The shared currency stays within the daily range following releases in the US docket, with EUR/USD navigating around the 1.1400 handle.

EUR/USD upside still capped near 1.1450

The pair keeps the daily correction lower unchanged after US personal income expanded more than expected in May, up 0.4% MoM vs. a 0.3% gain.

Further data saw personal spending rising 0.1% MoM, while inflation figures measured by the Core PCE rose 0.1% on a monthly basis and 1.4% on a year to May, matching consensus.

The pair has come under some tepid downside pressure after being rejected from recent multi-month tops in the 1.1440 region, although the bullish stance remains intact. This view is reinforced by the recent performance of EUR futures markets, clearly pointing to an extension of the up trend, at least in the near term.

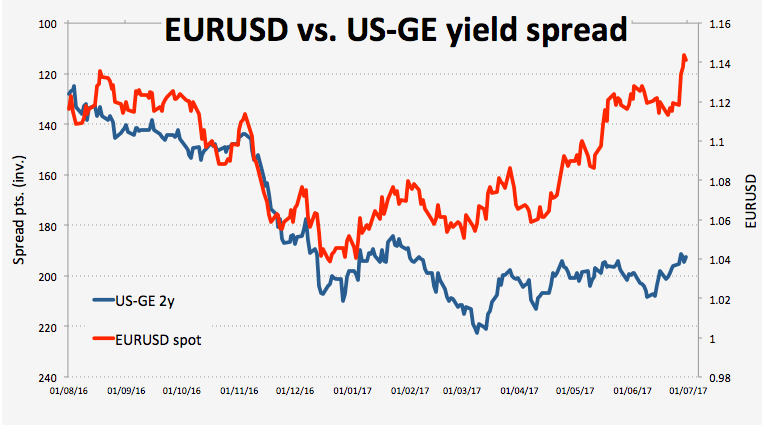

In the meantime, EUR’s constructive prospect stays bolstered by the rally in German yields, picking up extra pace in response to the recent hawkish comments by President Draghi at the ECB Forum.

EUR/USD levels to watch

At the moment, the pair is retreating 0.29% at 1.1408 and a break below 1.1290 (low Jun.28) would open the door to 1.1253 (10-day sma) and then 1.1238 (20-day sma). On the other hand, the next up barrier is located at 1.1445 (2017 high Jun.29) seconded by 1.1466 (high Apr.12 2016) and finally 1.1616 (high May 3 2016).