S&P500: the resumption of falling indices is not worth waiting for

The renewed tension in the trade relations between the US and China led to a sharp drop in the main US indices at the end of last week.

S & P 500, Dow Jones Industrial Average and Nasdaq Composite lost more than 2% on Friday. The aggravation of the trade conflict between the US and China threatens the growth of the world economy.

Last week, the White House announced import duties on 1300 categories of Chinese goods, with a total value of 50 billion US dollars. China, in turn, said that it would impose duties on 106 categories of goods from the United States. On Wednesday, the world stock markets collapsed after China announced that it was imposing import duties on US goods worth a total of $ 50 billion.

Nevertheless, since the beginning of today's trading day, futures for US stock indexes are growing. The statements of official representatives of the White House, sounded over the weekend, calmed investors. Representatives of the administration of the US President Donald Trump said that previously issued restrictive measures with respect to Chinese goods have not yet been implemented. In the White House they hope to come to an agreement and prevent the outbreak of a trade war. So, the US Treasury Secretary Stephen Munchin said on Sunday that he "does not expect the beginning of the trade war". Donald Trump wrote on Twitter that he expects China to reduce trade barriers, because "this will be the right decision". According to him, the US will take mutual measures in the field of taxes and conclude an agreement with China on intellectual property. Lawrence Kadlow, who is the head of the National Economic Council, reassured market participants, stressing that "so far nothing has happened".

Meanwhile, if there is no next round of escalation of the trade conflict between China and the US, this week we can expect the growth of US stock indices, as the US will start the reporting season. Positive reports of American companies are expected. According to FactSet, this is the maximum number (53 companies from the S & amp; 500 calculation base, which expect positive quarterly statistics) since 2006. Forecasts are highest in the technological sector.

Investors, it seems, were also encouraged by the news that the leader of North Korea over the weekend confirmed his willingness to discuss with the US the elimination of nuclear weapons.

This week (Wednesday at 18:00 GMT) will be published minutes from the March meeting of the Fed. As you know, the Fed raised the rate by 0.25% to 1.75% and gave a more positive outlook for economic growth. "The outlook for the economy has improved in recent months", the Federal Reserve said in an official statement following the meeting. The central bank expects GDP growth of 2.7% this year and 2.4% in 2019 against earlier forecasts of 2.5% and 2.1%, respectively. The Fed also kept the outlook for two more rate hikes this year, although many investors betting on the dollar's rise were counting on the Fed signaling about 4 rate hikes this year.

If in the protocols investors do not find signals aimed at a more accelerated tightening of monetary policy, then with a progressive positive forecast of the growth of the US economy, the stock indices will receive real support for more confident recovery and the resumption of growth.

For today, important news is not planned. It is likely that the sluggish dynamics of trading will remain the same during the American trading session, but the resumption of the fall of the indices is not yet to be expected.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

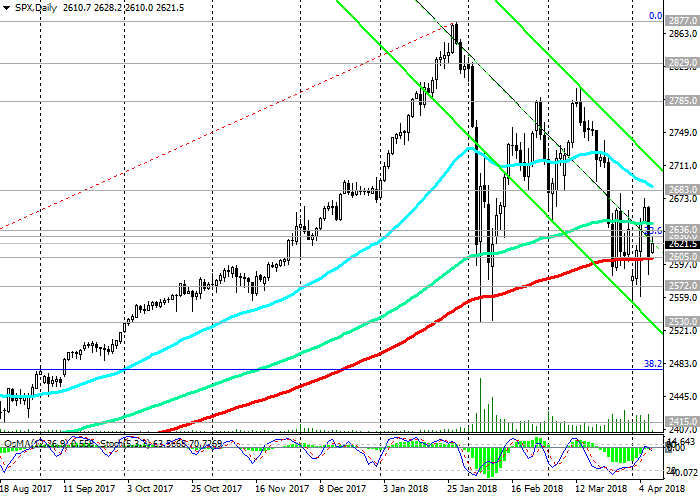

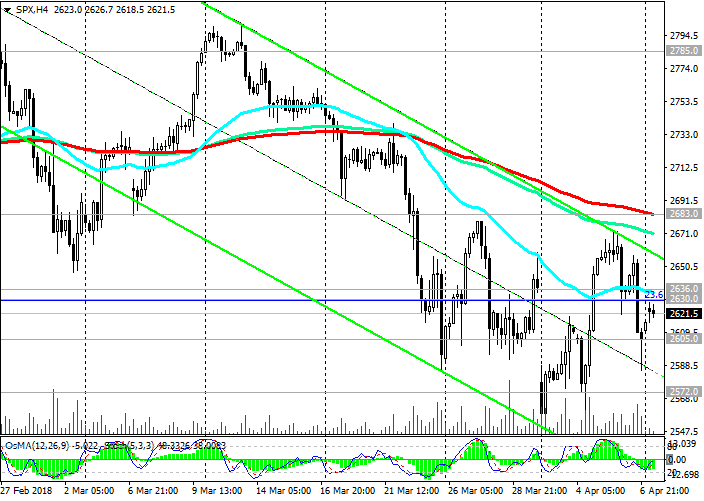

Support levels: 2605.0, 2572.0, 2530.0,

2480.0

Resistance levels: 2630.0, 2636.0, 2683.0, 2700.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell Stop 2609.0. Stop-Loss 2637.0. Objectives 2605.0, 2572.0, 2530.0, 2480.0

Buy Stop 2637.0. Stop-Loss 2609.0. Objectives 2683.0, 2700.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com