You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD Intra-Day Fundamentals: U.S. Jobless Claims and 6 pips range price movement

2016-08-11 12:30 GMT | [USD - Unemployment Claims]

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From the MarketWatch article:

==========

EUR/USD M5: 6 pips range price movement by U.S. Jobless Claims news event

NZD/USD Intra-Day Fundamentals: New Zealand Retail Sales and 31 pips range price movement

2016-08-11 22:45 GMT | [NZD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

==========

NZD/USD M5: 31 pips range price movement by New Zealand Retail Sales news event

USD/CNH Intra-Day Fundamentals: Chinese Industrial Production and 61 pips price movement

2016-08-12 02:00 GMT | [CNY - Industrial Production]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

==========

From RTTNews:

==========

USD/CNH M5: 61 pips price movement by Chinese Industrial Production news event

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: U.S. Advance Retail Sales

2016-08-12 12:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From MarketWatch:

==========

EUR/USD M5: 56 pips price movement by U.S. Advance Retail Sales news event

==========

GBP/USD M5: 69 pips price movement by U.S. Advance Retail Sales news event

==========

AUD/USD M5: 46 pips price movement by U.S. Advance Retail Sales news event

Weekly Outlook: 2016, August 14 - August 21 (based on the article)

Japan GDP data, inflation figures from the UK and the US, Employment data from the UK the US, New Zealand and Australia, US FOMC Meeting Minutes release and Manufacturing Index. These are the highlights on forex calendar.

Fundamental Weekly Forecasts for Dollar Index, USD/JPY, AUD/USD, USD/CAD, NZD/USD, USD/CNH and GOLD (based on the article)

Dollar Index - "Barring a tangible change in rate forecast – for better or worse – the Dollar will be difficult to transition to clear trend against the backdrop of global indecision. The ‘Summer Doldrums’ are discouraging traders from participating and the Greenback is suffering both for its key liquidity appeal (safe haven) as well as its unique risk orientation via early rate hikes. While traders should monitor it for volatility, they should also be skeptical of trend for the currency."

USD/JPY - "Due to this opacity of this scenario and further given the fact that the short-side of the Yen would seemingly be waiting for clues or innuendo ahead of that next phase of stimulus-driven Yen weakness, we’re setting the forecast on the Japanese Yen to neutral for the week ahead."

AUD/USD - "Needless to say, the Australian Dollar is likely to suffer if this ultimately translates into rebuilding bets on further stimulus expansion in the near term. As it stands, markets envision at least one more 25bps cut over the next 12 months but the move is not expected until the second quarter of next year."

USD/CAD - "USD/CAD may threaten the upward trend from earlier this year as the pair carves a near-term series of lower highs & lows, while the Relative Strength Index (RSI) fails to preserve the bullish formation from June. In turn, a break of the July low (1.2830) may foreshadow a shift in the broader trend, and the dollar-loonie may give back the advance from the May low (1.2460) as it breaks below near-term support around 1.2930 (61.8% expansion) to 1.2980 (23.6% retracement)."

NZD/USD - "Next week’s economic focus will be on the Employment Change and the Unemployment Rate that is expected at 5.3% on Tuesday. Given the migration boom in New Zealand, employment data has tended to outperform other economies. When looking at Economic Surprises over the past 3-months, the New Zealand Economy has been in line with expectations on average."

USD/CNH - "The PBOC’s monetary policy is on a much different track. The efficiency of China’s monetary policy has dropped to a new low and therefore, further easing measures will probably not help very much in the economy other than to exacerbate price bubbles. The July monetary supply report shows that the gap between the growth in M1 and M2 has widened to a new all-time high: The growth in M1 increased to 25.4% from 24.1% in the prior month while the growth in M2 dropped to 10.2% from 11.0%. As we discussed last week, a widened gap means that the problem of lacking investment opportunities becomes even worse. Also, new Yuan loans in July dropped more than expected: The print came out to be 463.6 billion Yuan and was 1.01 trillion Yuan less than the same month last year. New Yuan loans issued to corporates surprisingly dropped in July on an annualized basis, which was rarely seen in the past. Moreover, private investment in fixed assets continued to shrink in July: The growth in private investment has dropped to 2.1% from 2.8% in the prior month and is far below the 11.3% level from a year ago. These all add proof to the weakened conditions in the investment environment of Mainland China."

