Trading recommendations

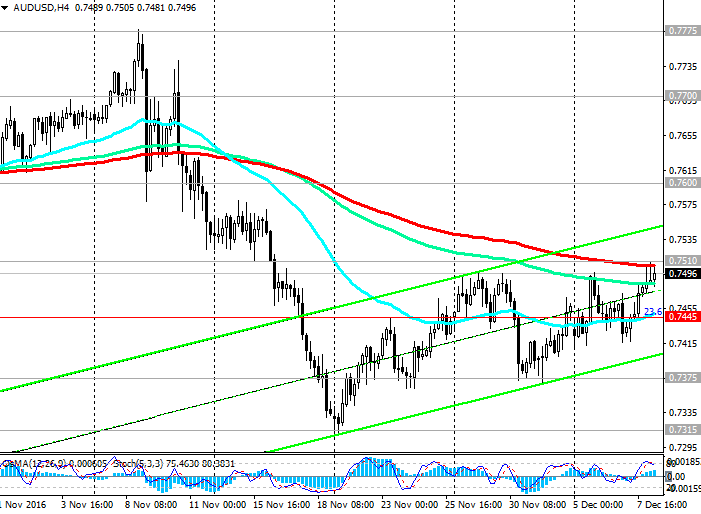

Sell in the market. Stop-Loss 0.7520. Take-Profit 0.7445, 0.7375, 0.7315, 0.7290, 0.7200, 0.7140

Buy Stop 0.7520. Stop-Loss 0.7480. Take-Profit 0.7600, 0.7700, 0.7750, 0.7820

Technical analysis

The US dollar declines in the currency market. Despite the weak macro data coming from Australia, AUD/USD pair rose for a third week in a row. Rising prices for raw materials supports raw Australian currency. The AUD / USD has been able to develop an upward trend above the level of 0.7445 (Fibonacci level of 23.6% correction to the wave of decrease in pair in July 2014), and came close to the key level 0.7510 (EMA200 on the 4-hour and daily charts) resistance.

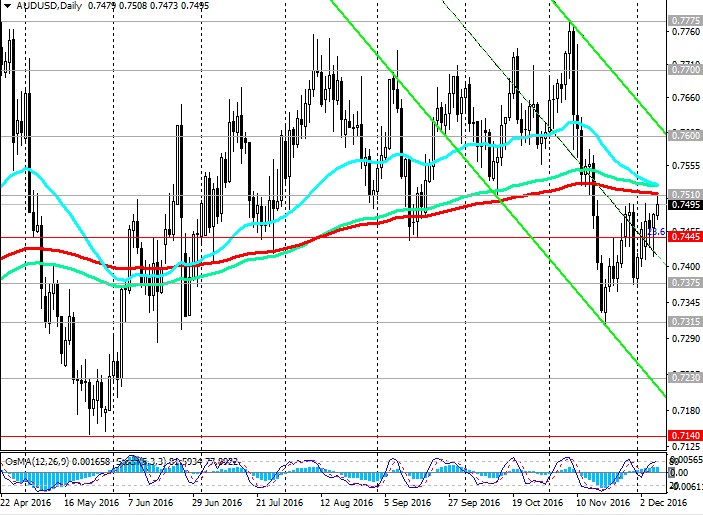

However, the steam remains within the downlink channel on the daily chart. The lower boundary of the channel is below the level of 0.7315 (November lows), 0.7230 near the mark.

On the weekly chart the pair AUD / USD also remains within the descending channel.

Indicators OsMA and Stochastic on the weekly, monthly charts are on the side of the sellers. On the 4-hour and daily charts Stochastic begins to unfold on sales.

In the case of rebound from 0.7510 level the pair AUD/USD risk decreased to the level of support 0.7445. In the case of renewal and reduce the breakthrough levels of 0.7375, 0.7315 target will be the level of 0.7140 (May lows).

The reverse scenario suggests the pair after consolidation above 0.7510 level, which will increase the likelihood of continued growth to the levels of 0.7700, 0.7775, 0.7820 (38.2% Fibonacci level and the April highs), 0.7920 (EMA144 on the weekly chart), 0.8130 (Fibonacci level of 50.0 EMA200% on the weekly chart).

Support levels: 0.7445, 0.7375, 0.7315, 0.7290, 0.7200, 0.7140

Resistance levels: 0.7510, 0.7600, 0.7700, 0.7750, 0.7820

Overview and Dynamics

Despite the weak data coming from Australia, the second day, AUD / USD pair is growing, and at the beginning of today's European session, trading near the 0.7500 mark.

As reported today, the Australian Bureau of Statistics, in October, the trade deficit amounted to 1.54 billion Australian dollars Australian that far exceeded the forecast of a deficit of 800 million Australian dollars. Exports rose by 1.0% and imports - by 2.0%.

On Wednesday, data released showed a reduction in the country's GDP in the 3rd quarter by 0.5%, marking the first quarterly decline in the economy since March 2011.

Left in Australia last Thursday, data on consumer spending and investment companies were also weak.

However, the dynamics of the pair AUD / USD in the current environment determines the dynamics of the US dollar in the currency market and commodity prices.

Raised the price of oil, gas, coal and iron ore are supporting the Australian dollar, which, in many respects, is commodity currency.

Prices for iron ore since the beginning of this year rose by more than 70%, remaining above US $ 80 per ton. In December the same month last year amid oversupply in the world market price for it has reached more than ten-year low of US $ 37 per ton. Coal prices have shown an even stronger recovery.

The US dollar, meanwhile, reduces the foreign exchange market. The probability of interest rate increase in the US Fed meeting on 13-14 December, appear to have priced in the US dollar.

Today the attention of traders will focus on the ECB meeting and the decision on the interest rate in the euro area, which will be published in the 15:45 (GMT + 3). The euro is rising against the dollar and, it seems, sets the tone for the currency market. At 16:30, will a press conference of the ECB host, which will make the head of the ECB, Mario Draghi. There is expected surge in volatility in all financial markets.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.