The Australian dollar has recently remained one of the weakest against the US dollar. Despite the fact that earlier in the month the RBA retained the interest rate in Australia at 1.5%, among market participants the opinion is growing that the RBA can go on reducing the interest rate in the country due to a record household debt, a record low salary growth and a weak market Labor. Domestic consumption makes a big contribution to GDP growth. In view of the weak growth in consumption in Australia, some economists forecast zero or insignificant GDP growth for the first quarter.

From the protocol published at the beginning of the month since the last meeting of the RBA, it follows that the bank as a whole is still optimistic about the situation in the Australian economy. However, according to the bank, "an increase in the interest rate will complicate the correction of the economy."

On Thursday, important macro data for Australia will be published, including retail sales for April and companies' investments for the first quarter. A slight, almost zero growth in the level of retail sales is expected in April (+ 0.3%). Another weak data on sales will strengthen the opinion of market participants that the interest rate in Australia will soon be lowered.

The RBA's restrained position on the rate in Australia and, conversely, the Fed's positive view on the process of raising the interest rate in the US strengthen the position of sellers of the Australian dollar against the US dollar.

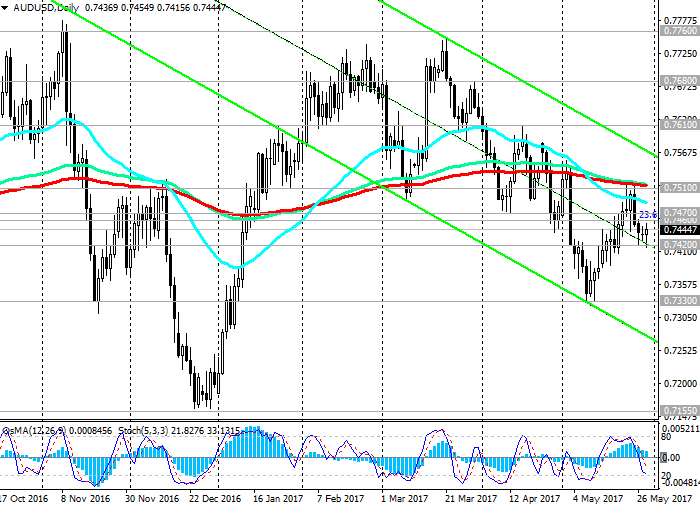

The negative medium-term dynamics of the AUD / USD pair remains.

Support and resistance levels

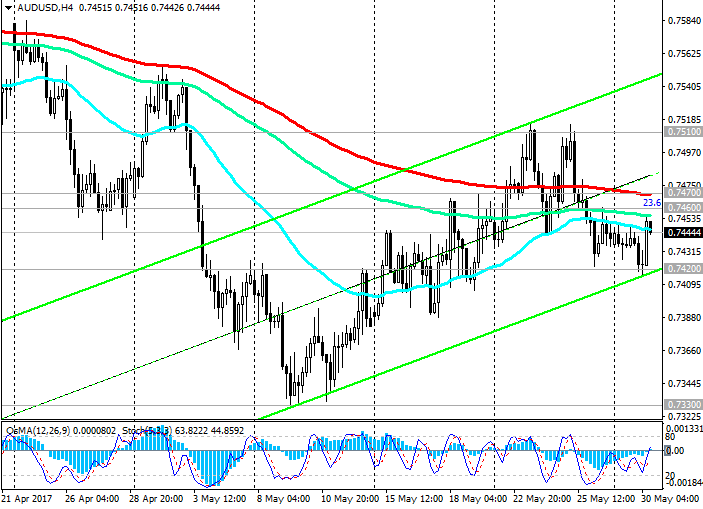

Indicators OsMA and Stochastics at different time intervals show mixed dynamics.

Nevertheless, the pair AUD / USD continues to remain within the downward channel on the daily chart, trading below the important resistance levels 0.7460 (Fibonacci level of 23.6% correction to the wave of decline of the pair since July 2014), 0.7470 (EMA200 on the 4-hour chart), 0.7510 (EMA200 on the daily chart).

Fundamental factors create the prerequisites for further reduction of the AUD / USD pair.

The nearest target in case of further decline of the pair will be the level of 0.7330 (November minima and the bottom line of the ascending channel on the weekly chart). The next target in case of breakdown of this support level is the level of 0.7155 (May, December minima of 2016). The minimum wave of the last global decline of the pair since July 2014 is close to the level of 0.6830.

The alternative scenario is related to the return of the pair AUD / USD to the zone above the level of 0.7510 and further growth to the resistance levels of 0.7610, 0.7680, 0.7760, 0.7840 (Fibonacci retracement of 38.2% correction to the fall wave from July 2014).

Meanwhile, the negative dynamics of the pair AUD / USD prevails.

Support levels: 0.7420, 0.7330, 0.7300, 0.7200, 0.7155

Resistance levels: 0.7460, 0.7470, 0.7510, 0.7545, 0.7570, 0.7610, 0.7680

Trading Scenarios

Sell Stop 0.7410. Stop-Loss 0.7465. Take-Profit 0.7330, 0.7300, 0.7200, 0.7155

Buy Stop 0.7465. Stop-Loss 0.7410. Take-Profit 0.7500, 0.7535, 0.7545, 0.7570, 0.7600

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics