Trading recommendations

Sell in the market. Stop-Loss 1.0725. Targets 1.0640, 1.0615, 1.0535, 1.0500, 1.0485, 1.0400, 1.0350

Buy Stop 1.0725. Stop-Loss 1.0670. Targets 1.0770, 1.0830, 1.0895, 1.0910

Overview and Dynamics

With the opening of today's EUR/USD pair is reduced, while the euro remained under pressure on the foreign exchange market. The scandal surrounding the presidential candidate Francois Fillon on the presidential race in France and gaining popularity movement for secession from the European Union countries are pushing down the euro quotes. According to the latest Marie Li Peng, the leader of the party "National Front" is gaining more and more supporters. Marie Li Peng insists on withdrawal of France from the European Union and NATO. In Italy and Greece also does not stop sounding voices in favor of leaving the EU.

Despite clear signs of improvement in the economic situation in the Eurozone, ECB President Mario Draghi said earlier that the time to abandon the program to stimulate the economy has not yet come. This means the ECB is that it would not consider the possibility to limit or minimize the program QE in the Eurozone, and this will contribute to further weakening of the euro. Dollar on the contrary, remains stable, despite the still caution investors against his purchases on a background of uncertainty related to the new economic and protectionist policies of Donald Trump.

At 14:10 and 18:10 (GMT) assigned presentations of James Bullard and Charles Evans (Fed representatives). Earlier in the week the president of the Federal Reserve Bank of Philadelphia, Patrick Harker said that at the March meeting of the Fed he would support a rate hike. He also reiterated that he considers it appropriate to raise rates this year three times. Another representative of the Federal Reserve, President of the Federal Reserve Bank of San Francisco John Williams spoke in the same vein, last week.

Quotes from Fed representatives of the high probability of repeated interest rate rises in the US, of course, will drive the dollar buying by investors.

From the United States continue to be a stable macro-economic data, and economists generally positive about the outlook for the US economy.

Despite the continuing uncertainty of the new protectionist policies of Donald Trump, the dollar may begin a large-scale offensive on the foreign exchange market in anticipation of higher interest rates in the United States.

At 07:00 (GMT) will be presented by German trade balance data for December. According to the forecast expected deterioration. The German economy is the locomotive of the economy across the Eurozone. Therefore, any weak macroeconomic figures from Germany will negatively affect the position of the euro on the currency market. It is likely that the downward movement of the pair EUR/USD may continue until the end of the trading day.

Technical analysis

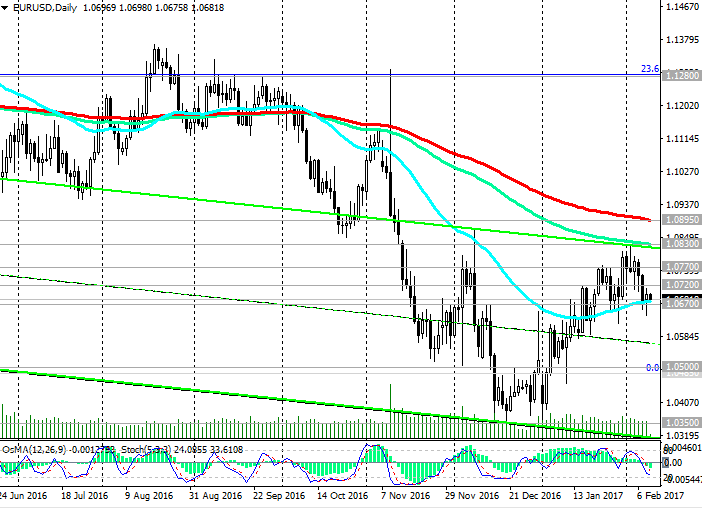

Today, with the opening of the trading day and the beginning of the European session the EUR/USD is dropping. However, the EUR/USD has found support near the level of 1.0670 (200-period moving average and the lower line of the rising channel on 4-hour chart), and the third day attempts to break this level. In the case of consolidation below this level, the probability of further reduction in the EUR / USD strengthened. The objectives of the likely further reduce of pair EUR/USD - 1.0500 levels (lows reached in February 2015, the last wave of decrease in pair with the level of 1.3900), 1.0350 (December low), 1.0200 (the lower line of the descending channel on the weekly chart).

OsMA and Stochastic indicators on the daily and 4-hour, 1-hour charts deployed on short positions on the weekly chart - also takes place on sale. The pair EUR/USD remains within the descending channel on the weekly chart.

In an alternative scenario, in case of return above the level of 1.0720 (EMA200 the 1-hour chart) likely increase in EUR/USD pair to the resistance level 1.0830 (EMA144 on the daily chart), 1.0895 (EMA200), 1.0910 (lows reached on the day of publication of the referendum on the Brexit and EMA50 on the weekly chart, the July lows).

Support levels: 1.0670, 1.0615, 1.0535, 1.0500, 1.0485, 1.0400, 1.0350

Resistance levels: 1.0720, 1.0770, 1.0830, 1.0895, 1.0910

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.