You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

German DAX - from bear market rally to the bullish reversal irrespective off the analytics forecasts (adapted from the article)

Some analytics are forecasting for Dax Index to be in bearish market condition with 10,000 strong support level as a nearest bearish target for the price to be bounced to above:

"DAX is turning strongly to the downside from a new high, so we believe that index is trapped in a new corrective pattern; a very complex one that can either be an Elliott Wave flat or an Elliott Wave triangle. As things stands at the moment, we favor the flat that is pointing down for wave five of C which could then form a bottom at 10000-10100 area."

But, anyway, the intra-day H4 price was bounced from 10,195 support level to above for the breakout as a bear market rally. For now, the price is testing 10,583 resistance level to above for the bullish reversal to be started.

Daily price broke 100-day SMA/200-day SMA reversal area to above to be reversed to the primary bullish market condition. The price is breaking 50.0% Fibo level at 10,509 to above for the primary bullish trend to be continuing.

Market opened with some interesting situation: H4 price was bounced from 100 SMA/200 SMA reversal levels to below for 10,019 support level to be testing for the bearish breakdown to be continuing. So, it means that analytics was right concerning Dax price movement:

Mexican peso plummets as Trump clinches victory (based on the article)

USD/MXN H1 timeframe: price is on breakout with the bullisgh reversal by breaking 100 SMA/200 SMA to above for the reversed from the primary bearish to the primary bullish market condition.

"The Mexican peso tumbled as the likelihood of a Trump victory increased throughout the night. The peso had been closely watched during the election campaign as a barometer of the markets' expectation of a Trump win. The peso weakened to a session low of 20.77, falling from an earlier high of 18.14. At 5:40 a.m. ET, the peso traded at 19.96 versus the dollar."

For now, the price is testing 20,7696 resistance level for the bullish trend to be continuing, otherwise - bullish ranging within the levels.

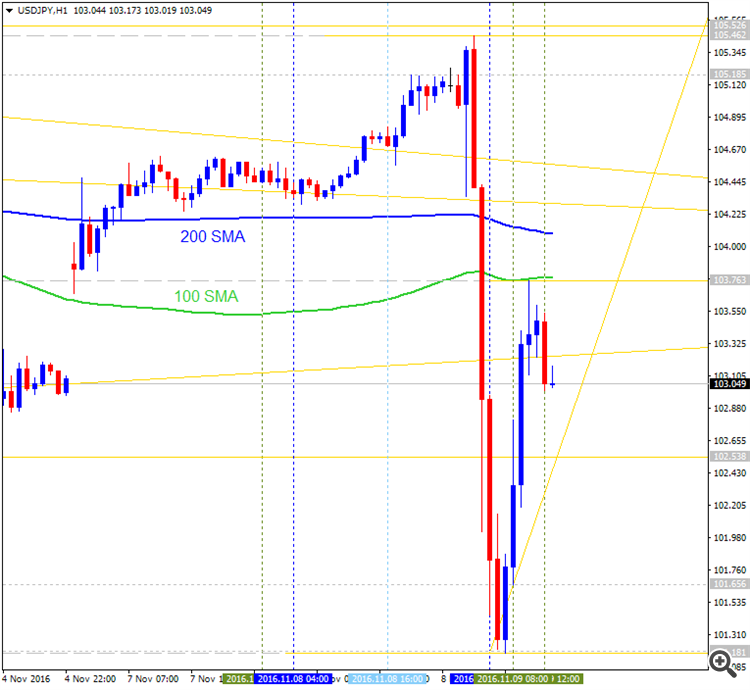

USD/JPY after Donald Trump's victory in the U.S. election (based on the article)

USD/JPY H1 timeframe: price broke 100 SMA/200 SMA levels to below for the reversal from the primary bullish to the primary bearish market condition with 101.18 support level to be testing for the bearish trend to be continuing.

"The yen climbed from an earlier session low of 105.46 to as high as 101.15 versus the dollar. As of 5:37 a.m. ET, the dollar/yen traded at 103.18."

For now, the price is bearish ranging to be bounced from 100 SMA to below for the second breakdown round to be started.Target Unchanged: Goldman Sachs Says Trump Win Doesn’t Mean Too Much for S&P 500 (based on the article)

Weekly price is located above Ichimoku cloud and above Sinkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. Price is on bullish ranging within 2,191 resistance level and 2,079 support level waiting for the direction of the bullish trend to be resumed or to the secondary correction to be started.

