According to data released today by Eurostat, the consumer price index (CPI) rose by 2.4% in March (against a preliminary estimate of 2.5%) and by 7.4% (in annual terms) after rising by 5.9% in February. Thus, the annual inflation in the Eurozone accelerated again, reaching a historical maximum, although it turned out to be slightly lower than the preliminary estimate. Energy prices continue to rise against the background of the military conflict in Ukraine, which contributes to further acceleration of inflation (in March, energy prices rose by an average of 44% compared to March of the previous year).

ECB President Christine Lagarde recently confirmed that there are additional risks to the region's economy, including from the ongoing military crisis in Ukraine, saying that "the longer the conflict lasts, the higher the economic costs will be, and the more likely we will find ourselves in more unfavorable scenarios.

Today, market participants will pay attention to the latest data on consumer confidence in the Eurozone (they will be published at 14:00 GMT). Consumer confidence in the Eurozone is expected to weaken significantly in April. The index fell to -20 after -18.7 in March and -8.8 in February. Such data are comparable to the values in the first wave of the pandemic. Since the creation of the single European currency, the fall in March to -18.7 from -8.8 in February was the second largest decline in this indicator. Now, an even greater decline (to -20) is expected.

All this (falling consumer confidence, significantly accelerated inflation amid inaction of the central bank and the unstable geopolitical situation in the Eurozone) are extremely negative factors for the European currency.

Probably, its current growth provides an excellent opportunity to build up short positions on it, including in pair with the dollar.

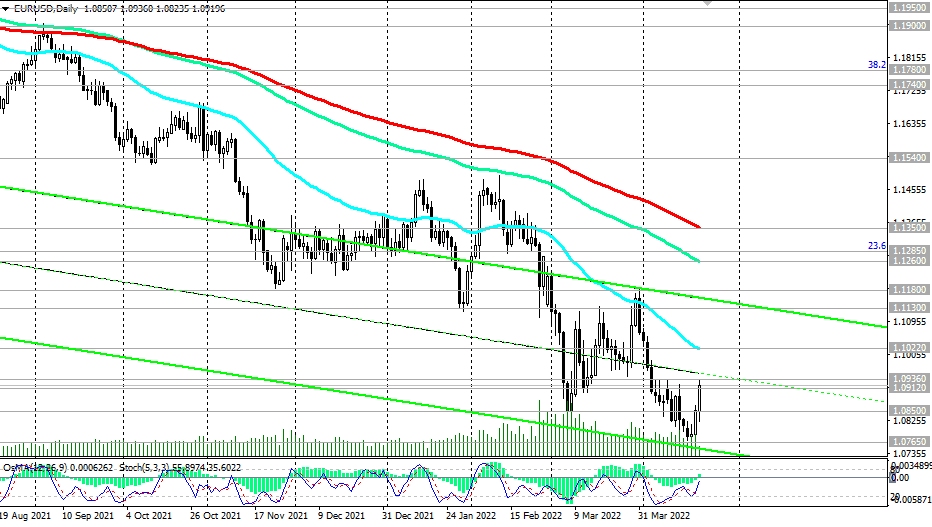

Support levels: 1.0900, 1.0844, 1.0800, 1.0765, 1.0700, 1.0500, 1.0350

Resistance levels: 1.0936 1.0964 1.1000 1.1022 1.1100 1.1130 1.1180 1.1200 1.1260 1.1285 1.1300 1.1350 1.1500 1.1540 1.1740

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex