Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.11 11:57

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

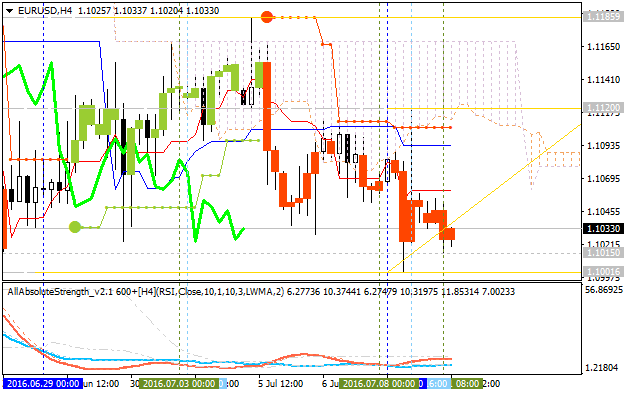

H4 price

is located below Ichimoku in the primary bearish area of the chart: price is on ranging within the following narrow support/resistance levels:

- 1.1120 resistance level located on the border between the ranging bearish and the primary bullish trend on the daily chart, and

- 1.1001 support level located far below Ichimoku cloud in the bearish area of the chart.

Absolute Strength indicator together with Chinkou Span line are estimating the ranging bearish condition to be continuing.

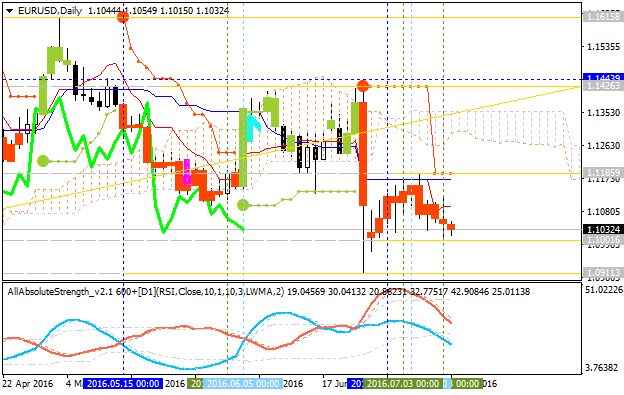

Daily

price. United Overseas Bank is considering for EUR/USD with the contuning the primary

bearish market condition to be lower than 1.0820:

"While EUR dropped to 1.0995/00 last Friday (lowest level seen this month), downward momentum is far from impulsive and it is doubtful that this pair would accelerate lower from here. However, looking further ahead, a move to 1.0820 cannot be ruled out just yet as long as 1.1185 is intact. In the meanwhile, further short-term sideway trading above the recent 1.0909 low seems likely and only a clear break below this level would indicate that the next bearish leg lower has started."

- If daily price breaks 1.1185 resistance level

on close bar so the local uptrend as a bear market rally will be started.

- If daily price breaks 1.1001 support level on close bar so the primary bearish trend will be continuing up to 1.0911 bearish target to re-enter.

- If not so the price will be ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.14 15:01

EUR/USD Intra-Day Fundamentals: U.S. Producer Price Index and 42 pips price movement

2016-07-14 12:30 GMT | [USD - PPI]

- past data is 0.4%

- forecast data is 0.3%

- actual data is 0.5% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

- "The Producer Price Index for final demand increased 0.5 percent in June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.4 percent in May and 0.2 percent in April. On an unadjusted basis, the final demand index advanced 0.3 percent for the 12 months ended in June, the largest 12-month increase since moving up 0.9 percent in December 2014."

- "In June, the advance in the final demand index was led by prices for final demand services, which rose 0.4 percent. The index for final demand goods advanced 0.8 percent."

- "Prices for final demand less foods, energy, and trade services rose 0.3 percent in June after declining 0.1 percent in May. For the 12 months ended in June, the index for final demand less foods, energy, and trade services increased 0.9 percent."

==========

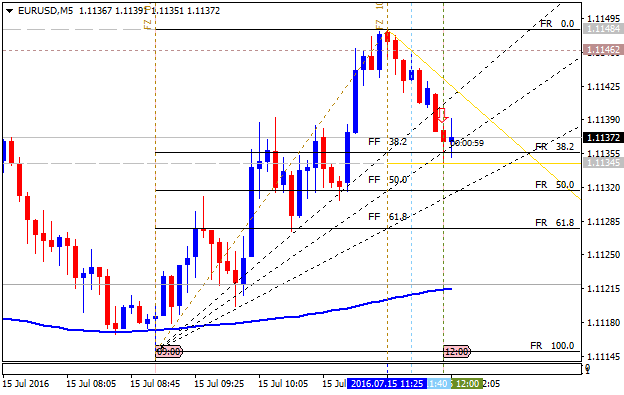

EUR/USD M5: 42 pips price movement by U.S. Producer Price Index news event :

M5 price is on the secondary correction within the primary bullish market condition: price is testing 1.1109 support level together with 200 period SMA to below for the reversal of the price movement to the primary bearish market condition.