If the price breaks 2,191 resistance level to above on close weekly bar so the primary bullish trend will be resumed.If the price breaks 2,079 support level to below on close weekly bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

If the weekly price breaks 1,981 support level to below on close bar so the reversal of the weekly price movement from the ranging bullish to the primary bearish market condition will be started.

If not so the price will be on bullish ranging within the levels.

NZD/USD Intra-Day Fundamentals: RBNZ Official Cash Rate and 121 pips range price movement

2016-11-09 20:00 GMT | [NZD - Official Cash Rate]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight.

==========

From official report:

==========

NZD/USD M5: 121 pips range price movement by RBNZ Official Cash Rate news event

USD/CAD Technical Analysis: bullish reanging for the bullish continuation or to the correction to be started (based on the article)

The daily price is located above Ichimoku cloud in the bullish area of the chart: price is on ranging within 1.3464 resistance level for the bullish trend to be resumed and 1.3263 support level for the secondary correction to be started.

If D1 price breaks 1.3263 support level on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

If D1 price breaks 1.2999 support level on close bar so we may see the reversal of the price movement from the ranging bullish to the primary bearish market condition.

If D1 price breaks 1.3464 resistance level on close bar from below to above so the primary bullish trend will be resumed with 1.3524 nearest bullish target.

If not so the price will be on bullish ranging within the levels.

SUMMARY: ranging

TREND: bullish

Trump Wins: EUR/USD A 'Confusing Story' - What's Next? - SocGen (based on the article)

Daily price is located below Ichimoku cliud and below Senkou Span line which is the virtual border between the primary ebarish and the primary bullish trend on the chart. The price is on bearish ranging within the following support/resistance levels:

Chinkou Span line of Ichimoku are evaluating the future trend as the bearish, and Absolute Strength indicator is estimating the trend as the ranging bearish in the near future.

"EUR/USD by contrast is a more confusing story. Relative real yields aren’t moving significantly in support of the dollar here, but pretty much every meeting I have been in today has seen clients express concern about the spread of populism to European voters in the months ahead, starting with the Italian referendum.. My hopes of EUR/USD testing the upper end of its current range before that vote on 4 December are taking a battering."

If D1 price breaks 1.1243 resistance level on close bar from below to above so we may see the reversal of the daily price movement from the ranging bearish to the primary bullish market condition with 1.1298 nearest bullish target to re-enter.

If not so the price will be on bearish ranging within the levels.

SUMMARY: bearish

TREND: ranging

US Dollar Index Daily Technicals: ranging bullish (based on the article)

"Charts don’t predict. Rather, the interpretation of trend and identification of price levels aid in tactics. The most recent comments for DXY were “the major trend defining test is the May-August trendline (channel bottom) and 200 day average (currently 95.82).” The reaction low after the election was 95.89. Did the chart ‘predict’ that the market was going there? Of course not. But, if you had this chart on hand Tuesday night, you’d be aware of the potential for big support on the drop. 1 day later and DXY is already nearing channel resistance."

Daily price is located above 100-day SMA/200-day SMA revcersal levels on the bullish area of the chart: the price is on ranging within 99.12 "bullish continuation" resistance level and 95.89 "bearish reversal" support level.

Most likely midterm scenario for the daily price movement is the following: the price will be continuing with bullish ranging within 99 resistance and 95 support levels.

EUR/USD Intra-Day Fundamentals: FOMC Member Bullard Speaks and 34 pips price movement

2016-11-10 14:15 GMT | [USD - FOMC Member Bullard Speaks]

[USD - FOMC Member Bullard Speaks] = Speech about the US economic outlook at the Commerce Bank conference, in St. Louis.

==========

From RTT News article: ECB's Coeure Says Too Early To Say If Trump Win Would Impact December Decision

==========

EUR/USD M5: 34 pips price movement by FOMC Member Bullard Speaks news event

Trading News Events: University of Michigan Consumer Sentiment (adapted from dailyfx)

Bullish USD Trade: U. of Michigan Confidence Survey Climbs to 87.9 or Greater

- "Need red, five-minute candle following the report to consider a short EUR/USD trade."

- "If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is met, set reasonable limit."

Bearish USD Trade: U.S. Household Sentiment Continues to DeteriorateDaily price is bloke 200-day SMA to below to be reversed to the primary ebarish market condition. Developing retracement bearish pattern was formed by the price together with descending triangle pattern for the bearish trend to be continuing.

-------

EUR/USD M5: 29 pips price movement by UoM Consumer Sentiment news event