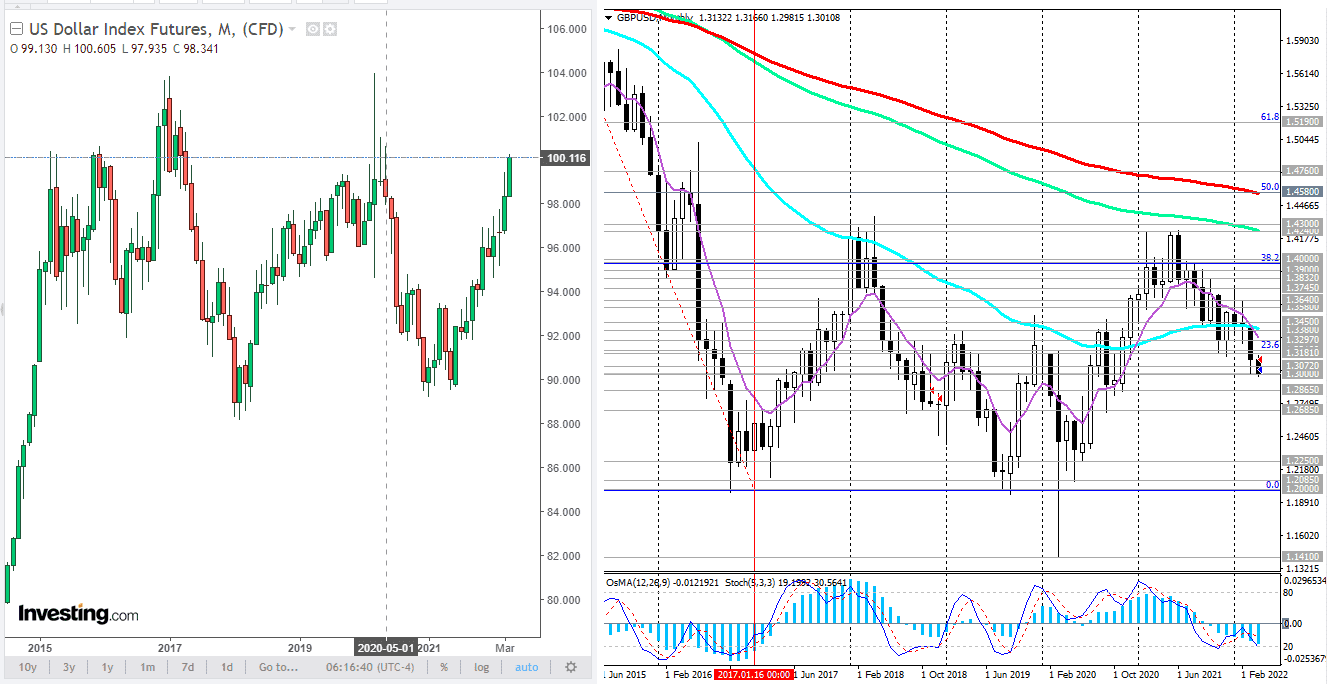

Today, market participants will study the report of the US Department of Labor Statistics with data on consumer inflation (its publication is scheduled for 12:30 GMT). It is expected that the consumer price index (CPI) in the US in March rose by +1.2% (+8.4% in annual terms). This is likely to support the opinion of the Fed leaders on the need for an aggressive increase in interest rates and support the dollar.

At the time of publication of this article, the DXY dollar index is near 100.11. If the inflation data is confirmed, the DXY could soon rise above 101.00, economists say, matching the highs since May 2020.

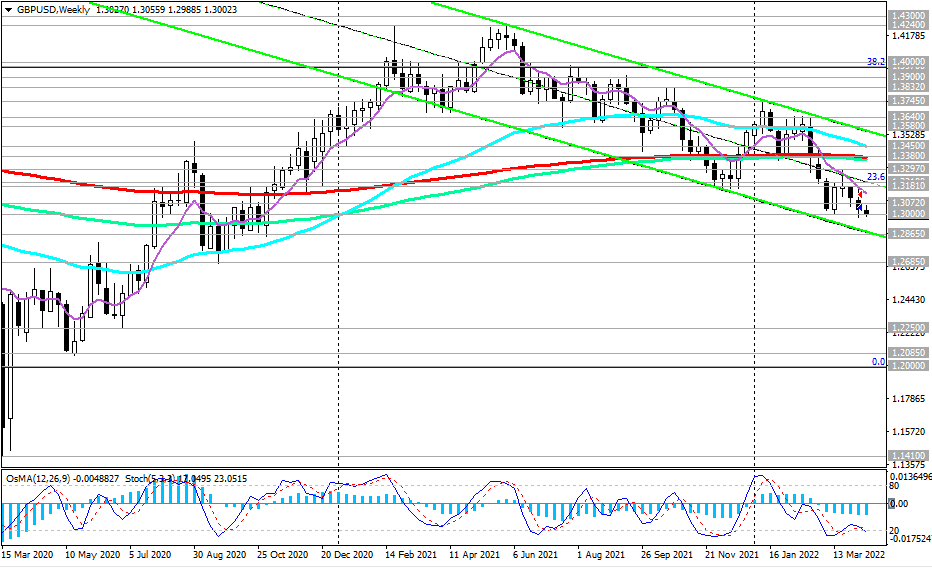

In this case, we should expect a further decline in the GBP/USD. A break of the support level of 1.3000 will open the way for the pair towards the lower border of the descending channel on the weekly GBP/USD chart, passing through the level of 1.2865. Anyway, trading below the key resistance levels of 1.4580, 1.3380, 1.3450 (see Technical analysis and recommendations), GBP/USD remains in the long-term bear market zone.

Support levels: 1.3000, 1.2980, 1.2865, 1.2685, 1.2400, 1.2250, 1.2085, 1.2000

Resistance levels: 1.3040 1.3072 1.3181 1.3210 1.3297 1.3380 1.3450 1.3580 1.3640 1.3700 1.3745 1.3832 1.3900 1.3970 1.4580

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex