You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Intra-Day Fundamentals: U.S. Consumer Price Index and Advance Retail Sales

2016-07-15 12:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

==========

2016-07-15 12:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

Market Watch :

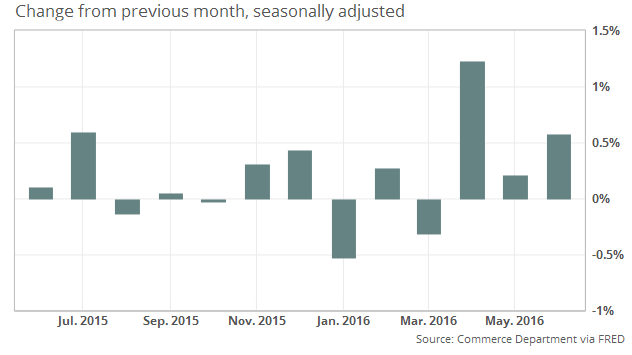

"Sales at U.S. retailers rose 0.6% in June, led by a surge in spending at home-and-garden centers and online stores, the government said Friday. Economists surveyed by MarketWatch had forecast a 0.1% increase. Stronger retail sales in June adds to evidence of a sharp rebound in U.S. growth in the recently ended second quarter."

==========

EUR/USD M5: 26 pips price movement by U.S. Consumer Price Index and Advance Retail Sales news event :

==========

NZD/USD M5: 27 pips price movement by U.S. Consumer Price Index and Advance Retail Sales news event :

==========

USD/JPY M5: 30 pips price movement by U.S. Consumer Price Index and Advance Retail Sales news event :

==========

AUD/USD M5: 27 pips price movement by U.S. Consumer Price Index and Advance Retail Sales news event :

Weekly Outlook: 2016, July 17 - July 24 (based on the article)

A very busy week saw the pound stage a recovery but erode the gains while the yen was the back foot. The upcoming week features UK Inflation and employment data, the ECB’s rate decision, US housing figures and more. These are the main events on forex calendar.

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/CAD, USD/JPY, NZD/USD, AUD/USD, USD/CNH and GOLD (based on the article)

Dollar Index - "Risk trends are a skewed support for the Dollar. Despite the charge to record high for equities, the Dollar has not lost the bulk of its post-Brexit surge. That is testament to the type of haven the Dollar represents (liquidity and primary reserve) as well as the dubious nature of the relentless and desperate push for yield. If equities falter and pulls other speculative-directed assets with it, however, the Dollar would readily draw the masses to its safe harbor."

GBP/USD - "The UK stands at a significant crossroads, and the uncertainty will almost certainly continue to weigh on domestic markets and the British Pound through the foreseeable future. Voting to leave was easy; negotiating for special status may be substantively more difficult."

USD/CAD - "The BoC argued ‘inflation has recently been a little higher than anticipated, largely due to higher consumer energy prices,’ and a stronger-than-expected CPI report may spur a further shift in the monetary policy outlook especially as the central bank anticipates a ‘pickup in growth over the projection horizon.’ With that said, Governor Poloz may adopt a hawkish tone over the coming months should the key data prints coming out of the Canadian economy boost the outlook for growth and inflation."

USD/JPY - "For next week the forecast for the Japanese Yen will be set to bearish under the premise of continued anticipation of eventual stimulus from Japan, whether that’s in July or September."

NZD/USD - "The recent China GDP could align with a further flight of global capital into New-Zealand’s Bond Market. While the correlation is messy, NZ 10-Yr Bonds have seen their yield fall (Yields trade inversely to price) over the last 3-months from 2.89% down to 2.21 % this week. That is a fall of ~25% in yields as the hunt for yield may have found a friend in the New Zealand Bond Market. Ironically, this may put further pressure on the RBNZ to hold or even discuss raising rates if the property price appreciation gets too far out of hand, as many argue it already has."

