Most traders are just too busy finding the right strategy, testing every indicators out there yet they still end up losing or getting their trading account wiped out, trading is a tough nut to crack and if we are not doing things in the right perspective we are destined to fail. First it is important for traders to understand that trading is a winners minus loser thing, meaning no matter how good a strategy is there were always a point of time to such strategy that will accumulate loses, but the only good thing about it is it has the ability to recover and become profitable again, this where the value of positive expectancy comes in trading.

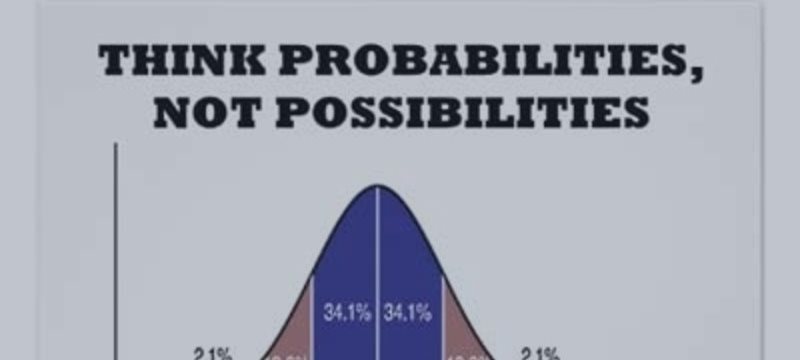

Positive expectancy simply means that no matter how many times we open a trade we will always come up in profits, open 100 or 1000 trades you will still come up in profits, how to find a system such as this one, first the trader must accept that fact that in trading you cannot win all the time, all you have to do is find a trading strategy that give less losing trades over series of trades all the time.

Here is my simple step in testing positive expectancy of a particular trading system, first you need to choose/create a trading strategy that you are comfortable with and has belief that it will work, next is you have to trade this system in a demo account(do it realistically) for at least 100 trades(the higher the more reliable), after 100 trades look at the winning rate of the system, it must be at least above 50%(55% and above are good numbers), then compute also the average risk/reward ratio of such system by dividing the average profit over average loss, it must have at least a value of 1 (higher is better).If you feel that there are still rooms for improvement then make the necessary adjustment and repeat the process until you get the best result.

To ensure our success in trading it is important that we trade a system that has good winning rate(55% or higher) and good risk reward ratio(1 or higher) rather that blindly follow a trading system without any statistical proof of winnability. Data that were taken from more than 100 trades shows more stability of a particular system.

Finally, there are two aspects in becoming a successful trader, these are the technical and psychological aspects, it is important that we traders do good on both in order to attained the desired results in our trading.If a trader is using a system that has been fully tested and has above 50% winning rate and at least 1 RR value that is extracted from at least 100 trades then rest assured that you will have a very good chance of survival and possibly becomes profitable in the long run (in the assumption that you follow its trading strategy religiously).

Happy Trading!