US stock indices save the positive dynamics after the Fed head Jerome Powell on Tuesday gave a positive assessment of the current state of the American economy.

According to Powell, the state of the US economy, the growth in the number of jobs and the acceleration of inflation "make the best solution is the gradual increase in rates".

In conditions when unemployment is 4%, and annual inflation has recently reached the target level of the central bank of 2%, the Fed management does not want to allow the economy to overheat.

On Wednesday, Jerome Powell will continue his speech, which will begin at 14:00 (GMT). It is likely that Powell will reaffirm the Fed's intention to further gradually increase the interest rate.

As US Treasury Secretary Stephen Mnuchin said last week, the US economy will not suffer as a result of the introduction of import duties.

Of the news for today, it is also worth paying attention to the publication (at 12:30 GMT) of the report on the dynamics of construction of new homes in the US for June. The growth of indicators is expected, which will support the dollar and US stock indices.

A weak report will cause a decline in indices in the short term. At 18:00 (GMT), the Fed will publish a monthly economic review "Beige Book", which can also cause volatility at the end of the trading day on the stock market.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

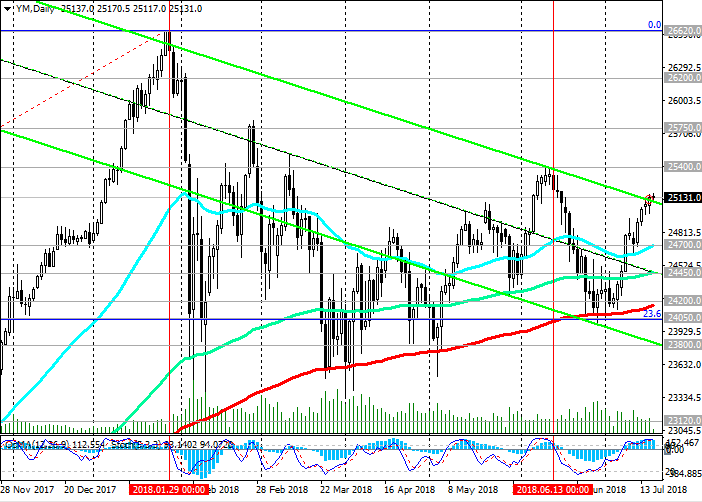

Pushed back at the end of June from the support level of 24050.0 (the Fibonacci level 23.6% of the correction to the growth from the level of 15650.0 in the wave that began in January 2016. The maximum of this wave and the 0% Fibonacci level are near the 26620.0 mark), DJIA is growing for the third week in a row.

While DJIA is trading above the key support levels of 24200.0 (EMA200 on the daily chart), 24050.0, positive dynamics remain, and the long-term bullish trend is not threatened.

Breakdown of the local resistance level 25400.0 (June highs) will accelerate the recovery and growth of DJIA. In this case, DJIA will go to the resistance levels 25750.0, 26620.0 (absolute and annual highs).

Signals for sales are not yet available.

Support levels: 25000.0, 24700.0, 24450.0, 24200.0, 24050.0, 23800.0

Resistance levels: 25400.0, 25750.0, 26200.0, 26620.0

Trading Scenarios

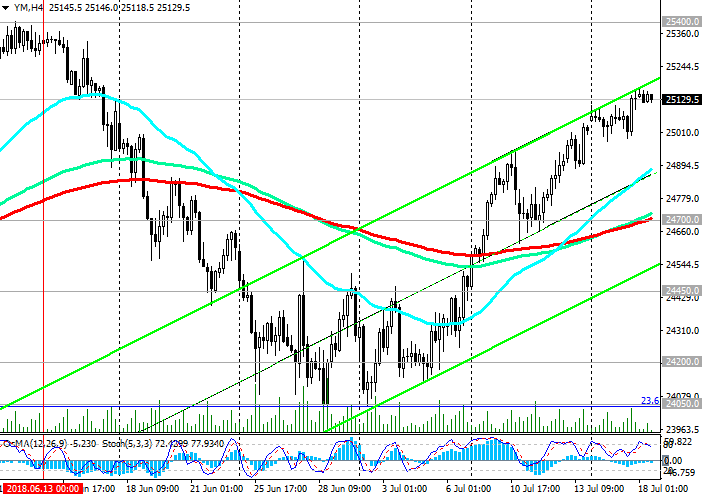

Buy Stop 25200.0. Stop-Loss 24950.0. Take-Profit 25400.0, 25750.0, 26200.0, 26620.0

Sell Stop 24950.0. Stop-Loss 25200.0. Take-Profit 24700.0, 24450.0, 24200.0, 24050.0, 23800.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com