AUD/USD - "On the geopolitical front, an attempted military coup in Turkey late Friday complicates the landscape further. The country’s proximity to and significant economic linkages with Western Europe may fuel fears that turmoil there will amplify existing post-Brexit vulnerabilities, catalyzing a broader unraveling."

USD/CNH - "External factors, on the other hand, could drive large moves in Yuan rates next week. European Central Bank (ECB) will announce its benchmark rate decision on July 21 and host a press conference following the release. A rate cut or an outlook on further easing programs could bring down the Euro, which is included in the Yuan currency basket. In order to maintain the Yuan’s relative stability to the currency basket, the Dollar/Yuan pair may need to move in the opposite direction. Still, 6.70 is a major level that the PBOC has been watching. The offshore USD/CNH fell below 6.70 on Tuesday following the sudden increase in Yuan borrowing costs. Traders will want to keep a close eye on Yuan’s daily fixing. A fixing above 6.70 is a signal that the PBOC agrees with Yuan breakout and moving further lower against the Dollar. In addition to PBOC’s guidance, event risks including US Jobless Claims, Home Sales, as well as Republican National Convention could directly affect Dollar/Yuan pairs as well."

GOLD (XAU/USD) - "Note that this week constitutes an outside-weekly reversal (bearish) and highlights the risk of further declines before prices level off. Gold has continued to trade within the confines of an ascending median-line formation off the 2015 lows and a break below former resistance (now support) at 1303/08 would suggests a larger correction is underway. Such a scenario would target subsequent support objectives at 1287 & 1264/66 where the 100-day moving average converges on the key 61.8% retracement of the late May ascent. A breach above 1380 would be needed to mark resumption of the broader uptrend."

NZD/USD Intra-Day Fundamentals: New Zealand CPI and and 54 pips price movement

2016-07-17 22:45 GMT | [NZD - CPI]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - CPI] = Change in the price of goods and services purchased by consumers.

==========

==========

NZD/USD M5: 54 pips price movement by New Zealand CPI news event

GBP/USD Intra-Day Fundamentals: Monetary Policy Committee Member Weale Speaks and and 47 pips price movement

2016-07-18 08:15 GMT | [GBP - MPC Member Weale Speaks]

[GBP - MPC Member Weale Speaks] = The speech about the implications of Brexit for monetary policy at the Resolution Foundation, in London.

==========

In his final speech as a member of the Monetary Policy Committee, Martin Weale outlined his analysis of the economic and financial market impact of the referendum vote and its implications for monetary policy.

Martin noted that the most prominent effect of the referendum result had been on the exchange rate, which has fallen sharply.

Martin stated that one reason this had happened was as a consequence of expected lower future productivity. He explained that, if expectations of a lower path for GDP are assumed to arise from a lower path for productivity, then it follows that real wages should also be weaker. To the extent that this is delivered through more inflation , then the exchange rate will have to be lower to offset the international effects of this. In other words, as Martin put it: "The relative fall in GDP resulting from Brexit might then be thought to set an upper limit to the decline in the exchange rate which would result from Brexit."

However, Martin also noted there were good reasons for thinking that the impact on the exchange rate will be larger than implied by the lower path for GDP. He said: "To the extent that the productivity effects work through reduced competition, then those are likely to be in the sectors of the economy most exposed to foreign competition - i.e. in the sectors of the economy producing internationally traded goods. If, say, half of our economic activity produces internationally tradable output and the productivity effect were actually limited to the tradeable sector, then the overall loss in productivity there would be twice as large in the economy as a whole. And, since the exchange rate needs to ensure that our internationally tradeable goods are competitive, the adjustment to the real exchange rate would need to be twice as large as if the loss were spread evenly across the economy."

Turning to the current policy decision, Martin noted that there remained a very high degree of uncertainty around the implications of leaving the EU. Uncertainty itself would suggest waiting for firmer evidence of what those implications might be. However, Martin does believe the short-term impact on demand will be more severe than that on supply, dampening inflation. "So is there a case for a stitch in time?"

