Unconditional center of attention of traders today will be the publication at 12:30 (GMT) of monthly data on the US labor market. It is widely expected that

the number of jobs in the non-agricultural sector increased by 193,000 in March after an increase of 313,000 in the previous month, unemployment fell to 4.0%, and the average hourly salary of Americans grew by 0.2% (against + 0.1% in February). It is this part of the report (growth of labor payment) that will be of interest to investors. During the December meeting, the leaders of the Fed planned to implement three key rate increases in 2018. However, recent forecasts showed that this year an increasing number of leaders are inclined to four increases, 0.25% each time.

New forecasts showed that now the Fed expects faster economic growth, higher inflation and a more significant reduction in unemployment this year.

So far, inflation in the US is below the target level of 2%, with most of the past five years.

A new fiscal policy in conditions of low unemployment can lead to a sharp rise in wages, which, in turn, will also cause inflation. In this case, the central bank will have to raise rates faster than expected to avoid hyperinflation and bubble growth in stock markets.

That is why the growth rates of salaries, personal income of Americans and inflation in March and April are very important. If they demonstrate faster growth then this can make Fed leaders more confident in their forecasts and plans for interest rates. And this is a strong fundamental factor in favor of the growth of the dollar.

At the same time, other major world central banks adhere to the former soft monetary policy. According to the Governor of the RBA Philip Lowey, at present there are no arguments in favor of changing the monetary policy of Australia.

Last Tuesday, the RBA left interest rates unchanged at 1.5%. "Despite the improvement in the labor market, wage growth rates remain low, which is likely to continue for some time", said RBA Governor Philip Lowe. "Inflation is likely to remain weak, reflecting the slow growth in labor costs and high competition in the retail sector", Lowe said, adding that the RBA will not follow other central banks in the world that are prone to tightening policies. The country is expecting a weak wage growth, as well as low inflation, which means interest rates can remain unchanged for most of 2019, according to many economists.

The key interest rate of the RBA remains at a record low of 1.5% since mid-2016, and now it is expected that the first increase will take place only in 2019. Some economists say that interest rates may remain unchanged for an even longer time, given the weak growth of wages and high underutilization of labor market capacities.

The unemployment rate fluctuated by about 5.5% for most of the past 12 months, and the RBA expressed doubts that full employment will be achieved in the near future.

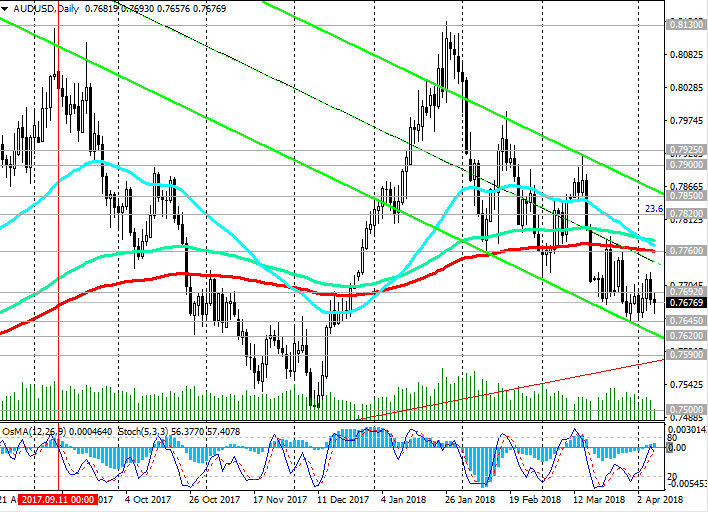

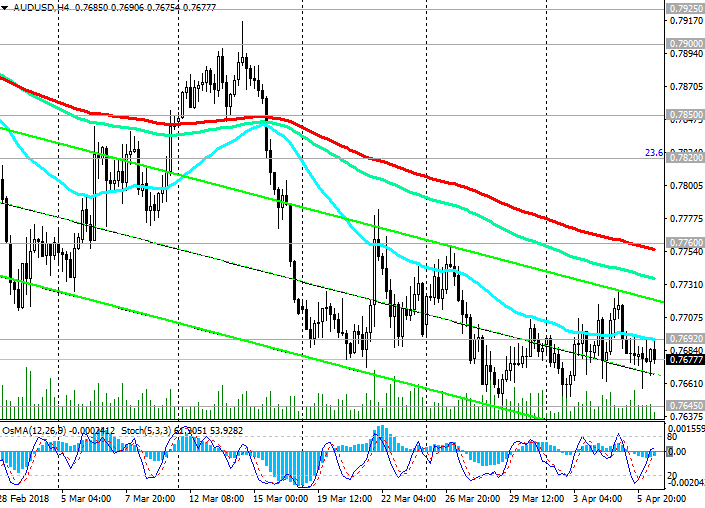

Thus, the different focus of monetary policy in the US and Australia will be the main most important long-term factor in favor of weakening the AUD / USD pair.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 0.7645, 0.7620, 0.7590, 0.7500, 0.7330

Resistance levels: 0.7700, 0.7760, 0.7820, 0.7850, 0.7900, 0.7925, 0.8000, 0.8100, 0.8130

Trading Scenarios

Sell in the market. Stop-Loss 0.7735. Take-Profit 0.7645, 0.7620, 0.7590, 0.7500, 0.7330

Buy Stop 0.7735. Stop-Loss 0.7635. Take-Profit 0.7760, 0.7820, 0.7850, 0.7900, 0.7950, 0.8000

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com