal to both bulls and bears, doves and hawks. While the “considerable time” wording remained in the Federal Reserve’s statement we believe this is simply on the basis of giving the central bank a little more time and we think that Wednesday’s minutes will emphasise this.

When asked in the post-decision press conference just what “considerable time” meant, Fed Chair Janet Yellen tap-danced like a pro and re-emphasised that there is no “mechanical” definition. As we have sometimes characterised the Bank of England’s forward guidance plan, this is “forward suggestion” at its finest; wave your arms around and distract the markets as much as possible while working out what to do.

The dollar has run higher since the meeting as rate targets portrayed in the Committee’s “dot chart” release showed a gradual increase in expected interest rates through 2015 and 2016. By the end of 2015 rates are expected to be around 1.375% in the US, up from 1.25% at the June meeting. The average for 2016 shifted to 2.68% from 2.53% in June. Today’s minutes may allow us a little more insight into whose dots are whose.

To be honest, should the dollar persist in strengthening through the rest of Q4 then it is more than likely that the tightness in monetary conditions that would materialise – higher yields for example – would be roughly equal to what the Federal Reserve is looking for throughout the whole of 2015. As we stated in the aftermath of the strong payrolls announcement on Friday and the disappointing European Central Bank release on Thursday, we think that we may have put in a near-term top in the USD.

That is not to say that the dollar uptrend is over. We still remain very constructive about the USD, as does much of the market, and we would maintain that any weakness in the dollar against EUR, AUD, GBP/USD and NZD in particular is bought up.

Noises from the Eurozone remain poor. Following the much weaker than expected German factory orders on Monday, we saw German industrial production decline by 4% month on month. Once again that is the lowest figure since 2009, but euro has remained supported still as traders weigh up the likelihood that for all the charm and bluster around quantitative easing and further monetary policy looseness, Draghi may be unable to help.

Bundesbank Chair Jens Weidmann, in an interview with the Wall Street Journal, criticised the European Central Bank’s plans to buy up debt as part of the ABS plan and called any further looseness in monetary policy “a dangerous path”. Draghi’s speech tomorrow in Washington is being flagged as another opportunity for euro weakness. He speaks on the European situation – what else – at 2pm tomorrow afternoon.

Apart from the latest set of minutes from the Federal Reserve the data docket is very quiet.

Will The FOMC Minutes End Dollar's Correction?

Corrective forces continue to grip the foreign exchange market. Many expect the dollar's downside correction/consolidation to end today. Technically-inspired short-term participants often see 3-4 day counter-trend moves to be typical of market moves. Fundamentally-inspired traders expect the FOMC minutes, which will be released in the North American afternoon, to be read by the market participants with a hawkish bias.

We are sympathetic to a hawkish read of the FOMC minutes, but do not believe that it reflects policy. Specifically, we argue that the FOMC minutes increase the noise to signal ratio by being comprehensive. The FOMC minutes, like the dot-plot forecasts makes it seem as if all views are equal. They are not. We understand the signal of Fed policy to be generated by three officials: Yellen, Fischer, and Dudley. Their main instrument, in addition to their speeches, like Dudley's yesterday, is the FOMC statement.

Recall that the FOMC statement contained three key points: First it characterized the slack in the labor market as significant. One may want to argue that this has been superseded by the recent jobs report that saw the unemployment rate fall below 6%. However, Dudley repeated that characterization yesterday.

Second, there is the "considerable" period of time between the end of asset purchases and the need to hike rates. Dudley again indicated that expectations for a rate hike in mid-2015 are "reasonable". That suggests a rough definition of "considerable period.

At the end of the FOMC statement there is a third piece of forward guidance. Even after the inflation and unemployment are consistent with the Fed's mandates, economic conditions may warrant a lower Fed funds rate than officials would regard as the long-term equilibrium rate.

At the September FOMC meeting, there were two dissents. The dissents were not over policy. It was over words, and specifically, how the forward guidance was provided. Dissenter Fisher from the Dallas Fad was quoted recently indicating he favored a Q1 15 rate hike. Leaving aside the temporal target rather than macro-economic conditions, the difference between his view and Dudley's (and we say the Fed's Troika view) could be as small as a few months. The FOMC meetings in Q1 15 are in late January and mid-March. The Q2 15 meetings are in April and June.