Martin argued, however, that the effects of weaker demand needed to be traded off against the implications of the lower exchange rate for inflation; the Committee might need to address that even if it gave substantial weight to output movements.

==========

GBP/USD M5: 47 pips price movement by Monetary Policy Committee Member Weale Speech news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.02.15 06:58

Trader Styles and Flavors (based on dailyfx article)

Technical vs. Fundamental

Technical analysis is the art of studying past price behavior and attempting to anticipate price moves in the future. These are traders that focus solely on price charts and often times incorporate indicators and tools to assist them. They look at price action, support and resistance levels, and chart patterns to create trading strategies that hopefully will turn a profit.

Fundamental analysis looks at the underlying economic conditions of each currency. Traders will turn to the Economic Calendar and Central Bank Announcements. They attempt to predict where price might be headed based on interest rates, jobless claims, treasury yields and more. This can be done by looking at patterns in past economic news releases or by understanding a country’s economic situation.

Short-Term vs. Medium-Term vs. Long-Term

Deciding what time frame we should use is mostly decided by how much time you have to devote to the market on a day-to-day basis. The more time you have each day to trade, the smaller the time frame you could trade, but the choice is ultimately yours.

Short-Term trading generally means placing trades with the intention of closing out the position within the same day, also referred to as

“Day Trading” or “Scalping” if trades are opened and closed very rapidly. Due to the speed at which trades are opened and closed, short-term traders use small time-frame charts (Hourly, 30min, 15min, 5min, 1min).

Medium-Term trades or “Swing Trades” typically are left open for a few hours up to a few days. Common time frames used for this type of trading are Daily, 4-hour and hourly charts.

Long-Term trading involves keeping trades open for days, weeks, months and possibly years. Weekly and Daily charts are popular choices for long term traders. If you are a part-time trader, it might be suitable to begin by trading long term trades that require less of your time.

Discretionary vs. Automated

Discretionary trading means a trader is opening and closing trades by using their own discretion. They can use any of the trading styles listed above to create a strategy and then implement that strategy by placing each individual trade.

The first challenge is creating a winning strategy to follow, but the second (and possibly more difficult) challenge is diligently following the strategy through thick and thin. The psychology of trading can wreak havoc on an otherwise profitable strategy if you break your own rules during crunch time.

Automated trading or algorithmic trading requires the same time and dedication to create a trading strategy as a discretionary trader, but then the trader automates the actual trading process. In other words, computer software opens and closes the trades on its own without needing the trader’s assistance. This has three main benefits. First, it saves the trader quite a bit of time since they no longer have to monitor the market as closely to input trades. Second, it takes the emotions out of trading by letting a computer open and close trades on your behalf. This means you are following your strategy to the letter and are not able to deviate. And third, automated strategies can trade 24 hours a day, 5 days a week giving your account the ability to take advantage of any opportunity that comes its way no matter the time of day.

AUD/USD Intra-Day Fundamentals: Reserve Bank of Australia Monetary Policy Meeting Minutes and and 41 pips price movement

2016-07-19 01:30 GMT | [AUD - Monetary Policy Meeting Minutes]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From Economic Calendar article:

Officials at the Reserve Bank of Australia (RBA) are awaiting further information on growth and inflation before deciding whether to adjust monetary policy, the minutes of the July 5 meetings revealed Tuesday.

“The Board noted that further information on inflationary pressures, the labour market and housing market activity would be available over the following month and that the staff would provide an update of their forecasts ahead of the August Statement on Monetary Policy,” the official July 5 minutes said. “This information would allow the Board to refine its assessment of the outlook for growth and inflation and to make any adjustment to the stance of policy that may be appropriate.”

The RBA voted to keep its benchmark interest rate at 1.75% earlier this month. That was the second consecutive month interest rates have remained on hold. Policymakers voted to cut the benchmark rate by 25 basis points to 1.75% in May, a new all-time low.

