USD/CAD: The Bank of Canada should act carefully. Or where will the CAD go?

The deterioration of the situation on the labor market and less positive reports on the country's GDP, published earlier, significantly complicate the problem of curbing rising inflation for the Bank of Canada.

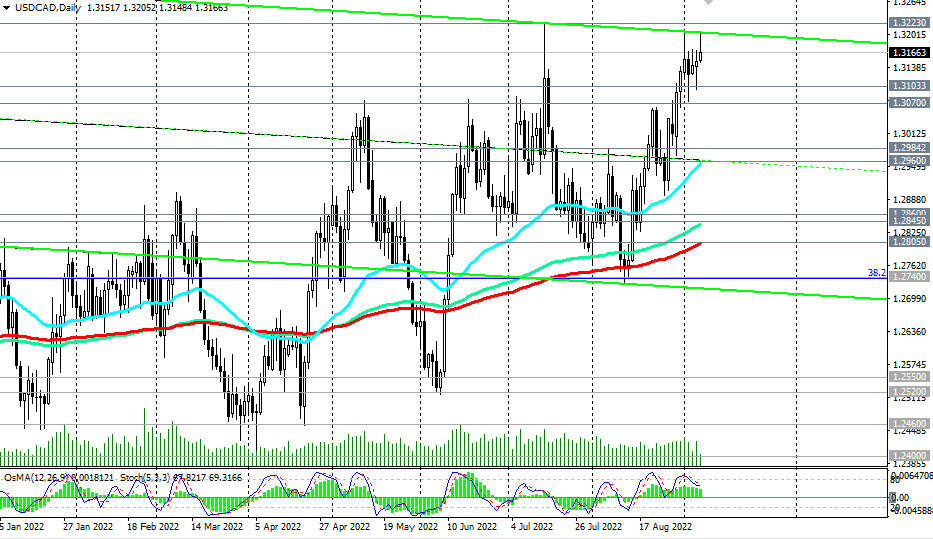

From a technical point of view, USD/CAD is in the bull market zone, above the key support levels 1.2845, 1.2805.

Today's publication may become a driver for further growth (for more details, see the Most Important Economic Events of the Week 09/05/2022 - 09/11/2022), if the decision of the Bank of Canada and the accompanying comments disappoint market participants.

The breakdown of the local resistance level (and the high of July) 1.3223 will be a confirming signal for new long positions in USD/CAD.

In an alternative scenario, and after the breakdown of support levels 1.3103, 1.3070 (local support level), USD/CAD will head towards support levels 1.2984, 1.2960.

Support levels: 1.3103, 1.3070, 1.2984, 1.2960, 1.2860, 1.2845, 1.2805, 1.2740

Resistance levels: 1.3223, 1.3300

*) see also

“Technical analysis and trading recommendations” -> Telegram