WTI: There is expected to reduce inventories in the US oil storage reservoirs

According to the American Petroleum Institute (API) on Tuesday evening, US oil inventories fell by 3.016 million barrels last week. Gasoline stocks increased by 2.1 million barrels, and distillate stocks increased by 757,000 barrels. Nevertheless, this did not prevent the growth of oil prices on Wednesday. Brent crude oil futures rose 0.48% to $ 75.44 per barrel. The spot price for WTI oil at the beginning of the European session was close to $ 65.50 per barrel, which is about $ 0.6 higher than the opening price of the trading day.

The US Energy Information Administration's report on oil and petroleum products in the country's storage facilities will be released on Wednesday at 14:30 GMT, and investors will closely follow this publication.

As expected, commercial oil and oil products in the country's warehouses fell by 1.898 million barrels in the week of June 9-15.

This is positive information that can support oil price quotes.

Nevertheless, the main focus of the oil market participants will be focused on the OPEC meeting, which, as expected, can make important statements regarding the mitigation of the oil production reduction program. The OPEC meeting will begin on Thursday and will last until the end of the trading week.

Last month, Saudi Arabia and Russia announced plans to soften the terms of the OPEC+ agreement and increase oil production. The OPEC+ agreement on production reduction came into force in January 2017, and since then oil prices have risen by about 35%. The agreement expires at the end of 2018.

OPEC member Saudi Arabia and the non-cartel Russia insisted on increasing production. Iran's oil minister does not expect that this week the OPEC countries will agree on an increase in production. On Tuesday, he said that Tehran is against any increase.

If the member countries of the agreement do not agree on an increase in oil production, then oil prices will start to rise again. With the reverse scenario and an increase in production (expected to be 1 million barrels per day) prices could fall by about $ 15 per barrel.

Last Friday, a weekly report was released from the American oil service company Baker Hughes, according to which the number of active oil drilling rigs in the US increased again by 1 unit and currently stands at 863 units (against 862, 861, 859 and 844 in the past weeks). The growth of this indicator is another negative factor for the oil market and for oil prices.

Simultaneous growth in oil production in OPEC and the US can break the bullish trend of oil. This is especially true in the unfolding trade war between the US and China.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

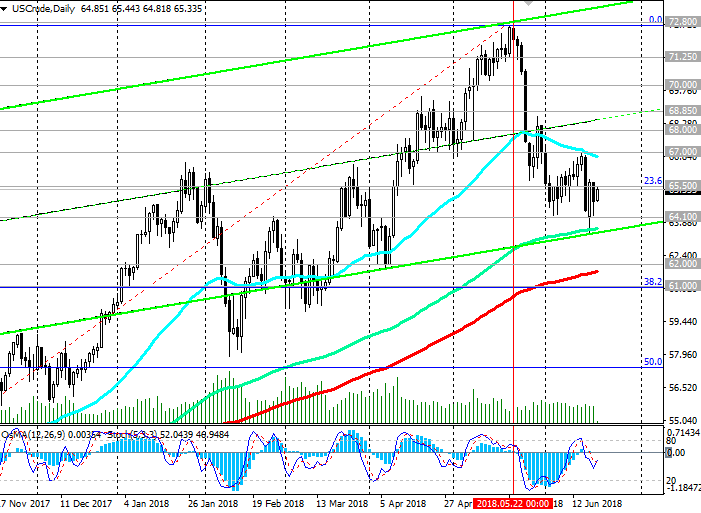

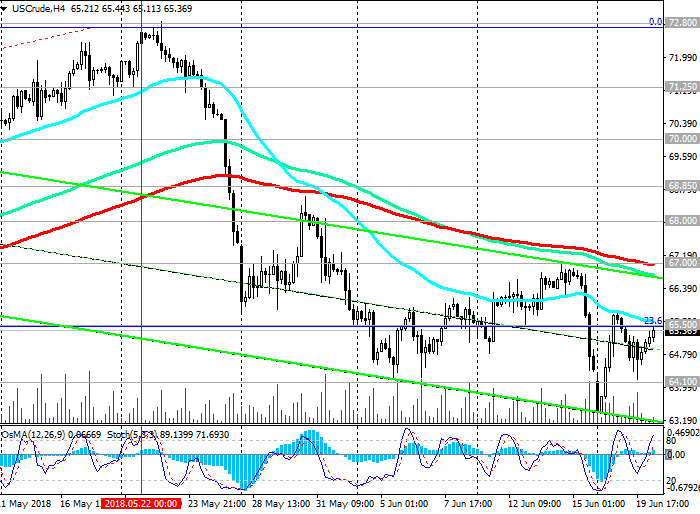

Support levels: 63.70, 62.00, 61.00

Resistance levels: 65.50, 67.00, 68.00, 68.85, 70.00, 71.25, 72.80, 74.00, 75.00

Trading Scenarios

Sell Stop 64.80. Stop-Loss 65.90. Take-Profit 64.00, 63.00, 62.00, 61.00

Buy Stop 65.90. Stop-Loss 64.80. Take-Profit 67.00, 68.00, 68.85, 70.00, 71.25, 72.80, 74.00, 75.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com