The trading bot for XAUUSD using a seasonal strategy enhanced by artificial intelligence (AI). Instead of overwhelming users with complexity, it taps into AI models for sentiment and market insights, helping the bot make more informed decisions 1 to 3 times per day.

This blog explores how the bot works, the role of AI, and what to consider before using it.

💰 What Does It Cost?

The bot uses external AI APIs (such as OpenAI, Grok by xAI, or Google Gemini) for supplemental analysis. These services charge based on the number of tokens processed, meaning both the input and output length of each request.

Typical usage costs:

-

Around $5 per model can cover 1.5 to 2 months of average operation.

-

Comparable to the cost of running a VPS.

-

API usage can be monitored via provider dashboards.

💡 Note: These are third-party services. Please check each provider’s terms and pricing before integrating.

🧠 Why Use AI in Trading?

Modern AI models are great at interpreting complex patterns and sentiment from large datasets.

AI doesn’t directly trigger trades. Instead, it assesses market context: such as momentum, news-driven sentiment, and trend behavior to support the bot’s seasonal strategy.

Think of it as a second opinion, working alongside traditional indicators like ATR or EMA.

✅ Benefits of AI Integration

-

Adaptability: AI helps the bot respond to changing market conditions.

-

Deeper Insights: Detects patterns beyond simple formulas or fixed rules.

-

Consensus-Driven Decisions: Multiple AI models provide balanced perspectives—like a panel of advisors.

⚠️ Things to Consider

-

Setup Complexity: API key configuration may require basic technical knowledge. A setup guide is in development to help simplify the process.

-

Recurring API Costs: Budget for ongoing usage, similar to VPS or subscription services.

🔍 How AI Enhances the Bot

1. Trade Filtering

AI evaluates sentiment to help the bot avoid low-confidence trades—preserving capital and reducing drawdown.

2. Risk-Adjusted Lot Sizing (coming soon)

Upcoming updates will use AI confidence scores to fine-tune lot size based on trade risk.

3. Dynamic Exits

Instead of static profit targets, the bot adapts exits using AI predictions. For example, if a default TP is 3×ATR but AI predicts reversal sooner, the exit is adjusted based on trade duration and behavior.

🤝 Why Use Multiple AI Models?

Combining models like OpenAI, xAI, and Gemini allows for more consistent, reliable decisions through cross-validation.

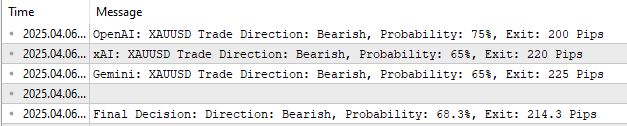

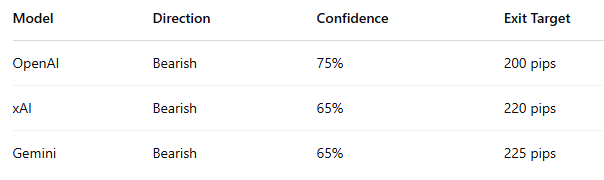

Example 1 – Strong Consensus

All three models predict a bearish move on XAUUSD:

➡️ Final Decision: Bearish, 68.3% Confidence, TP: 214.3 pips

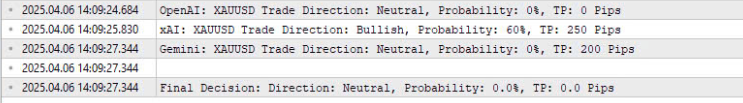

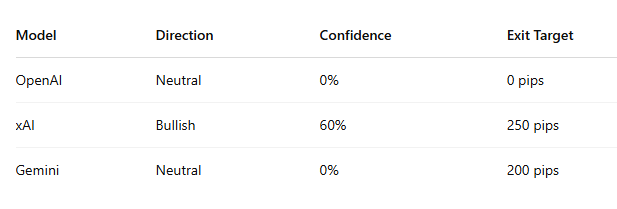

Example 2 – Disagreement

Mixed signals from the models:

➡️ Final Decision: Neutral, 0% Confidence — Trade filtered out.

This shows how using all three AI models helps avoid biased or overly aggressive trades.

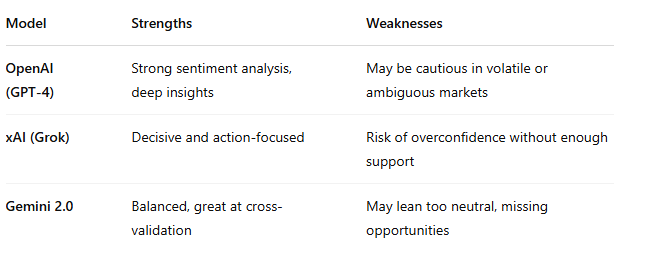

🧩 Strengths & Weaknesses of Each AI Model

Together:

-

GPT-4 provides depth,

-

Grok adds confidence,

-

Gemini keeps things in check.

🔄 Gradual Updates, Version by Version

We improve the bot incrementally, ensuring each update is tested and practical.

🏁 Final Thoughts

Combines seasonal trading logic with AI-powered market analysis not to replace decision-making, but to enhance it.

It’s a flexible, evolving tool built to help traders adapt to ever-changing market conditions. With a modest cost and a focus on smart risk management, it could be a powerful addition to your trading toolbox.

Disclaimer: This tool uses third-party AI services as supplemental analysis tools. It does not guarantee profits or trading success. Always use proper risk management.