In this article I will provide my view on the NZD/CAD and the EUR/USD. These are the pairs that I am currently interested in or was interested in last week for trading with the Hybrid Grid strategy.

- All trades are based on specific rules according to the FxTaTrader Hybrid Grid strategy.

- All open positions can be viewed by clicking here.

This articles will provide:

- The weekly currency chart for the interesting pairs.

- The daily(timing) chart for the interesting pairs.

- Possible positions for the coming week and positions taken.

The article has been adjusted because it provided a lot of information. Each weekend an article is dedicated to the Weekly Forex Currency Score. The article of today is available on the blog.

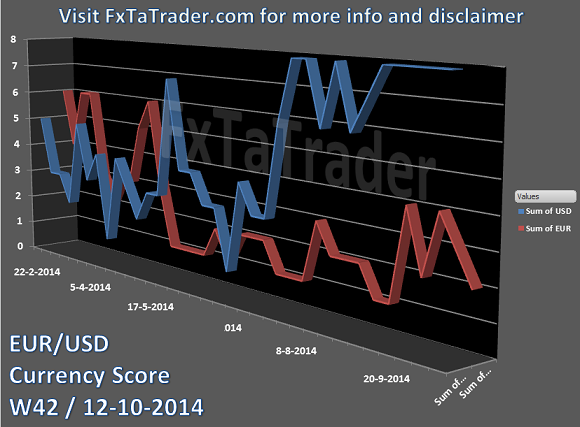

- According to the "Currency score" and "Ranking & Rating list" the EUR/USD is the best pair to trade and the EUR/GBP and NZD/USD are the second best. The pairs comply to the strategy rules for the FxTaTrader Hybrid Grid strategy.

- Last week (pending) orders were placed for the NZD/CAD and profit was made on 1 position.

___________________________________________

Open/pending positions of last week.

NZD/CAD

Ranking and rating list Week 42

Rank: 14

Rating: -

Total outlook: Down

The interesting pair for coming week is the EUR/USD so in this article the NZD/CAD will be discussed briefly. The situation compared to last weeks has not changed very much for going short and this pair remains interesting for the Hybrid Grid strategy. The NZD/CAD was chosen last week to trade with instead of the EUR/CAD which was the interesting pair last week that was analyzed.

- The EUR/CAD moved too much sideways and it was not high in the ranking & rating list during last week. The NZD/CAD on the other hand was oversold at the begin of the week but had a nice pull back and offered possibilities to go short.

- The NZD/CAD had then a ranking of 5 in the raking & rating list. During that period it was in the Bearish Ichimoku cloud in the 4H chart and the EUR/CAD was above.

- The NZD/CAD is also just a bit stronger(bullish) in the monthly chart because it is not in the Ichimoku cloud. The outlook for the EUR/CAD in the monthly chart is Neutral and for the NZD/CAD it is Up. This has no impact on the decision because the total outlook is what matters.

- Last difference is that the NZD/CAD is more in an oversold situation at the moment compared to the EUR/CAD. As soon as the NZD/CAD has a pull back like last week this is no more an issue.

- The analysis of the NZD/CAD is almost similar to the EUR/CAD, except for the points mentioned above, since the EUR and NZD are the weaker currencies at the moment. See for more information the previous article Review FxTaTrader Strategy Wk 40/41

___________________________________________

Possible positions for coming week.

EUR/USD

The situation has improved compared to last week for taking positions. The pair is no more oversold according to the FxTaTrader Hybrid strategy rules. According to this a pair is overbought/oversold once it is above/below the Weekly Bollinger Band. The pair is interesting for going short and for the FxTaTrader Hybrid Grid strategy.

Ranking and rating list Week 42

Rank: 3

Rating: ---

Weekly Currency score: Down

Based on the currency score the pair looks interesting in the last 3 months. The USD showed no dips in that period. Based only on this information the pair looks interesting for going short.

Weekly currency score EUR/USD

Monthly chart: Down

- On the monthly(context) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions

- The MACD has entered into negative territory and gaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context where that pair is in for the long term the indicators are looking fine because they are showing a clear down trend.

Weekly chart: Down

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative territory and showing continuation of this downtrend.

- The Parabolic SAR is going short but not showing the preferred pattern of lower stop loss on opening of new long and short positions. However the pair made a new recent low so the preferred pattern is being developed.

Daily chart: Down

- On the daily(timing) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative territory. The histogram is showing some weakness in the down trend and price may consolidate in short term to pick up the downtrend again after that.

- The Parabolic SAR is going short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Total outlook: Down

EUR/USD Daily chart

___________________________________________

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose. If you like to use this article then mention the source by providing the URL www.FxTaTrader.com or the direct link to this article. Good luck in the coming week and don't forget to check my weekly Forex "Ranking and Rating list" and the "Currency Score".