Despite the continuing, and even accelerating, growth of the US economy, some economists still believe that in the US, in about two years, a recession may begin.

This means that the growth of the economy may slow from the middle of next year, and towards its end become zero. The probability of such a scenario is 85%.

The basis of such assumptions is the declining difference in yields of 2-year and 10-year US bonds. If this trend continues, then, as historical observations show, in another 12 months a recession may begin. This is a long-term negative scenario for the dynamics of the dollar.

Meanwhile, the dollar continues to be in demand and strengthened amid expectations of further tightening of the Fed's monetary policy, as well as positive macro statistics coming from the US.

Today at 12:30 (GMT) data on retail sales in the US will be published. A relative decline in sales is expected (+ 0.5% in June against + 0.8% in May). If the data is even weaker, the dollar may fall.

Nevertheless, investors will wait for new signals from the head of the Fed, Jerome Powell, regarding monetary policy.

Hard Powell rhetoric coupled with positive forecasts will again force investors to buy the dollar. Possibly, Powell will also touch upon the topic of US trade relations with China. As you know, last week the US Treasury Secretary Stephen Mnuchin ruled out the possibility of negative impact on the US economy from the introduction of duties. Mnuchin said that the US economy will not suffer as a result of this.

Powell will speak twice this week, on Tuesday (14:00 GMT) and on Wednesday (also at 14:00).

If Powell confirms the Fed's desire to further raise rates in the US, then gold will continue to decline in price.

In conditions of an increase in the interest rate, the investment attractiveness of the dollar is growing, and of gold is falling. The likelihood that the Fed will raise rates this year four times rose to 60%. This is one of the highest levels this year.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

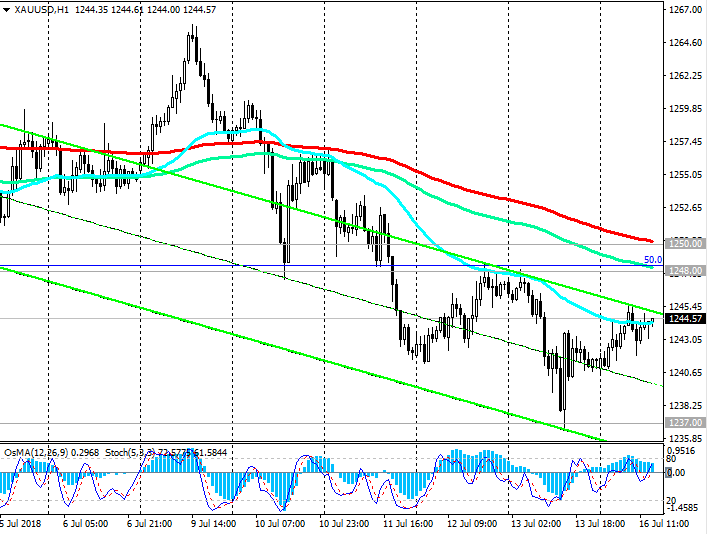

With the opening of the trading day on Monday, the XAU / USD is growing against the background of a weakening dollar.

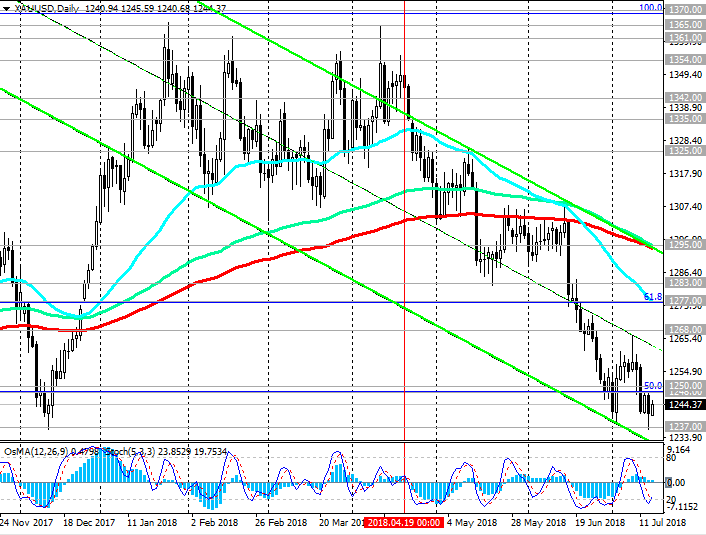

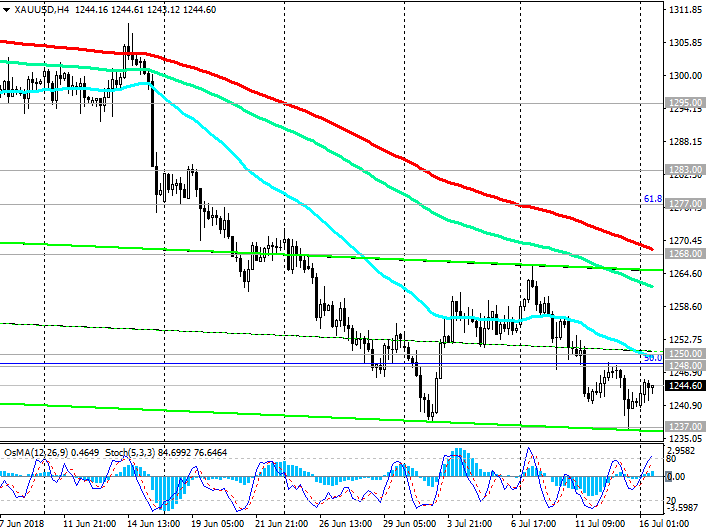

Nevertheless, below the resistance levels of 1250.00 (EMA200 on the 1-hour chart), 1248.00 (the Fibonacci level of 50% of the correction to the wave of decline since July 2016), the downward trend predominates.

The signal for purchases will be a breakdown of the short-term resistance level of 1250.00. In this case, corrective growth can last up to resistance level 1268.00 (EMA200 on the 4-hour chart).

The breakdown of the support level of 1237.00 (annual lows) will confirm the return of XAU / USD to the global downtrend, which began in October 2012.

Support levels: 1237.00, 1220.00

Resistance levels: 1248.00, 1250.00, 1268.00, 1277.00, 1283.00, 1295.00

Trading Scenarios

Sell in the market. Stop-Loss 1252.00. Take-Profit 1273.00, 1220.00, 1200.00

Buy Stop 1252.00. Stop-Loss 1239.00. Take-Profit 1268.00, 1277.00, 1283.00, 1295.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com