Today the pair EUR / USD continued its growth, started on Thursday after the ECB meeting and press conference, at which ECB President Mario Draghi spoke. He was very careful in his statements and tried not to cause unnecessary emotions for traders who traded the euro.

"We studied the economic situation in the Eurozone and noticed the acceleration of economic growth with still slow inflation", Draghi said. He also noted that the future of the QE program during the two-day ECB meeting was not discussed, and "the discussion of this topic should begin in the fall".

Investors took the words of Draghi as a signal to buy the euro. The pair EUR / USD reached almost 2-year high at 1.1679 in the first half of the European session.

The growth of the pair was also promoted by Bloomberg's announcement that transactions in the companies belonging to the US president will be checked as part of the Trump investigation. This publication has increased the uncertainty surrounding the presidential administration and its plans to accelerate economic growth in the United States.

Meanwhile, investors continue to evaluate ECB President Mario Draghi's comments on Thursday and expect ECB plans to wind down the stimulus program to be released in September.

Meanwhile, according to the results of the poll published on Friday, in the next two years, inflation in the Eurozone will not reach the target level set by the ECB slightly below 2.0%.

Quarterly survey conducted by the ECB among economists showed that this year inflation will be 1.5%, in the next - 1.4%, and in 2019 - 1.6%. According to the latest data, for the year prices rose by only 1.3%. Forecasts for each year were lowered by 0.1 percentage points compared to the results of the previous poll, which was held in April.

Yesterday, Mario Draghi again stressed that the ECB leadership will be extremely cautious approach to the issue of curtailing its stimulus measures, focusing on the growth rate of inflation in the Eurozone.

And the more inflation will be below the target level, the further the ECB will postpone the decision on curtailing the stimulus program and raising the interest rate in the Eurozone. And this is a negative factor for the euro.

Today, at the end of the trading week, some investors will want to record profits in short positions on the US dollar, which may provoke some strengthening. It is likely that this may occur closer to the end of the US trading session.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

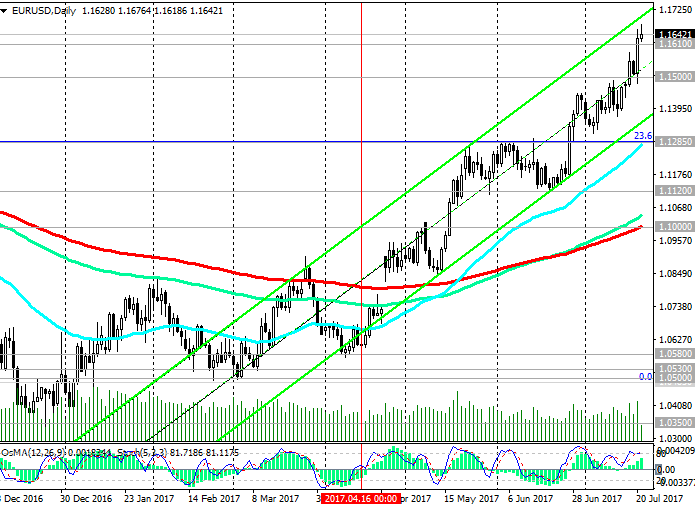

Yesterday, the pair EUR / USD broke through the key resistance level near the 1.1610 mark (EMA200 on the weekly chart), continuing to trade in the uplink on the daily chart.

The positive dynamics of the EUR / USD pair remains. In case of consolidation above resistance level 1.1610, the pair EUR / USD growth may continue. In this case, the target will be the resistance level 1.1785 (the Fibonacci retracement level of 38.2% of the corrective growth from the lows reached in February 2015 in the last wave of the global fall from 1.3900).

The reverse scenario implies a decrease to the zone below the level of 1.1285 (Fibonacci level of 23.6%), which will increase the risks of return to the downtrend.

In the case of a breakdown of the short-term support level 1.1500 (EMA200 and the bottom line of the uplink on the 1-hour chart) and the acceleration of the downward dynamics, this scenario may develop.

Support levels: 1.1610, 1.1500, 1.1400, 1.1370, 1.1285, 1.1240, 1.1120, 1.1000

Resistance levels: 1.1650, 1.1700, 1.1785

Trading Scenarios

Sell Stop 1.1610. Stop-Loss 1.1685. Take-Profit 1.1500, 1.1400, 1.1370, 1.1285, 1.1240, 1.1120

Buy Stop 1.1685. Stop-Loss 1.1610. Take-Profit 1.1700, 1.1785, 1.1800

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com