After yesterday (22:45 GMT) the Bureau of Statistics of New Zealand published strong data on the state of the labor market in the country, the New Zealand dollar rose in the foreign exchange market. The unemployment rate in New Zealand in the first quarter decreased more than expected (4.9% against the forecast of 5.2% and the same level in the 4th quarter of last year). The NZD / USD pair jumped 0.5% or 33 points at the time of publication of the data, however, then declined just as rapidly and at the beginning of today's European session it was already trading near the opening level of 0.6933.

According to market participants, although unemployment levels are lower than expected, the Reserve Bank of New Zealand will not rush to raise interest rates. The unemployment rate of 4.9% corresponds to the forecast of the central bank published earlier this year. At the same time, the employment report released today points to a weak wage growth.

Also, the RBNZ is concerned about the recent decision by the US to introduce import duties on wood from Canada. This news is evidence of increased protectionism in world trade by the US, and this has a negative impact on commodity currencies, including the New Zealand dollar.

It is likely that at the meeting scheduled for the next week (May 10), RBNZ will not change its forecast of the dynamics of interest rates. It is expected that the RBNZ will start raising rates not earlier than 2019.

At the same time, the attention of traders will be riveted to today's Fed decision on the interest rate, which will be published at 18:00 (GMT). The probability that the Fed will raise the rate today is about 5%, according to the CME Group. Investors will follow the accompanying comments. The US central bank will report its assessment of the economic situation and may signal the prospects for interest rates for the coming months. The press conference of the chairman of the FRS, Janet Yellen will not. She will speak later on Friday.

The Fed statement may contain information on the probability of an increase in the key rate at the next meeting, which will be held on June 13-14. The probability of the June increase is estimated at 71%, and market participants expect two more interest rate hikes this year. Also, the Fed may signal that it will start cutting its portfolio of bonds and other assets already in September, which now amounts to about $ 4.5 trillion. All this can dramatically strengthen the position of the US dollar, if, of course, the Fed today will say what it expects market participants.

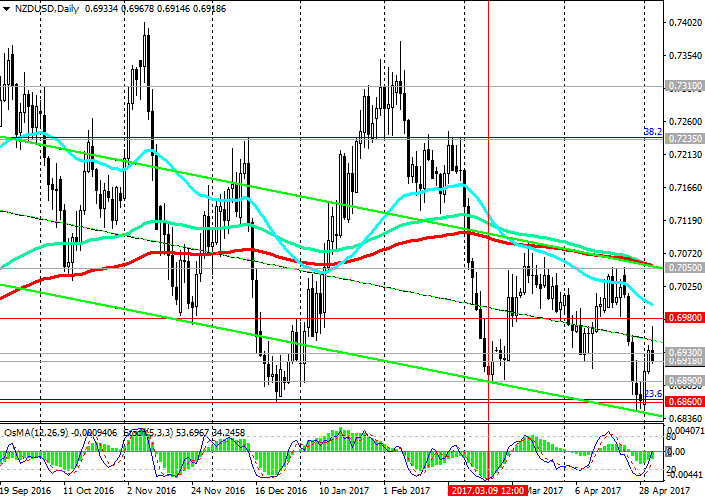

Support and resistance levels

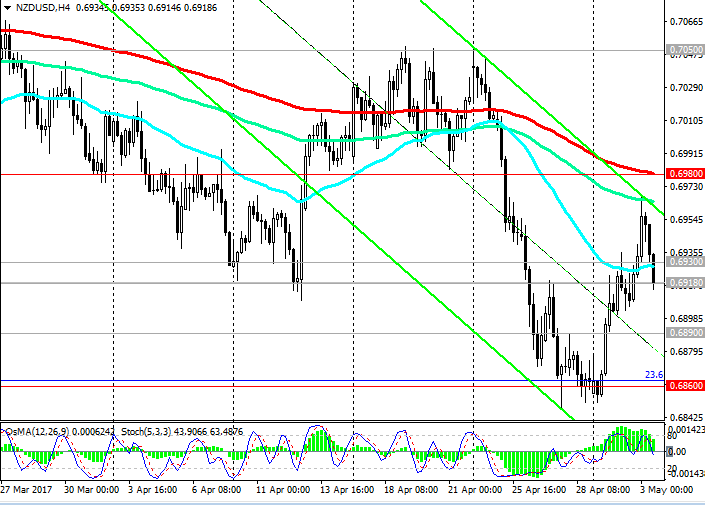

With the opening of today's trading day, the pair NZD / USD has risen sharply on positive data from the New Zealand labor market. During the European session, the NZD / USD pair resumed its decline. At the moment, the pair NZD / USD is trading at the short-term support level of 0.6930 (EMA200 on the 1-hour chart), however, OsMA and Stochastic indicators moved to the sellers' line on the 1-hour and 4-hour charts. The pair NZD / USD was unable to develop an upward movement above the level of 0.6970.

There is probably a second test of support level 0.6860 (Fibonacci level of 23.6% of the upward correction to the global wave of decline of the pair from the level of 0.8800, which began in July 2014). At this level are also the minimums of December 2016, and the lower border of the descending channel passes on the daily chart.

The negative impulse predominates. In case of breakdown of the support level of 0.6860, the global downtrend of the NZD / USD pair, which began in July 2014, will resume. The minima of the wave of this trend are close to the level of 0.6260, which were reached in September 2015, and from which the current upward correction began. The level of 0.6860 is the key level (the Fibonacci level is 23.6%) in this correction.

In case of rebound from the level of 0.6860, the pair NZD / USD may return to the depth of the descending channel with the prospect of growth to the levels of 0.6980 (EMA200 on the 4-hour chart), 0.7050 (EMA200 on the daily chart, the upper limit of the descending channel on the daily chart).

The scenario for the medium-term growth of the NZD / USD pair will be possible only after the pair is consolidated above the key resistance level of 0.7050. Below this level, the negative dynamics of the pair NZD / USD prevails.

Support levels: 0.6918, 0.6890, 0.6860, 0.6800, 0.6680

Resistance levels: 0.6980, 0.7050

Trading Scenarios

Sell in the market. Stop-Loss 0.6970. Take-Profit 0.6900, 0.6890, 0.6860, 0.6800, 0.6680

Buy Stop 0.6970. Stop-Loss 0.6910. Take-Profit 0.7000, 0.7050

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics