You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBP/USD Intra-Day Fundamentals: U.K. Gross Domestic Product and 35 pips range price movement

2017-02-22 09:30 GMT | [GBP - GDP]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

==========

GBP/USD M5: 35 pips range price movement by U.K. Gross Domestic Product news event

USD/CAD Intra-Day Fundamentals: Canada's Retail Sales and 42 pips range price movement

2017-02-22 13:30 GMT | [CAD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Retail Sales] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

==========

USD/CAD M5: 42 pips range price movement by Canada's Retail Sales news event

AUD/USD Intra-Day Fundamentals: Australian Private Capital Expenditure and 27 pips range price movement

2017-02-23 00:30 GMT | [AUD - Private Capital Expenditure]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Private Capital Expenditure] = Change in the total inflation-adjusted value of new capital expenditures made by private businesses.

==========

From official report:

==========

AUD/USD M5: 27 pips range price movement by Australian Private Capital Expenditure news event

Dollar Index - ranging inside Ichimoku cloud waiting for the direction (based on the article)

Daily price is located inside Ichimoku cloud for the ranging market condition: price is located within 101.74 resistance level for the bullish trend to be resumed and 100.39 support level for the bearish reversal to be started.

"Recent DXY updates have noted that “if a broader decline is underway, then resistance probably needs to register (again) near the channel line that has been resistance and support since Brexit…the 55 day average is up here too.” Resistance is holding and a possible head and shoulders top is evident and would confirm on a drop under the February low. Even then, trendline support registers below 98.00. Watch for range support near 99.80."

Facebook with live sport, Facebook platform and the bullish trend to be continuing with 136 resistance level to be broken (based on the article)

Daily share price is located above 100-SMA/200-SMA in the bullish area of the chart. The price is on testing with 136.78 resistance level for the bullish trend to be continuing.

USD/CAD Intra-Day Fundamentals: Canada's Consumer Price Index and 37 pips range price movement

2017-02-24 13:30 GMT | [CAD - CPI]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

==========

USD/CAD M5: 37 pips range price movement by Canada's Consumer Price Index news event

S&P 500 Technical Outlook: bullish ranging within 2367/2351 levels (based on the article)

S&P 500 on daily chart is located above Ichimoku cloud for the bullish market condition: the price was bounced from 2367 resistance level to below for the bullish ranging to be started.

If the price breaks 2367 level to above so the bullish trennd will be resumed, otherwise - bullish ranging within the levels.

Weekly Outlook: 2017, February 26 - March 05 (based on the article)

Durable Goods Orders, GDP data from the US, Australia, and Canada, US Consumer Confidence, Manufacturing PMI, Crude Oil Inventories, Unemployment Claims and rate decision in Canada. These are the main events on forex calendar.

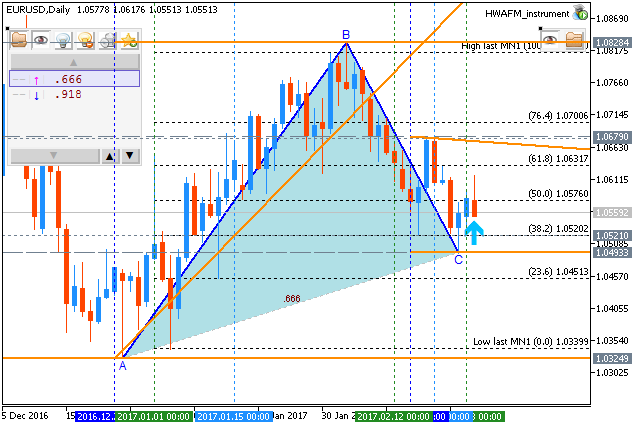

Weekly EUR/USD Outlook: 2017, February 26 - March 05 (based on the article)

EUR/USD had a relatively balanced week, dipping to the downside but never going too far. The upcoming week is packed with PMI data, inflation figures and more. Will the pair move decidedly to one direction or another?

Dollar Index - "The week ahead will keep the same themes firmly in the spotlight. A busy docket of scheduled commentary from Fed policymakers is headlined by remarks from Chair Yellen and Governor Lael Brainard, a vocal dove. If she too is keen to get on with stimulus withdrawal, a hike in March will seem more likely. On the economic data front, a broad offering of activity indicators is expected to show steady progress in line with recent trends. A revised set of fourth-quarter GDP figures is projected to deliver an upgrade, nudging the on-year growth rate to 2.1 percent from the originally reported 1.8 percent. At face value, this seems like a generally supportive environment for the US currency. However, it may all prove for naught if fiscal considerations spoil the mood again. Whether or not that happens will depend on President Trump, who is due to address a joint session of Congress on Wednesday."