NZD/USD: expected to increase prices for dairy products

Trading recommendations

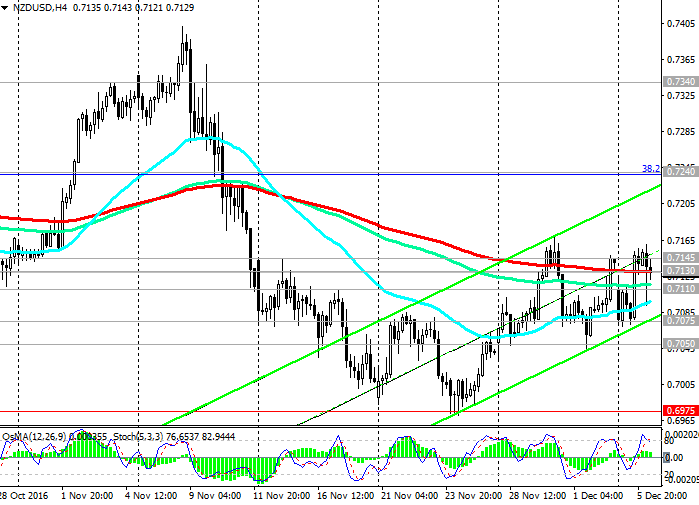

Sell in the market. Stop-Loss 0.7170. Take-Profit 0.7110, 0.7075, 0.7050, 0.6975, 0.6930, 0.6900, 0.6860

Buy Stop 0.7170. Stop-Loss 0.7130. Take-Profit 0.7200, 0.7240, 0.7380, 0.7485, 0.7550

Technical analysis

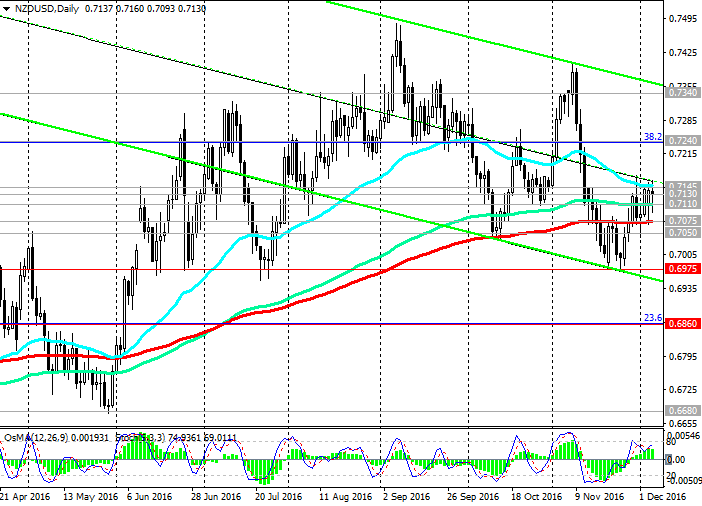

This month the pair NZD / USD started with growth rebounding from the support level 0.7075 (EMA200 on the daily chart). With the opening of today's trading day the pair NZD / USD is reduced. US dollar rises against the commodity currencies but lower against European currencies.

The pair NZD / USD was able to break the resistance level 0.7145 (EMA50 daily chart). However, its further growth stalled.

OsMA and Stochastic indicators deployed on short positions on the 4-hour, as well as weekly and monthly charts.

Break of the support level 0.7110 (EMA144 on the daily chart) will send a pair NZD / USD to the 0.7075 support level. Break of this level could trigger deeper decline towards levels of 0.6975, 0.6860 (23.6% Fibonacci level of upward correction to the global wave of decrease in pair with the level of 0.8800, which began in July 2014).

In case of return above 0.7145 resistance level of growth may continue towards resistance level 0.7240 (38.2% Fibonacci level and EMA144 on the weekly chart), 0.7340 (EMA200 on the weekly chart).

The pair NZD / USD remains inside the rising channel on the weekly chart, the upper limit of passing above the resistance level 0.7550 (50.0% Fibonacci level).

While the pair NZD / USD is above the support level of 0.7075 (EMA200 on the daily chart), the rising dynamics of the pair is maintained.

Support levels: 0.7110, 0.7075, 0.7050, 0.6975, 0.6930, 0.6900, 0.6860

Resistance levels: 0.7145, 0.7240, 0.7380, 0.7485, 0.7550

Overview and Dynamics

The unexpected resignation of the Prime Minister of New Zealand today has caused a sharp decline in the New Zealand dollar on the currency market. Prime Minister John Key also stated his intention to resign as leader of the ruling conservative party. Despite the fact that the impact of retirement on the economy of New Zealand in the short term will be limited, as the economists say, there is a possibility that this may lead to the resignation of political uncertainty that negatively affect business confidence in 2017. And it can affect the quotes of the national currency.

Today, in the aftermath of 17:00 (GMT + 3) index is published on dairy product prices, which usually causes a spike in volatility in the New Zealand dollar trade. The last two weeks before the auction of dairy products have on the growth of world prices for dairy products by 4.5%. The main export article of the country is just milk.

Rising prices for dairy products in recent weeks due to reduced production in New Zealand, which along with Australia is the largest exporter of milk.

The next price increase will support the New Zealand currency, and vice versa. Market analysts expect some dairy price increases. And it will have to support the position of the New Zealand dollar on the currency market.

Otherwise the pair NZD / USD will accelerate the reduction was outlined today. Also, the pair NZD / USD is worth paying attention to the publication at 18:00 on data from the US. It is expected that US factory orders rose 2.6% in October (in addition to an increase of 0.3% in September), which have a positive impact on the US dollar, including in the pair NZD / USD.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.