In this article I will provide my view on the NZD/USD and the EUR/CHF. These are the pairs that I am currently interested in or was interested in last week for trading with the Hybrid Grid strategy.

- All trades are based on specific rules according to the FxTaTrader Hybrid Grid strategy.

- All open positions can be viewed by clicking here.

This articles will provide:

- The weekly currency chart for the interesting pairs.

- The daily(timing) chart for the interesting pairs.

- Possible positions for the coming week and positions taken.

- According to the "Currency score" and "Ranking & Rating list" the USD/CAD is the best pair to trade followed by the GBP/CAD, EUR/CHF and EUR/GBP. The pairs comply to the strategy rules for the FxTaTrader Hybrid Grid strategy.

- Last week (pending) orders were placed for the NZD/USD and profit was made on 1 position.

___________________________________________

Open/pending positions of last week

The situation compared to last weeks has not changed very much for going short and this pair remains interesting for the Hybrid Grid strategy. The pair had a significant pull back and this offers opportunities.

The rank in the Ranking and Rating is not in the Top 10 and this is mainly because price is above the Ichimoku cloud in the 4H chart. This is seen as a temporary pull back and it is being confirmed by other reasons that makes this pair still interesting for going short. More information can be found in the previous article Forex Currency Score Wk 43 and the Technical analysis charts which will be looked into later in this article. Last week (pending) orders were placed for the NZD/USD and profit was made on 1 position.

Ranking and rating list Week 43

Rank: 24

Rating: =

Weekly Currency score: Down

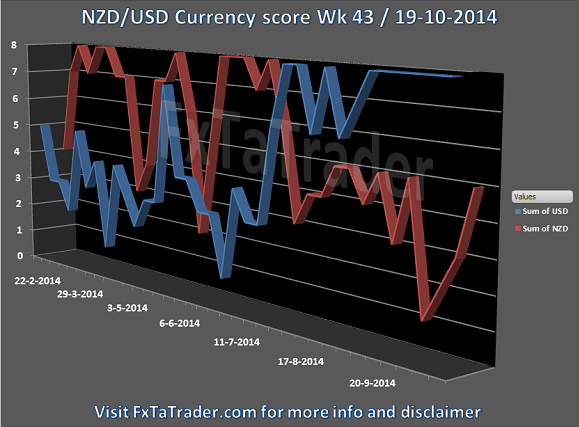

Based on the currency score the pair looks interesting in the last 3 months. The USD showed no dips in that period. The NZD had a significant pull back last weeks and this offers opportunities because this currency looks weak from a longer term perspective. Based only on this information the pair looks interesting for going short.

Monthly chart: Neutral

- On the monthly(context) chart the indicators are looking weak for going long.

- The Ichimoku is neutral. The pair is below the 2 MA's but in the Bullish Ichimoku cloud and the Chikou-Span is above the cloud.

- The MACD is in positive area but showing weakness by making lower tops and the histogram is also showing weakness.

- The Parabolic SAR is short but not showing the preferred pattern of lower stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context where that pair is in for the long term the indicators are looking fine because they are showing weakness in an up trend.

Weekly chart: Down

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative territory and showing continuation of this downtrend.

- The Parabolic SAR is going short but not showing the preferred pattern of lower stop loss on opening of new long and short positions. However the pair made a new recent low so the preferred pattern is being developed.

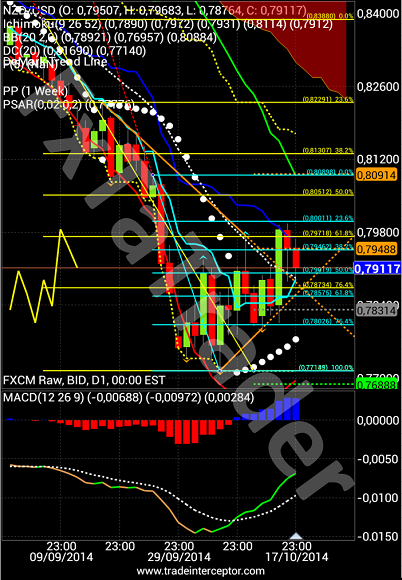

Daily chart: Down

- On the daily(timing) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative territory. The histogram is showing some weakness in the down trend and price may consolidate in short term to pick up the downtrend again after that.

- The Parabolic SAR is not going short but showing the preferred pattern of lower stop loss on opening of new long and short positions.

Total outlook: Down

NZD/USD Daily chart

___________________________________________

Possible positions for coming week.

EUR/CHF

This pair will be discussed briefly in this article. The situation has improved compared to last week for taking short positions. The pair had a pull back a week ago but reversed last week making the daily chart improving significant. One of the more favorable reasons for taking positions on this pair is that the correlation between these 2 currencies have no impact when there is a clear difference in strength. This is not the case when trading the CHF with another currency than the EUR. It may then be dragged down because of the correlation with the EUR. The pair is interesting for going short and for the FxTaTrader Hybrid Grid strategy.

Ranking and rating list Week 43

Rank: 10

Rating: --

Total outlook: Down

___________________________________________

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose. If you like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week and don't forget to check my weekly Forex "Ranking and Rating list" and the "Currency Score".