==========

AUD/USD M5: 41 pips price movement by RBA Monetary Policy Meeting Minutes news event

Trading News Events: U.K. Consumer Price Index (adapted from the article)

2016-07-19 08:30 GMT | [GBP - CPI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

What’s Expected:Why Is This Event Important:

"With the U.K. preparing to depart from the European Union (EU), there’s growing speculation the BoE will reestablish its easing cycle at the next interest-rate decision on August 4, but we may see another split decision to retain the current policy as the marked depreciation in the British Pound raises the risk of overshooting the 2% target for inflation."

==========

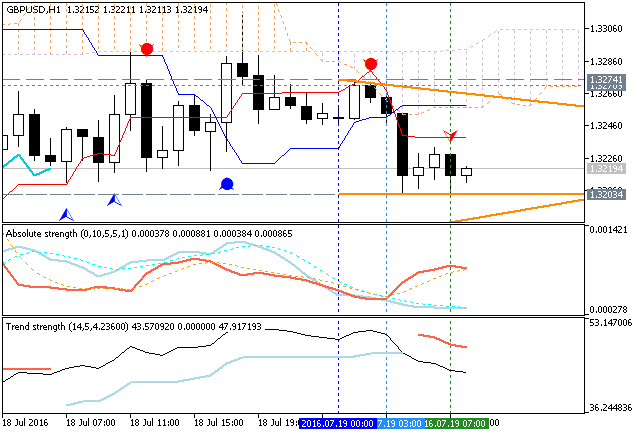

GBP/USD H1: ranging below Ichimoku cloud. The price is located below Ichimoku cloud in the bearish area of the chart for the ranging within the following key support/resistance levels:

Chinkou Span line and Absolute Strength indicator are estimating the trend as the secondary ranging, and Trend Strength indicator is evaluating the market condition as the bearish in the near future.

If the price breaks 1.3203 support level to below on close H1 bar so the primary bearish trend will be continuing.

If the price breaks 1.3274 resistance to above on close H1 bar so the reversal of the price movement from the ranging bearish to the primary bullish market condition will be started.

If not so the price will be continuing with the ranging within the levels.

=========

GBP/USD M5: 30 range pips price movement by GBP - CPI news event

EURUSD Price Action Technical Analysis: ranging around 200-day SMA waiting for direction (adapted from the article)

Daily price is on ranging around 200-day SMA waiting for the direction of the trend to be started. Ascending triangle pattern was formed by the price to be crossed for bullish trend to be resumed.

If D1 price breaks 1.1001 support level on close bar so we may see the primary bearish trend to be started up to 1.0911 level to re-enter.

If D1 price breaks 1.1164 resistance level on close bar from below to above so the primary bullish trend will be resumed.

If not so the price will be on ranging within the levels.

Trading News Events: U.K. Jobless Claims (adapted from the article)

2016-07-20 08:30 GMT | [GBP - Jobless Claims]

if actual < forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Jobless Claims] = Change in the number of people claiming unemployment-related benefits during the previous month.

==========

What’s Expected:Why Is This Event Important:

"Even though U.K. Jobless Claims are projected to increase 4.0K in June, another pickup in household earnings may generate a bullish reaction in GBP/USD as it highlights an improved outlook for growth and inflation."

==========

GBP/USD H1: bearish ranging within narrow s/r levels. The price is below Ichimoku cloud in the bearish area of the chart. Price is on ranging within the narrow support/resistance levels:

- 1.3064 support level located far below Ichimoku cloud in the primary bearish area, and

- 1.3119

resistance level located in the beginning of the rally to be started.

Chinkou Span line and Absolute Strength indicator are estimating the ranging condition waiting for the direction for breakout/breakdown.

If the price breaks 1.3064 support level to below on close H1 bar so the primary bearish trend will be continuing.If the price breaks 1.3274 resistance to above on close H1 bar so the local uptrend as the bear market rally will be started.

If not so the price will be continuing with the ranging within the levels.

=========

GBP/USD M5: 55 pips price movement by U.K. Jobless Claims event