EUR/GBP: the pair is again trying to break into the bull market zone

The euro continues to please its buyers today, having strengthened again at the beginning of today's European session, which cannot be said about the pound. On the contrary, it fell sharply after the publication (at 08:30 GMT) of the Purchasing Managers' Index (PMI). According to the Royal Institute of Purchasing and Supply, manufacturing PMI (from Markit Economics) fell to 54.6 in May from 55.8 in April. The PMI index for the services sector fell to 51.8 in May from 58.9 in April. The forecasts were 55.1 and 57.0, respectively.

Values above 50 indicate an increase in activity. However, the relative decline in performance turned out to be a negative factor for the pound. The published data "suggest that the economy is slowing down as inflationary pressures have risen to unprecedented levels," S&P economists said.

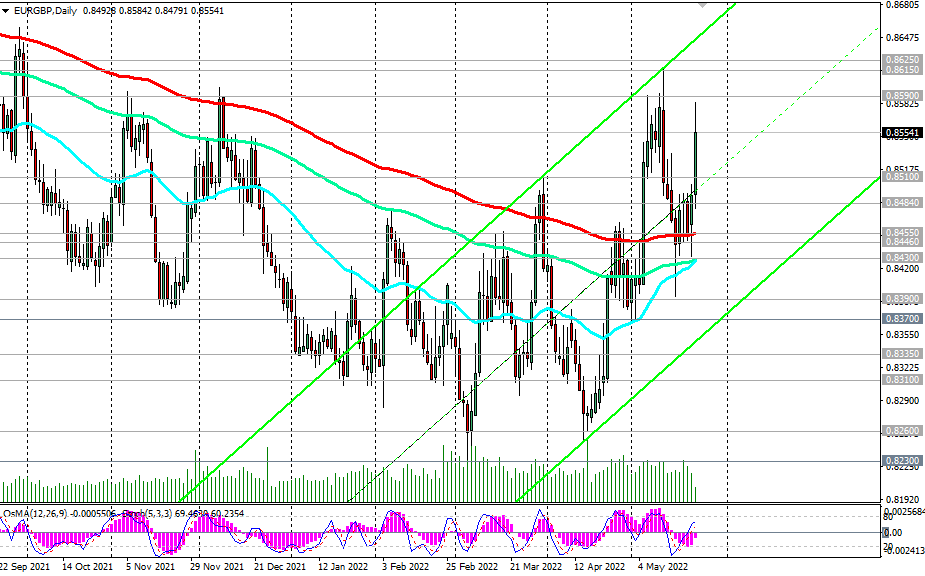

As a result of the coincidence of overlapping factors, EUR/GBP rose sharply today at the beginning of the European session, reaching 0.8584, which is 91 points higher than the opening price of today's trading day (we wrote about the features of trading this currency pair in our review for 04/20/2022), again heading towards the key resistance level 0.8625, separating the long-term bull market from the bear market (for more details, see "EUR / GBP: technical analysis and trading recommendations for 05/24/2022").

Christine Lagarde will deliver her speech again today at 18:00 (GMT) as part of events related to the International Economic Forum in Davos. During the speech of the head of the ECB, the volatility of trading increases not only in the euro and European stock indices, but also in the entire financial market, especially if Christine Lagarde touches on the subject of the monetary policy of the Central Bank. New statements on the topic of curtailing the QE program and raising rates in the Eurozone may cause a new growth of the euro. If Christine Lagarde does not touch on the subject of the ECB's monetary policy, then the reaction to her speech will be weak.

Support levels: 0.8550 0.8510 0.8484 0.8455 0.8446 0.8430 0.8400 0.8390 0.8370 0.8335 0.8310 0.8260 0.8230 0.8200 0.8145

Resistance levels: 0.8585, 0.8590, 0.8600, 0.8615, 0.8625

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex