You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Weekly price is located below 100 SMA/200 SMA reversal levels in the bearish area of the chart for the ranging within 1.0873 resistance level and 1.0324 support level.

If the price breaks 1.0873 resistance to above on weekly close bar so the secondary rally will be started.

If the price breaks 1.0324 support level so the primary ebarish trend will be resumed.

if not so the price will be on bearish ranging within the levels.

"Last was the smallest non-holiday weekly range since September 2012. This week was an outside week (although didn’t close on the highs). The current dynamic is the exact opposite of what happened in September 2012. Price wise, EUR/USD is fighting against 1.0820/50, which was support in 2015 and 2016. It’s a big level but consider upside as long as above this week’s low due to the mentioned small range, outside week dynamic. If this week’s low is taken out then I’d still watch for support near 1.0462-1.0539 (2015 lows)."

Rate decision in Australia and New Zealand, US Crude Oil Inventories, Unemployment Claims, Consumer Sentiment and Canadian employment data. These are the highlights of this week.

EUR/USD enjoyed the weakness of the dollar and some good European data to rise. Can this continue? Industrial output data stands out in the first full week of February. Here is an outlook for the highlights of this week.

Dollar Index - "The forecast for the U.S. Dollar will remain as neutral for the week ahead. While near-term price action is bearish, the longer-term up-trend and justification for such continues to exist as the U.S. is still one of the few developed global economies even debating the prospect of higher rates at the moment."

USD/JPY - "JGB yields may accelerate upward if this happens, intensifying the BOJ vs. markets standoff. With that in mind, the Yen’s path in the week ahead is as likely to be decided in Washington, DC as it is in Tokyo. A relatively quiet week on the relevant economic data front offers few distractions, leaving simmering market tensions to their own devices."

AUD/USD - "It's not expected to alter current record-low interest rates – on hold at 1.5% since August. But it may return market focus to the domestic Australian economy. There, consumer demand and pricing levels look a lot less healthy than does the white-hot export sector. RBA Governor Phillip Lowe will speak in Sydney the following day. It’s also a quiet week for scheduled international economic news."

NZD/USD - "The central bank may keep the door open to further embark on its easing-cycle as the upward pressure in the New Zealand dollar exchange rate ‘continues to generate negative inflation in the tradables sector.’ In turn, Governor Wheeler may prepare New Zealand households and businesses for another rate-cut as ‘significant surplus capacity exists across the global economy,’ and the 0.8% expansion in New Zealand Employment may do little to alter the RBNZ’s cautious outlook as wage growth remains depressed. In turn, a slew of dovish rhetoric from Governor Wheeler and Co. may spur near-term headwinds for the New Zealand dollar as the central bank appears to be in no rush to remove its accommodative policy stance."

USD/CAD - "The two significant pieces of economic data next week come on Wednesday's Housing Starts, which is expected to show 207k starts, and could surprise as recent data showed Toronto homes showing a supply shortage that is keeping prices elevated. Next week will close with Canadian Unemployment figures, which showed a 46.1k addition in December, and a reading of +53.7k is anticipated for January payroll growth according to Bloomberg. One of the more exciting components has been the shift toward full-time employment and simultaneous drop in part-time employment, which is a fundamental factor in longer-term economic growth."

USD/CNH - "Next week, China will also release the January foreign reserves read between February 6th and 7th, another top event to watch. Chinese individuals’ annual $50,000 quota on purchasing foreign exchange has been renewed on January 1st, which may accelerate the drop in foreign reserves. According to Bloomberg’s forecast, the January print is expected to fall to $3 trillion, a psychological level. Stabilizing Yuan rates and maintaining foreign reserves are two targets that may not be easily achieved together under China’s current capital control policy. Therefore, Chinese regulators may prioritize one of them, a decision that could be made around the key psychological level, and then impact the flexibility of Yuan rates."

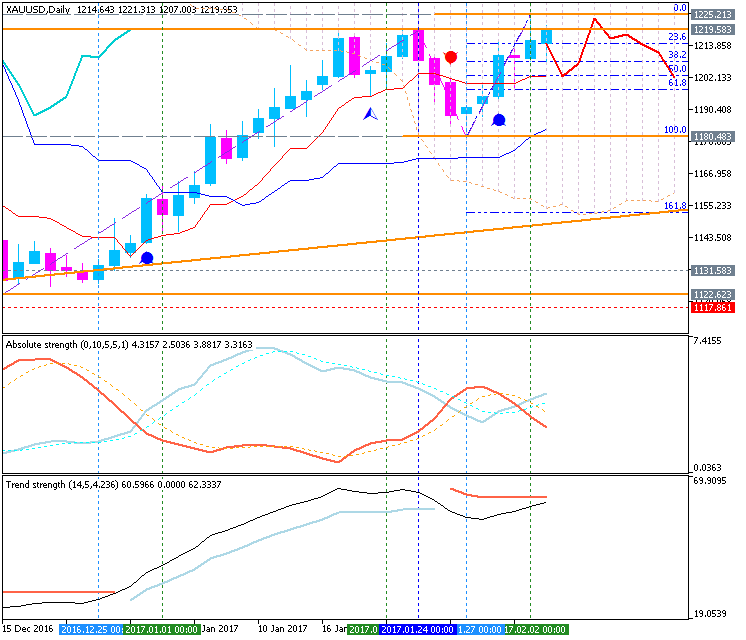

GOLD (XAU/USD) - "Non-Farm Payrolls released on Friday showed the U.S. economy added 227K jobs for the month of January, far surpassing expectations for a print of 180K. While the headline unemployment rate did uptick to 4.8%, it was accompanied by a 0.2% uptick in Labor Force Participation (which is a good thing). Still, slower wage-growth figures are likely to encourage a continued wait-and-see approach from the FOMC. Fed Fund Futures remain well rooted with expectations for a June rate-hike currently priced at just under 70% (roughly the same as last week). So, what does all this mean for gold? As long as the outlook for interest rates remains stable, the downside is likely to remain limited for bullion in the medium-term, especially as boarder equity markets continue to probe into new record highs. That said, gold prices are closing the week just below technical resistance and leave the constructive outlook at risk into the February open."