How to leverage crypto to revamp the mql5 community , and drive more traffic .(more traffic = more commissions)

A.The blockchain :

Pick an EVM chain with low fees :

- Avalanche

- Arbitrum

- Polygon

- Binance Smart Chain

B.Deploy 3 token contracts ,2 with "minting for" functionality . one as a "reward".

Token 1 , let's call it "Positive Activity" , it has a minting for function.

Token 2 , let's call it "Negative Activity" , it has a minting for function too.

Token 3 , let's call it "Reward" , it has a fixed supply , and a fixed transaction fee .

and let's also call NCT the native chain token . (Avalanche = AVAX , Arbitrum = ETH , Polygon = MATIC , BSC = BNB , etc)

You have a Bucket , an address , which is "Treasury" and is in NCT.

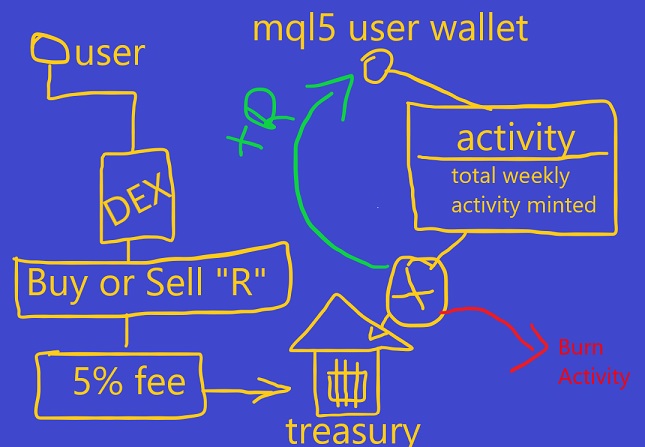

You head on to the DEX of the chain and create a liquidity pool with your Reward token and the NCT.

What value in $ (measured in $) goes in that pool , you will decide .

You create an exchange rate in the liquidity pool with 100% of the reward tokens vs the NCT of the chain.

For instance , you buy 10000$ of the NCT , of Ethereum , and you create a liquidity pool with 10000000 "Reward" tokens.

So the pool has 10000$/10000000R creating the rate of 1 R ("Reward")

This reward token is what the mql5.com users receive in their wallets as a reward for positive interactions on the site.

C.How does it work ?

Per week you distribute "Activity" tokens , positive and negative .

These activity tokens are minted in the users addresses (minted for) . This action requires fees on chain . This is Cost_Mint_Fees

If you want to avoid that cost, you can maintain the activity internally in your database and not on chain.

So for each user , you sum up positive and negative activity . Those with a positive sum are considered , and you also have a sum of all the positive sums.

You go into the treasury , you deduct Cost_Mint_Fees , and , the Cost_Send_Reward_Fees (which is the cost of sending the reward tokens , or the NCT tokens since its straight from the treasury)

If the treasury cannot cover the fees , you do not touch the amount of NCT tokens and you let them accumulate for next week.

The amount left after subtracting the Fee costs is then proportionally distributed to the users wallets based on the proportion of their sum of activity to the total positive sum of all activities . If you maintain activity tokens on chain you burn the user's activity tokens (reset) if you maintain it in your database you reset the values for the new week.

D.What could happen ?

The moment you deploy the liquidity pool the Reward token is exposed for any trader to purchase .

When they buy or sell a small chunk of that value goes into the treasury address.

The treasury address fills up and is the incentive for the users here.

Also as your token is discovered it is an extra advertisement for the site.

In a bull market cycle , this year for instance and the next , the benefit is you place a chunk of value up front (in the pool) and then you just manage the "treasury" . You place no additional funds . (Unless you choose Ethereum's Layer1 chain where fees reach double and tripple digits).So you could theoretically say , we would have paid this amount of $ for the rating rewards we stopped yearly , place it in the pool once.

You will also have to incentivize users to maintain the ecosystem (mql5.com) with positive rewards for reporting bad actors and spammers , and you will also have to include the moderators in the loop.

So if moderators vote to act upon an item on your ecosystem , then the user who reported it and the moderator who brought it to the other moderators for a vote get positive activity rewards while the perpetrator gets negative activity rewards .

This also almost certainly guarantees a spike in spam initially but you will have to look past that .

The rest may result in more freelance , more signal followers more market customers etc.