You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.20 09:55

2013-03-20 07:00 GMT (or 08:00 MQ MT5 time) | [EUR - German PPI]

if actual > forecast = good for currency (for EUR in our case)

==========

German Producer Prices Decline For Seventh Month

Germany's producer prices fell for the seventh successive month in February, and the rate of decline matched economists' forecast, latest data revealed Thursday.

The industrial producer price index decreased 0.9 percent in February from the same month of last year, the Federal Statistical Office said. This followed a 1.1 percent contraction in January.

The February outcome matched economists' expectations. Prices have now fallen for the seventh consecutive month.

The development in February was influenced most by a 2.6 percent fall in energy prices, and a 1.9 percent drop in prices of intermediate goods. Meanwhile, capital goods prices grew by 0.5 percent, and consumer goods prices recorded a 1.3 percent gain.

Month-on-month, producer prices held steady in February, after dropping 0.1 percent in the beginning of the year. Expectations were for a 0.1 percent increase.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.03.20

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 11 pips price movement by EUR - German PPI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.20 17:57

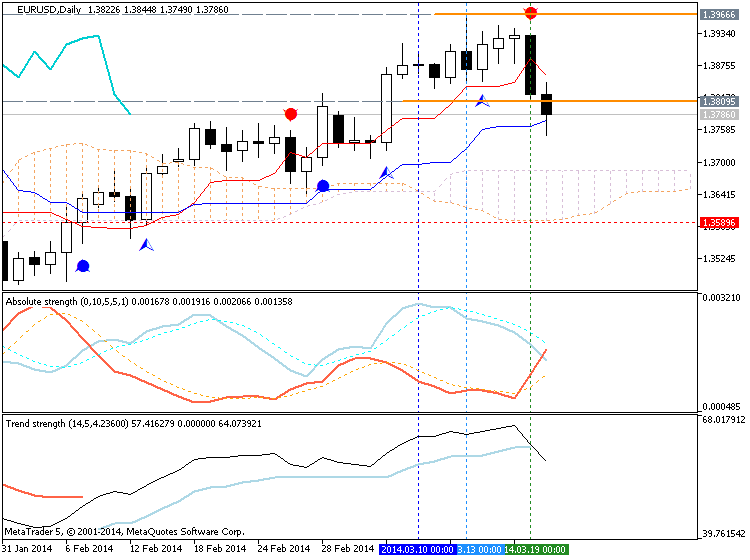

EURUSD Technicals for 2014.03.20 (based on investing article)

The euro was trading close to two-week lows against the dollar on Thursday as prospects for an earlier than expected rate hike by the Federal Reserve saw the dollar strengthen across the board.

EUR/USD was last down 0.47% to 1.3766, after falling to session lows of 1.3750 earlier. The euro fell more than 0.8% against the dollar on Wednesday.

The dollar rallied against the other main currencies after Fed Chair Janet Yellen indicated that the bank could begin to raise interest rates about six months after its bond-buying program winds up, which is expected to happen this fall.

The Fed also cut its monthly bond purchases by an additional $10 billion to $55 billion at the conclusion of its two-day policy setting meeting on Wednesday.

The comments prompted investors to bring forward expectations for a rate hike to as soon as April of next year.

Meanwhile, data on Thursday showed that U.S. initial jobless claims rose less-then-expected last week.

The Department of Labor reported that the number of people filing for initial jobless benefits in the week ending March 15 rose by 5,000 to 320,000 from the previous week’s total of 315,000. Analysts had expected jobless claims to rise by 10,000 last week.

Elsewhere, the common currency was also weaker against the yen and the pound, with EUR/JPY down 0.43% to 140.92, and EUR/GBP shedding 0.19% to trade at 0.8343.