After the Bank of Canada left the rate at the previous level of 1.25% in April, the Canadian dollar declined. The central bank is concerned about international trade conflicts and weaker economic expectations than expected.

"Despite the higher demand in the world economy, the growth of investment (Canadian) companies focused on exports will be limited by the increased uncertainty surrounding foreign trade and concerns about regulatory rules. In addition, after the tax reform in the United States, there is the question of likely investors switching to US assets", the central bank said.

Nevertheless, in recent days, the Canadian dollar has been receiving support from rising oil prices. Strengthening of the Canadian dollar and the decline in the USD / CAD will continue if the bull market continues to be present in the oil market.

So far, everything is in favor of further price increases after Tuesday, US President Donald Trump announced the US withdrawal from the agreement on Iran's nuclear program. The unilateral exit of the US from the deal implies the resumption of sanctions against Iran and limiting of the Iranian oil on the world market, which is approximately 1 million barrels a day.

At 12:30 (GMT), the publication of data from the Canadian labor market is planned. It is expected that unemployment in Canada in April remained at 5.8%, and the number of employed increased by 17,400 people. If the data prove to be better than the forecast, the Canadian dollar will strengthen, and the USD / CAD will decrease.

Meanwhile, the US dollar is declining from the opening of today's trading day. Investors continued to analyze yesterday's weak data on consumer inflation in the US. The growth in consumer price indices was less significant than economists had expected.

Data pointed to a possible slowdown in inflation, and this is a negative sign for the Fed in the matter of tightening monetary policy and the prospects for strengthening the US dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

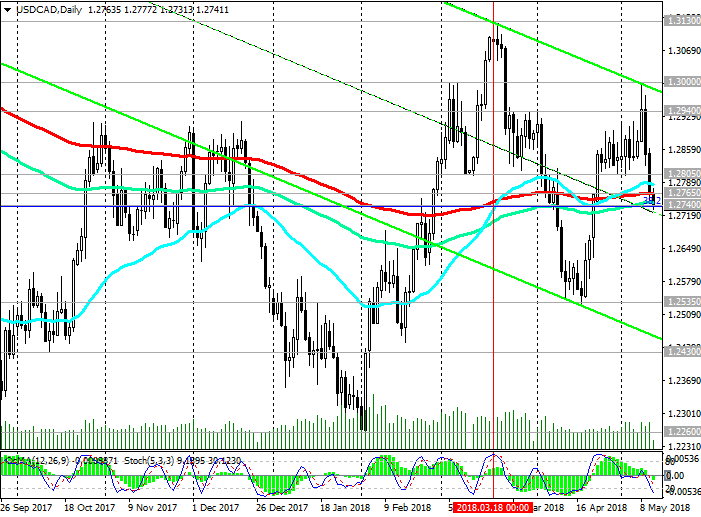

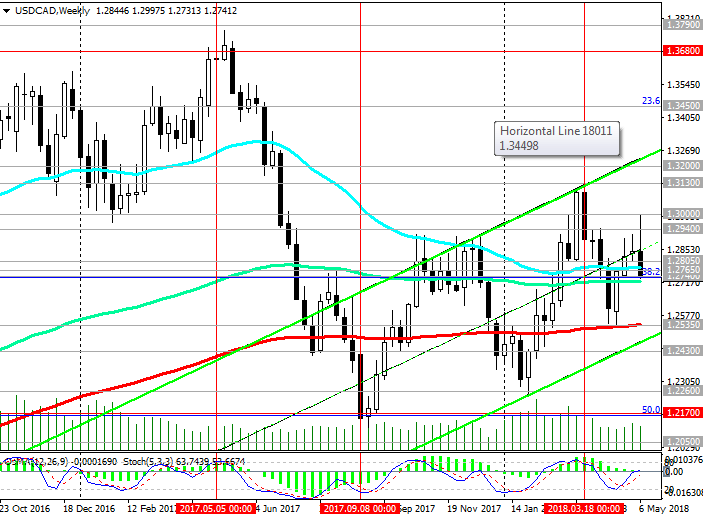

Support levels: 1.2740, 1.2600, 1.2535,

1.2430, 1.2360, 1.2260, 1.2170, 1.2100, 1.2050

Resistance levels: 1.2765, 1.2805, 1.2900, 1.2940, 1.3000, 1.3130, 1.3200

Trading Scenarios

Sell in the market. Stop-Loss 1.2780. Take-Profit 1.2700, 1.2600, 1.2535, 1.2430, 1.2360, 1.2260, 1.2170

Buy Stop 1.2780. Stop-Loss 1.2720. Take-Profit 1.2805, 1.2900, 1.2940, 1.3000, 1.3130, 1.3200

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com