Although we played down the fundamentals driving the dollar's heavier tone so far this week, we do, of course, recognize the decline in US yields. The yield on the US10-year note has slumped back toward the year's lows set in mid-August near 2.30%. It is now changing hands near 2.33%. It had traded above 2.60% in mid-September. There are several drivers here. First, many are citing the weakening of the world growth outlook. The IMF revised down its global growth forecasts. Yet, this is due to the timing of its meeting, not that it presents new news. The OECD previously cut its growth forecasts. At the same time, the poor German industrial production figures and the HSBC Chinese services PMI (53.5 from 54.1) weigh on growth sentiment.

Second, and related, is the sharp decline in commodity prices, led by the new multi-month low in oil prices. The conventional wisdom is emphasizing the weakening demand side. However, we often find that supply shocks are more important than demand shocks. That is to say, oil output still seems to be open spigot, and there appear to be bumper US crops. We also note that although oil prices continue to fall, the CRB index itself bottomed at the end of last week, when the dollar also closed just below JPY110 and the euro was near $1.25.

Third, we note that there has been strong demand for US Treasuries from both domestic and foreign sources. In the foreign exchange market, there has been increasing talk that a significant weigh on the euro has been coming from reserve managers. The IMF's COFER data that were released at the end of September did show that reserve managers reduced euro holdings in Q2, the same time speculators in the futures market were shifting from a net long to a net short position.

Data included in the Japanese August current account figures, released earlier today, showed Japanese investors continued to buy US Treasuries. They bought JPY877.5 bln (~$8 bln) of US bonds in August, which brings the year-to-date purchases to JPY3.51 trillion. This contrasts with sales of JPY5.83 trillion in there first eight months of 2013.

In terms of domestic buyers, we continue to see signs that US banks continue to accumulate. Could this be the overlooked carry trade ? Rising bank deposits, which cost banks practically nothing, are lent to the US government.

In addition to the FOMC minutes, the decline in oil prices and US yields, a third issue today is the start of the US Q3 earnings season with Alcoa's report after the close the markets today. Earnings expectations for the S&P 500 have been trending lower, and FactSet now puts them at 4.5% with a 3.7% increase in sales. In Q2 earnings rose 7.3% on a 4.4% increase in sales.

Nearly half of the S&P 500 revenues are derived from foreign sales, and there is some concern that the sharp dollar rally will hit earnings. Some analysts attributed the recent 7.7% decline in Alcoa shares to be driven by concern about the dollar's impact. Still we note that the shares are still up a little more than 50% year-to-date. In addition to the dollar's appreciation, there is also the sharp decline in commodity prices that can impact various S&P sectors. We are suspicious of mechanical models that go from the change in the euro to drop in S&P earnings. It does not take into account various corporate hedging strategies, or that part of foreign sales that are transacted in US dollars.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

USD: FOMC Preview, 3 Potential Changes from the Fed

Investors are buying dollars ahead of the Federal Reserve's monetary policy announcement. The central bank is widely expected to reduce asset purchases by another $10 billion, a move that will reduce the amount of stimulus provided to the economy on a month-to-month basis. While this announcement alone should be positive for the dollar because it pushes the Fed closer to ending Quantitative Easing, the market has already discounted a steady pace of tapering -- in the past we've seen the dollar and Treasury yields fall instead of rise on tapering. What is different this time around is that in addition to announcing a reduction in asset purchases, the Fed is also expected change its forecasts and the dollar's reaction will depend on how Janet Yellen explains those changes. We are looking for 3 potential adjustments to the Fed's forecasts:

A forecast of higher inflation and lower unemployment suggests that the Fed is moving closer to achieving their goals and if Janet Yellen acknowledges that in her press conference, the dollar should extend its gains against all major currencies. However if she downplays these improvements and stresses that the unemployment rate remains high so therefore a highly accommodative stance remains appropriate, the boost to the dollar will be limited. There won't be any talk of when rates will rise but we'll be watching is see if they decide to halt reinvestments.

The bottom line is that the dollar should have an upward bias given the expected changes to the Fed's unemployment and inflation forecasts.

read more