Today, the financial markets are growing dollar and the resumption of growth in US stock indices. The dollar strengthened after comments from US Federal Reserve Chairman Janet Yellen, which increased the likelihood of another increase in interest rates. On Tuesday, Yellen spoke in support of the central bank's plan to raise interest rates.

"It would be unreasonable to pursue an unchanged monetary policy until inflation returned to 2%," Yellen said. According to the CME Group, investors estimate the likelihood of a rate hike in December at 83.1%, while the previous day it was 72.3%. Nevertheless, the propensity of investors to buy risky assets is growing again. Yield of 10-year US government bonds rose to 2.290% from yesterday's level of 2.229%.

Long-term soft monetary policy has become an important fundamental factor for the growth of the stock market. Now many investors believe that the stock market is able to cope with the gradual tightening of the policy.

As the head of the Federal Reserve, Janet Yellen, said earlier, the possibility of a gradual tightening of monetary policy speaks about the strength of the American economy. One increase in rates is not enough to break the bull market. More important factors are the strong corporate reports of US companies, the stable state of the labor market and the growth of the US GDP.

Today, the administration of the US president and the Republican leaders in the congress will publicize a preliminary tax reform plan that provides for tax cuts on citizens and the US company, and will allow the return of trillions of dollars invested abroad, Trump said. Until now, stock markets have ignored the failures of the administration of the US president, relying mainly on the strong reports of US companies and macro statistics. If the preliminary tax reform plan is adopted in the congress, it will also support the US stock market. Donald Trump's speech should begin at 21:00 (GMT).

In general, the positive dynamics of the US stock market remains.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

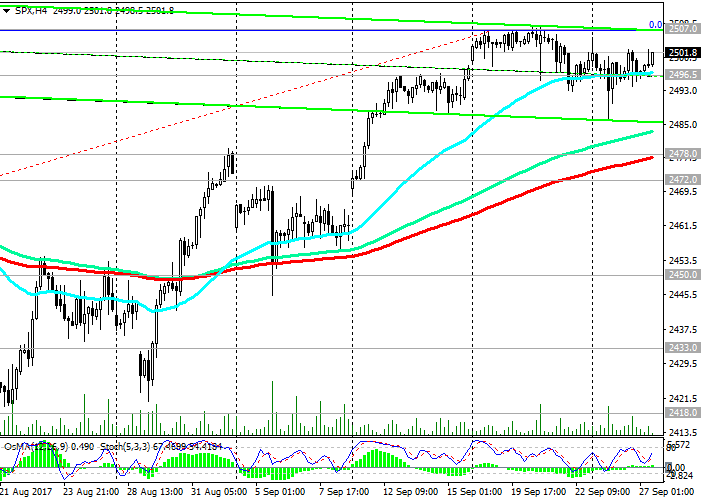

Last week, the S & P500 index updated its annual high near the 2507.0 mark, however, it subsequently fell against the backdrop of an escalation of tensions on the Korean Peninsula.

Today, the index resumed growth, trading at the beginning of the European session near the mark of 2500.0.

In general, the positive dynamics of the index remains. About the reversal of the bullish trend is not yet talking. There is a possibility of further growth in the ascending channels on the daily and weekly charts. In the event of a breakdown of the local resistance level of 2507.0 (annual and absolute highs), the index's growth will continue.

In case of a breakdown of the short-term support level 2496.5 (EMA200 on the 1-hour chart), a downward correction is possible to the support levels 2478.0 (EMA200 on the 4-hour chart), 2472.0 (EMA50 and the middle of the uplink on the daily chart).

The medium-term upward movement of the S & P500 index is maintained as long as it trades above the key support level of 2386.0 (EMA200 on the daily chart).

Only the breakdown of the support level of 2348.0 (the Fibonacci level of 23.6% of the correction for growth since February 2016) could significantly increase the risk of the S & P500 returning to a downtrend.

Support levels: 2496.5, 2478.0, 2472.0, 2463.0, 2450.0, 2433.0, 2418.0, 2378.0, 2348.0

Resistance Levels: 2507.0

Trading Scenarios

Sell Stop 2492.0. Stop-Loss 2504.0. Objectives 2490.0, 2478.0, 2472.0, 2463.0, 2450.0, 2433.0, 2418.0, 2378.0

Buy Stop 2504.0 Stop-Loss 2492.0. Objectives 2507.0, 2510.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com