H4 price is on bear market rally: the price broke 100 SMA to above and it is located within 100 SMA/200 SMA bearish ranging area waiting for the direction of the bearish trend to be resumed or the bullish reversal to be started. Key resistance at 1.1185 is the bullish reversal level, and key level at 1.1082 is the bearish continuation support.

Daily price is on ranging around 200-day SMA waiting for direction:

If the price breaks 1.1219 resistance level on close daily bar so the primary bullish trend will be resumed.

If the price breaks 1.1001 support level on daily close bar so the bearish market condition will be started.

If not so the price will be on the ranging condition.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.15 11:17

EUR/USD Intra-Day Fundamentals: Euro Consumer Price Index

2016-07-15 09:00 GMT | [EUR - CPI]

- past data is 0.1%

- forecast data is 0.1%

- actual data is 0.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - CPI] = Change in the price of goods and services purchased by consumers.

==========

Eurostat said that Euro zone CPI remained unchanged at a seasonally adjusted annual rate of 0.1%, from 0.1% in the preceding month.==========

EUR/USD M5: price movement by Euro Consumer Price Index news event :

M5 price is located above 200 period SMA in the bullish area of the chart: the price is on secondary correction by 1.1134 support level to be tested to below for the correction to be continuing. The bearish reversal target is Daily Pivot at 1.1121, and if the price crosses this level to below so the intra-day bearish reversal will be started.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.15 15:13

Intra-Day Fundamentals: U.S. Consumer Price Index and Advance Retail Sales

2016-07-15 12:30 GMT | [USD - CPI]

- past data is 0.2%

- forecast data is 0.2%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

- "The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.0 percent before seasonal adjustment."

- "For the second consecutive month, increases in the indexes for energy and all items less food and energy more than offset a decline in the food index to result in the seasonally adjusted all items increase. The food index fell 0.1 percent, with the food at home index declining 0.3 percent. The energy index rose 1.3 percent, due mainly to a 3.3-percent increase in the gasoline index; the indexes for natural gas and electricity declined."

==========

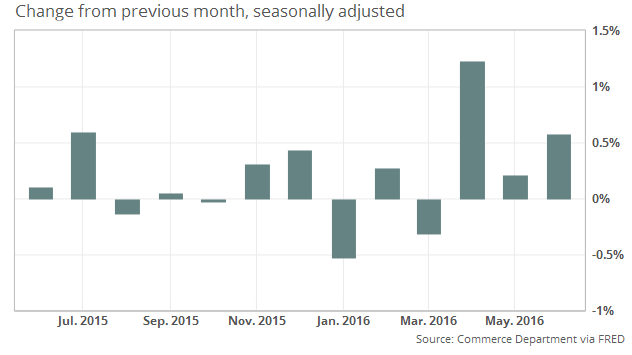

2016-07-15 12:30 GMT | [USD - Retail Sales]

- past data is 0.2%

- forecast data is 0.1%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

"Sales at U.S. retailers rose 0.6% in June, led by a surge in spending at home-and-garden centers and online stores, the government said Friday. Economists surveyed by MarketWatch had forecast a 0.1% increase. Stronger retail sales in June adds to evidence of a sharp rebound in U.S. growth in the recently ended second quarter."

==========

EUR/USD M5: 26 pips price movement by U.S. Consumer Price Index and Advance Retail Sales news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located below Ichimoku cloud on the bearish market condition with the ranging within the narrow key support/resistance levels:

Chinkou Span line is below the price indicating the ranging bearish market condition for the coming week, and Trend Strength indicator and Absolute Strength indicator are estimating the trend as the ranging bearish.

If D1 price break 1.0911 support level on close bar so the bearish trend will be continuing.

If D1 price break 1.1186 resistance level on close bar from below to above so the local uptrend as the bear market rally will be started.

If D1 price break 1.1446 resistance level on close bar from below to above so we may see the reversal of the price movement to the primary bullish market condition.

If not so the price will be on ranging within the levels.

SUMMARY : bearish

TREND : ranging