GOLD (XAU/USD) - "We’ll be looking for a break of the objective monthly opening range with a break lower targeting 1303 & a more significant support confluence at 1287 where the 50% retracement of the late May advance converges on a pair of median-lines – Both areas of interest for possible short-side exhaustion / long-entries. While the immediate risk is for a deeper pullback, ultimately we’re looking higher in gold with a breach above near-term downtrend resistance targeting 1380."

USD/JPY Intra-Day Fundamentals: Japan Gross Domestic Product and 16 pips range price movement

2016-08-14 23:50 GMT | [JPY - GDP]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From the RTTNews article:

==========

USD/JPY M5: 16 pips range price movement by Japan Gross Domestic Product news event

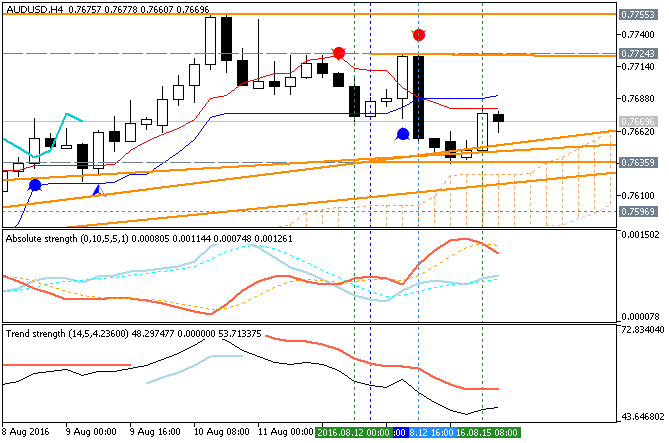

AUD/USD Intra-Day Technical Analysis: Ahead of RBA Minutes (based on the article)

H4 price is above Ichimoku cloud for the bullish ranging within 0.7724 resistance level and 0.7635 support level:

If H4 price breaks 0.7635 support level on close bar so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If H4 price breaks 0.7724 resistance level on close bar from below to above so the primary bullish trend will be resumed with 0.7755 level as a nearest bullish target.

If not so the price will be on bullish ranging within the levels.

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Monetary Policy Meeting Minutes and 27 pips range price movement

2016-08-16 01:30 GMT | [AUD - RBA Minutes]

[AUD - RBA Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From RTTNews article:

"Members of the Reserve Bank of Australia's monetary policy board said that additional stimulus likely would aid the prospects for the country's economic, minutes from the central bank's August 2 revealed on Tuesday. Inflation was below the target range and was expected to remain there for the foreseeable future, giving the bank the means to cut rates. Inflation was just 1 percent in the June quarter, well below the RBA's target band of 2-3 percent. "Underlying inflation was expected to remain low for a time before picking up gradually as spare capacity in labor and many product markets diminished," the minutes said. In particular, it was weakness in the housing market that convinced the board to take action. At the meeting, the board trimmed its benchmark lending rate by 25 basis points, to a fresh record low 1.50 percent from 1.75 percent following two months of no action."

"The bank last reduced its rate by 25 basis points in May, which was the first reduction in a year. The RBA noted the possibility that it may not be the only bank to provide stimulus. "Monetary policy had continued to be highly accommodative in most economies and there was a reasonable likelihood of further stimulus by a number of the major central banks," the minutes said."

==========

AUD/USD M5: 27 pips range price movement by Reserve Bank of Australia Monetary Policy Meeting Minutes news event

GOLD Price Action Analysis - Intra-day ranging near 100 SMA/200 SMA reversal area for direction (based on the article)

H4 price is broke 100 SMA/200 SMA to be reversed to the primary bullish area of the chart. The price is breaking 61.8% Fibo level at 1348.03 for the bullish trend to be continuing with 1357.16 Fibo target to re-enter.

If the price breaks Fibo support level at 1333.12 so the primary bearish trend will be resumed.

If the price breaks Fibo resistance level at 1357.16 from below to above so the primary bullish trend will be continuing.

If not so the price will be on ranging within the levels.

Trend:

H4 - ranging