GBP/USD: on the eve of the meeting of the Bank of England

The US dollar declined on Monday. The driver of its decline was the message that the UK and the EU have made progress on Brexit negotiations.

The EU's chief negotiator for Brexit, Michel Barnier, said that an agreement with the UK could be reached in the next six to eight weeks. In response to this message, the pound rose sharply, including against the dollar, carrying with it other currencies, primarily European ones.

On Tuesday, with the opening of the trading day, the decline in the dollar continued. However, closer to the beginning of the US trading session, the decline in the dollar slowed, and the dollar index DXY, which tracks the rate of the US currency against the basket of 6 other major currencies, shifted to positive territory near 95.20, 6 points higher than the opening level of the trading day.

This week, investors will follow the meeting of the Bank of England, which will be held on Thursday September 13, and at 11:00 (GMT) will publish the decision on the interest rate. It is expected that the rate will remain at the same level of 0.75%. Economists believe that the next rate increase will occur no earlier than May next year.

The main risks for the UK after Brexit are associated with expectations of a slowdown in the country's economic growth, as well as a large current account deficit in the UK's balance of payments.

Meanwhile, the Fed is likely to continue tightening monetary policy. As Federal Reserve President Boston Rosengren said in an interview with the WSJ on Monday, "The US economy has good performance, and there is no need to slow or accelerate the current rate of quarterly rate increases". Rosengren sees no reason to pause the rate hike until economic growth and inflation slows. And this means, in his opinion, the Fed will raise the rate this year 2 more times. This is a bullish factor for the dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

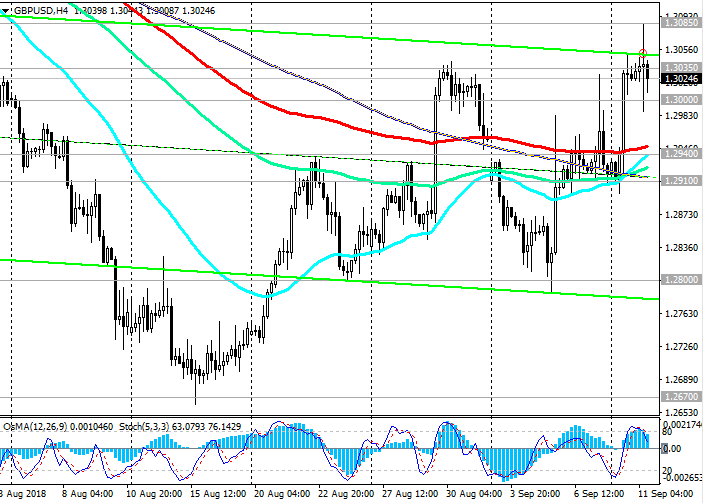

Since the beginning of the week, the GBP / USD pair has grown amid reports of the possibility of a favorable outcome of the Brexit talks. At the beginning of the European session on Tuesday, GBP / USD was trading near the 1.3085 mark. However, in the future, GBP / USD moved to negative territory, trading closer to the opening of the US trading session near the mark of 1.3015.

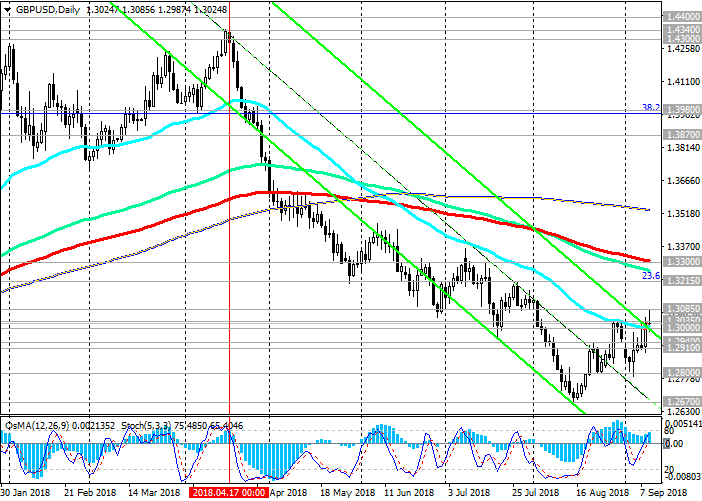

Starting in May, GBP / USD is traded in a downward channel on the daily chart, the lower limit of which is near 1.2300.

Corrective growth may continue to resistance levels 1.3215 (Fibonacci retracement level of 23.6% of the correction to the GBP / USD decline in the wave, which began in July 2014 near the level of 1.7200), 1.3300 (EMA200 on the daily chart).

Nevertheless, short positions are preferable, a long bearish trend persists, and the GBP / USD pair may fall towards the August and annual lows near the support level of 1.2670, and 1.2365 mark, through which the lower border of the descending channel on the weekly chart is passing.

Support levels: 1.3000, 1.2910, 1.2800, 1.2670, 1.2590, 1.2365

Resistance levels: 1.3085, 1.3100, 1.3215, 1.3300

Trading Scenarios

Sell Stop 1.2990. Stop-Loss 1.3050. Take-Profit 1.2910, 1.2800, 1.2670, 1.2590, 1.2365

Buy Stop 1.3050. Stop-Loss 1.2990. Take-Profit 1.3100, 1.3215, 1.3300

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com