S&P500: the intensity has been asleep; investors switched attention to economic data

In recent weeks, investors have been alarmed by geopolitical tensions, by lower than expected macroeconomic data, and trade conflicts.

Investors sighed with relief after the air strikes on Syria, inflicted on Saturday, did not lead to a serious aggravation of the conflict and not escalate into a large-scale military conflict. A representative of the Pentagon said that a single wave of blows has been completed so far. President Donald Trump on Saturday wrote on Twitter that "the task is completed".

The yield of 10-year US government bonds rose to 2.851% from 2.828%. The dollar index DXY, reflecting its value against the other 6 major currencies, is declining from the opening of the trading day, dropping from 89.50 to 89.28 at the beginning of the US trading session.

Uncertainty may increase again, but the darkest scenario has not yet been realized, which allowed the risky assets to recover. Investors turned their attention to economic data and corporate reporting. On Monday, traders are waiting for new US data on retail sales. Retail sales are expected to grow by + 0.4% in March (against a decline of -0.3% in February and the previous forecast release of -0.1%), which should positively affect the US stock indexes when confirming the forecast.

Volatility in the stock markets could rise sharply on Tuesday during the Asian session, when at 02:00 (GMT) Chinese data on economic growth (GDP for the first quarter) and the March business activity statistics and industrial production, as well as the level of retail sales will be published.

This will be particularly reflected in the dynamics of Asian stock indices, but will affect the US indices as well.

Also it is worth paying attention to today's speech by representatives of the Fed (at 16:00 and 17:15 GMT). If they touch on the topic of monetary policy in the US, then volatility in the dynamics of US stock indices will grow (in the short term).

)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

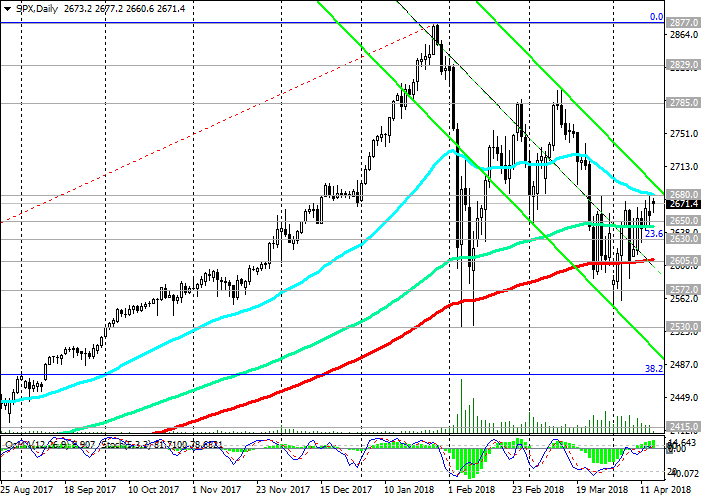

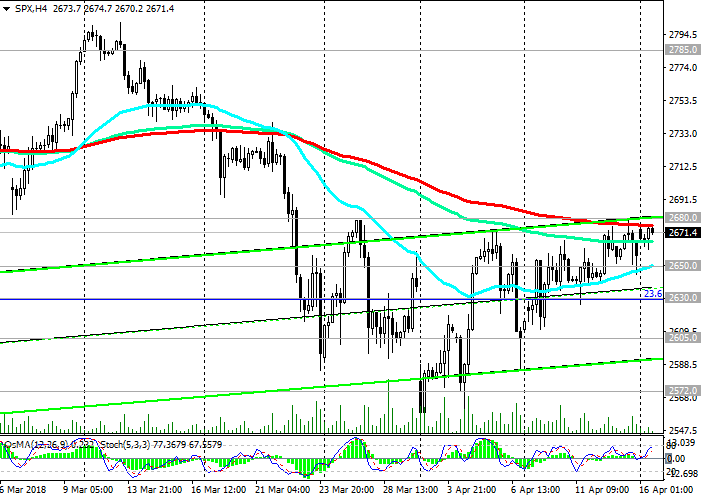

Support levels: 2650.0, 2645.0, 2630.0,

2605.0, 2572.0, 2530.0, 2480.0

Resistance levels: 2680.0, 2700.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell Stop 2645.0. Stop-Loss 2685.0. Objectives 2630.0, 2605.0, 2572.0, 2530.0, 2480.0

Buy Stop 2685.0. Stop-Loss 2645.0. Objectives 2700.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com