After the elections in Germany, held last weekend, the euro is traded with a decrease of 0.4%, to 1.1880. Investors analyze the results of the elections, and the auctions on the world stock exchanges are multidirectional.

Angela Merkel secured a fourth term in the Chancellor's chair, however, the party headed by her "Christian Democratic Union" (CDU) will receive 33% of the vote in the German parliament, this is the weakest result for this party since 1949. None of the parties won a parliamentary majority. The surprise was that the extremely right-wing party "Alternative for Germany" won seats in the parliament. Now the victorious Christian Democratic Union will be forced to form a coalition, most likely with the Free Democratic Party and the "green", which will create some political uncertainty in Germany, whose economy is the largest in the entire economy of the Eurozone.

The yield of 10-year government bonds in Germany fell to 0.445% today from the level of 0.450%, noted on Friday. The StoxxEurope600 index gained 0.1% at the beginning of the session, the DAX30 and EuroSTOXX50 indexes also slightly increased at the beginning of the European session. All European stock indexes, in contrast to the British FTSE100 and American indices, retain positive dynamics.

Later today (13:00 GMT) ECB President Mario Draghi should make a speech. It is unlikely that he will say anything new about the monetary policy in the Eurozone. Although, there may be surprises. Mario Draghi is famous for being able to develop markets. Most likely, Mario Draghi will again decide to support the European stock market and remind us of the ECB's inclination to soft politics.

A number of representatives of the Federal Reserve are also scheduled for today. Among the speakers - the head of the Federal Reserve Bank of New York, William Dadley, the head of the Federal Reserve Bank of Chicago and a member of the Committee on Open Markets of the Federal Reserve Bank Charles Evans.

By the way, the representative of the Federal Reserve John Williams said on Friday that the Fed is likely to raise the key rate in December, but it will very slowly raise the key rate over the next two years, as well as the fact that the neutral interest rate, in his opinion, is at 2.5%.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

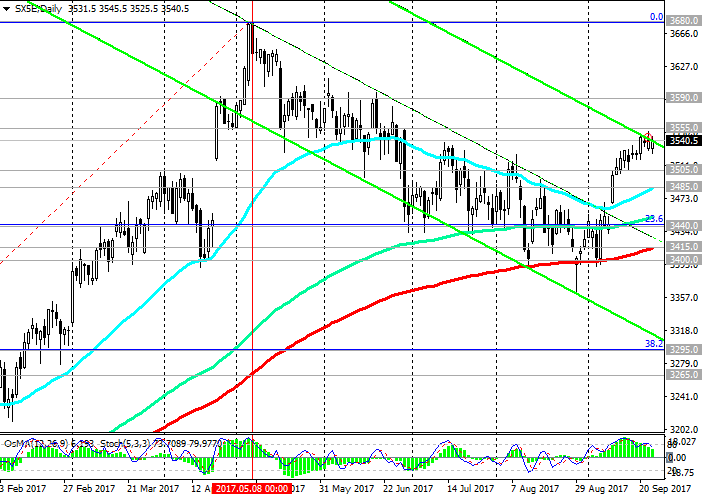

After in May the EuroStoxx50 index reached the annual maximum near the 3680.0 mark, a downward correction began against the background of the strengthening of the euro. The EuroStoxx50 index fell to the level of 3400.0. In the current month, the EuroStoxx50 index was able to completely "beat off" the losses of the previous two months, and at the moment EuroStoxx50 is trading near the 3535.0 mark.

Nevertheless, the negative dynamics of the EuroStoxx50 index may again return.

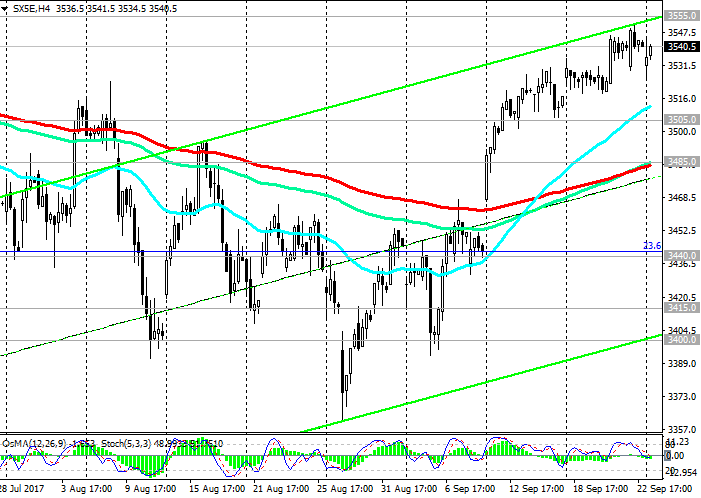

Indicators OsMA and Stochastics on the 4-hour, daily charts turned to short positions. Sooner or later, the ECB will have to return to consideration of the issue of curtailing the QE program in the Eurozone, and this is a negative strong fundamental factor.

While the EuroStoxx50 is trading above the 3485.0 support level (EMA200 on the 4-hour chart, EMA50 on the daily chart), bulls can be calm.

The first signal for the trend reversal and the opening of short positions will be a breakdown of the support level of 3505.0 (EMA200 on the 1-hour chart).

The breakdown of support levels 3415.0 (EMA200 on the daily chart), 3400.0 will be a turning point in the development of the bearish trend. The immediate goal of further decline is the support level of 3295.0 (the Fibonacci level of 38.2% of the downward correction to the growth wave from July 2016 and from the level of 2675.0 and the bottom line of the descending channel on the daily chart).

The scenario for growth is related to the breakdown of the local resistance level of 3555.0 and further strengthening with the target at the level of 3590.0.

For now, short positions are preferable until the situation around the QE program becomes clear.

Support levels: 3505.0, 3485.0, 3440.0, 3415.0, 3400.0

Resistance levels: 3555.0, 3590.0, 3610.0, 3680.0, 3700.0

Trading Scenarios

Sell Stop 3518.0. Stop-Loss 3555.0. Take-Profit 3505.0, 3485.0, 3440.0, 3415.0, 3400.0

Buy Stop 3555.0. Stop-Loss 3518.0. Take-Profit 3590.0, 3610.0, 3680.0, 3700.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com