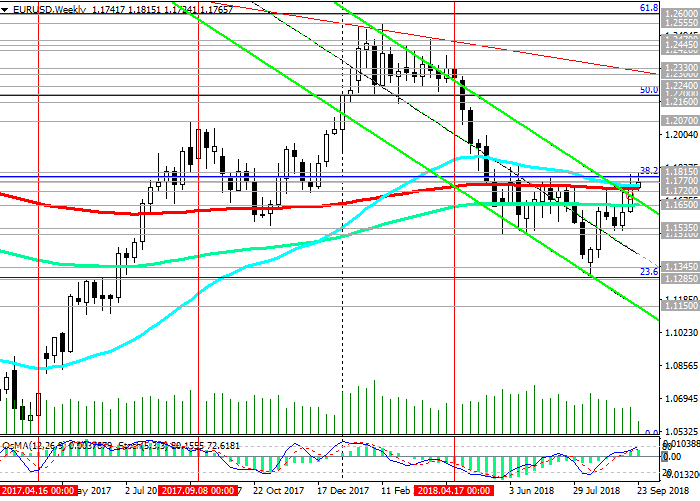

From a technical point of view, the upward correction is at the final stage.

For the fifth day in a row, EUR / USD is attempting a breakdown of the key resistance level 1.1770 (EMA200 on the daily chart). Either the breakdown will take place. Then this will already be called a trend change or a break of the trend. Either EUR / USD will not be able to break the level of 1.1770 and will return to the depth of the descending channel on the weekly chart, the lower limit of which passes near the support level of 1.1150.

Much in the future dynamics of EUR / USD will depend on the outcome of the Fed meeting and Powell's speech at a press conference that will begin at 18:30 (GMT).

In the case of soft Powell rhetoric and breakdown of the local resistance level 1.1815 (September highs), EUR / USD will head towards resistance levels of 1.2000, 1.2070 (highs of 2017).

The signal for opening short positions will be the break of the short-term support level 1.1720 (EMA200 on the 1-hour chart). The breakdown of the important support level 1.1650 (EMA50 on the daily chart, EMA200 on the 4-hour chart) will open the way for further reduction with target at support levels 1.1535, 1.1510. The long target of the decline is at the support level of 1.1150 (the lower boundary of the descending channel on the weekly chart).

Support levels: 1.1720, 1.1650, 1.1600, 1.1535, 1.1510, 1.1400, 1.1345, 1.1285, 1.1150

Resistance levels: 1.1770, 1.1790, 1.1815

Trade recommendations

Sell Stop 1.1710. Stop-Loss 1.1820. Take-Profit 1.1650, 1.1600, 1.1535, 1.1510, 1.1400, 1.1345, 1.1285, 1.1150

Buy Stop 1.1820. Stop-Loss 1.1710. Take-Profit 1.1900, 1.2000, 1.2070

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.